Maruti Suzuki sells more UVs than Tata Motors in February, leads the race in FY2023

For avid automotive industry observers, India’s booming utility vehicle (UV) segment is a truly exciting segment with strong double-digit growth. With every second car sold in the country being either a UV, an SUV or an MPV, the segment contributes over 50% of overall passenger vehicle sales. This also stiff competition for leadership and there’s one currently underway in the ongoing fiscal year between the top three players.

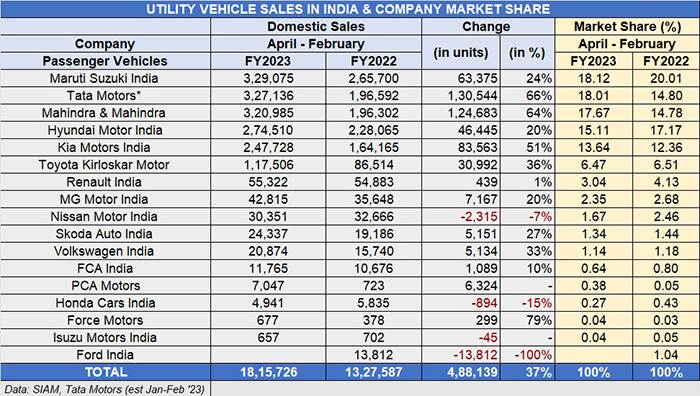

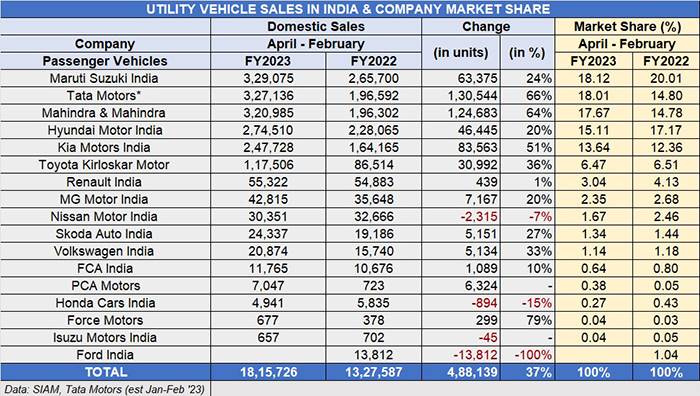

As per SIAM’S wholesales numbers for the first 11 months of FY2023 (April 2022-February 2023) and including Tata Motors’ UV sales for January-February 2023 (since Tata Motors does not provide monthly sales numbers to the industry body), a total of 18,15,726 UVs have been sold, 488,139 units more than the year-ago 13,27,587 units and translates into robust 37% year-on-year growth

Of the 16 OEMs in the UV arena, the top six have each clocked six-figure sales and account for 89% of total sales. But the real battle for supremacy is amongst the top three players which have each sold over 300,000 units. This trio, which has some of the popular models in the market, has together sold 977,196 units or 54% of total UV sales in the fiscal to date

At the end of February 2023, Maruti Suzuki has a slender lead of 1,939 units over Tata Motors. March 2023 sales will provide the clincher for FY2023.

At the end of February 2023, Maruti Suzuki has a slender lead of 1,939 units over Tata Motors. March 2023 sales will provide the clincher for FY2023.

Trading places at the top of the UV table

The No. 1 position just changed wheels. Yes, Tata Motors, which was leading the UV charts in April-December 2022 with cumulative sales of 268,570 and 18.27% market share, and continued to do so in January 2023, has ceded position to a hard-charging Maruti Suzuki India.

Tata Motors was in No. 1 position right till January, when it had cumulative sales of 298,747 units to Maruti Suzuki’s 295,525 – ahead by 3,222 units. But the shift in market leader position happened in February 2023 – Tata Motors sold an estimated 28,389 UVs compared to Maruti Suzuki’s 33,550 units: a difference of 5,161 units. If one deducts Tata’s 3,222-unit lead in January from Maruti’s 5,161-unit lead in February, you get the current difference between the two companies – 1,939 units.

As per the latest available UV industry data, Maruti Suzuki has registered wholesales of 329,075 units in the April 2022-February 2023 period, just 1,939 units ahead by erstwhile leader Tata Motors, which sold 327,136 units, and third-placed Mahindra & Mahindra, which has clocked 320,985 units. As a result, there is also a shift in market share – Maruti Suzuki with 18.12% pips Tata which now has 18% while M&M has 17.67 percent.

Let’s take a closer look at how the the top UV manufacturers fared in February as well as the first 11 months of the ongoing fiscal year. .

With sales of over 15,750 units, the Maruti Brezza is the best-selling UV in February and ahead of the Tata Nexon.

With sales of over 15,750 units, the Maruti Brezza is the best-selling UV in February and ahead of the Tata Nexon.

Maruti Suzuki India: 329,075 units / up 24%

UV market share: 18.12%, down from 20.01% a year ago

A resurgent Maruti Suzuki, the overall PV market leader, has driven past Tata Motors to take the lead in the UV market. The company, which continues to see its production and in turn sales impacted by semiconductor supply chain issues, has done well to sell 329,075 UVs in the first 11 months of FY2023 (up 24%).

What has given a fresh charge to the company’s UV sales is the demand for the Grand Vitara SUV. Launched in September 2022, the Grand Vitara has clocked estimated sales of 41,270 units in just six months.

Meanwhile, sustained demand for the new Brezza compact SUV, launched in end-June 2022, has ensured that the brand is the best-seller in the fiscal to date with 129,438 units, followed by the Ertiga MPV with 118,652 units and the XL6 with 34,669 units. The Brezza was the best-selling UV in India last month with over 15,750 units, ahead of the Tata Nexon.

This solid performance notwithstanding, Maruti Suzuki’s pace of sales growth is slower than Tata Motors and M&M, both of whom also have plenty more UV models. This means its UV share is down to 18.12% from 20.01% a year ago albeit better than April-December 2022’s 17.70 percent.

Tata Motors: 327,136 units / up 66% YoY

Tata Motors: 327,136 units / up 66% YoY

UV market share: 18.01%, up from 14.80% a year ago

Tata Motors, which has four SUVs – Nexon, Punch, Harrier and Safari, in its seven-model portfolio which includes the Tiago, Tiago and Altroz, has maintained strong double-digit growth throughout the fiscal. It has registered estimated wholesales of 327,136 units in the April 2022-Febraury 2023 period, up 66% YoY.

The carmaker was in No. 1 position right till January, when it had cumulative sales of 298,747 units to Maruti Suzuki’s 295,525 units but the latter’s much-improved performance in February has pipped Tata to the top spot.

In terms of UV market share, Tata Motors currently has 18% compared to 14.80% a year ago and remains the company which has achieved maximum gains in the ongoing fiscal. The company has a market advantage in that it has the largest EV portfolio – Nexon, Tigor, Tiago – and products across the petrol, diesel and EV powertrains.

The Nexon, India’s best-selling UV, has sold an estimated 157,369 units, accounting for 48% of overall sales. It is followed by the Punch compact SUV (122,925), Harrier (28,072) and Safari (18,767). Will Tata Motors claw back its lead this month and for FY2023? We have a few more weeks to find out.

M&M, which has a sizeable order backlog, has ramped up its manufacturing capacity to reduce the waiting period for its high-in-demand SUVs.

Mahindra & Mahindra: 320,985 units / up 64%

UV market share: 17.67%, up from 14.78% a year ago

Just 6,151 units behind Tata Motors, Mahindra & Mahindra is also an outperformer in the ongoing fiscal. The period under review sees M&M increase its UV share – by three percentage points to 17.67% from 14.78% a year ago with robust 68% growth to 320,985 units from 196,302 units.

The Bolero, with 91,031 units, is the top-selling product, followed by the Scorpio (61,698), XUV700 (61,366), XUV300 (56,258) and the Thar (42,496).

M&M, which is understood to have a sizeable order backlog, is ramping up manufacturing capacity to reduce the waiting period for popular models like the flagship XUV700, Scorpio N and Scorpio Classic, Thar, Bolero and Bolero Neo and the XUV300.

Meanwhile, deliveries of the all-electric XUV400 – the first proper rival to the Tata Nexon EV – have commenced and as per SIAM data, 183 units have been sold till end-February 2023.

Hyundai Motor India: 274,510 units / up 20%

UV market share: 15.11%, down from 17.17% a year ago

At No. 4 in the UV rankings is Hyundai Motor India with 274,510 units, up 20% YoY. The bulk of the company’s UV sales have come from the Creta, the No. 2 best-selling UV in India with 136,346 units, and the Venue compact SUV (110,629 units). These two SUVs together constitute 90% of Hyundai’s total UV sales.

Like Maruti Suzuki, Hyundai’s slower rate of growth compared to faster-growing rivals like Tata and Mahindra mean that its UV market share has reduced to 15.11% from 17.17% in April 2021-February 2022.

Kia India: 247,728 units / up 51%

UV market share: 13.64%, up from 12.36% a year ago

Kia Motors, with 247,728 units and 51% YoY growth, is fifth in the UV industry rankings and 26,782 units behind its Korean sibling. Like Hyundai, Kia too clocked its best-ever annual sales numbers in CY2022 but stiff market competition means its market share growth remains marginal.

Its first product, the Seltos midsize SUV remains its best-seller with 93,578 units, followed by the Sonet compact SUV with 85,419 units, the Carens MPV (64,212), Carnival MPV (4,089) and all-electric EV6 (430).

Club the two Korean carmakers’ UV market share is 28.75%, which is more than the combined 8.41% share of three Japanese players – Toyota, Nissan and Honda – in the Indian marketplace.

Toyota Kirloskar Motor: 117,506 units / up 36%

Toyota Kirloskar Motor: 117,506 units / up 36%

UV market share: 6.47%, down from 6.51% a year ago

The sixth player with six-figure sales and also sixth in the UV rankings, Toyota Kirloskar Motor has sold a total of 117,506 units, up 36% YoY. The bulk of the sales came from the popular MPV, the Innova Crysta (47,497), Fortuner (27,580), the discontinued Urban Cruiser (April-September 2022: 22,158) and the recently launched Hyryder which has sold 19,365 units in six months since launch. The company also retails the Hilux and the Vellfire.

Will UV sales cross 2-million milestone in FY2023?

With one month left for FY2023 to end, the Indian UV industry is 184,274 units short of the two-million-units milestone. UV sales in CY2022 fell short of this big number by 77,234 units with total sales of 19,22,766 units.

Given that prices are slated to rise from April 2023 when RDE (Real Driving Emission) norms kick in, it is likely that SUV buyers might advance their purchase decisions.

Meanwhile, with an estimated backlog of around half-a-million UVs (most of them with the top five OEMs), vehicle manufacturers are putting their shoulder to the UV production wheel to keep their assembly lines busy and cater to demand. All in all, an exciting time for India UV Inc. Stay tuned in.