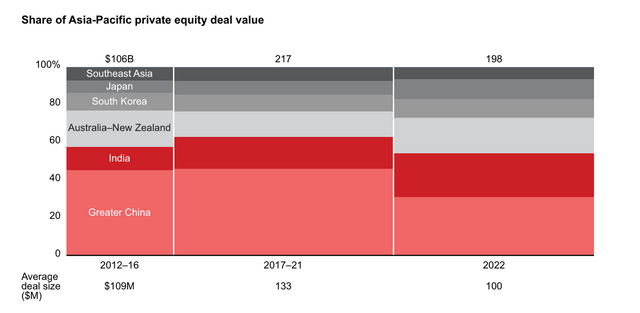

Private equity (PE) deal value in the APAC region plunged 44% year-on-year (YoY) to $198 billion in 2022 as slow economic growth, increasing inflation, and escalating regional uncertainties put an end to two years of record dealmaking, according to Bain & Company’s Asia Pacific Private Equity Report 2023.

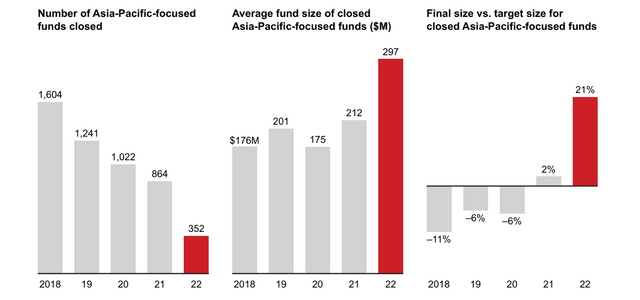

The number of funds closed in the region fell drastically to at least a five-year low in 2022, according to data in the report, although their average size grew and general partners (GPs) far exceeded their target sizes compared with previous years. The share of large-sized funds in the total funds raised increased to 29% last year from 20% in 2021.

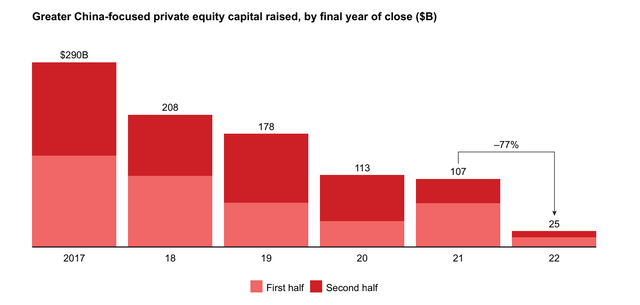

While overall fundraising in the Asia-Pacific fell sharply in 2022, Greater China-focused funds saw the sharpest drop, slumping 77% from 2021 to $25 billion.

Greater China’s share of the total funds raised in APAC shrunk to a 15-year low of 24%. The share of private equity raised by Australia-New Zealand, Japan, and India rose to 7%, 6%, and 5%, respectively. The increase in share for these three countries reflects greater limited partner (LP) capital allocation to alternative markets within Asia, following the exit of foreign capital from China, the report added.

Greater China suffered the biggest contraction in deal activity as well. COVID lockdowns, declining growth, and geopolitical tensions contributed to a 53% drop in deal value from the previous year and led to its share in the region touching a nine-year low of 31%. However, it still retained the lion’s share of APAC deals by value.

Southeast Asia’s deal value plummeted more than 50% last year as it saw fewer growth deals, while India’s declined 25%.

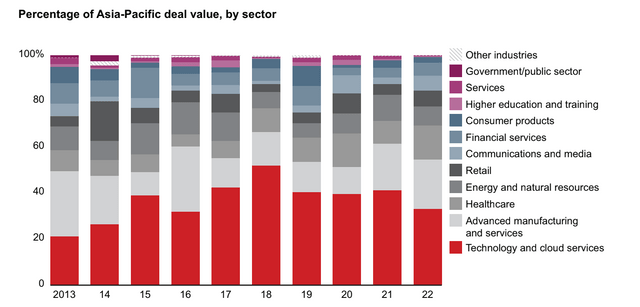

Under the current market conditions, investors across the region turned to sectors offering steady cash flow, lower risk, and the potential to act as a hedge against inflation, including advanced manufacturing and energy and natural resources, which resulted in an increase in the number of deals in these sectors.

Government demand for private capital investment to develop and upgrade critical infrastructure including utilities, telecommunications, and transportation also remained strong, especially in Southeast Asia and India.

Healthcare deals, too, saw an uptick as part of a dynamic shift in Asia such as an ageing population and increasing wealth, especially in China and Japan. India’s pharmaceutical services sector will benefit as global pharmaceutical companies shift their manufacturing from China to India, the report added.