The Indian passenger vehicle industry, which recorded robust 24% growth in CY2022 to clock record 3.8 million units, has also outdone itself in the just-ended fiscal year FY2023. Powering this growth are the Top 6 OEMs – Maruti Suzuki India, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar Motor. This, even as smaller players have chipped in with useful contributions.

The sustained consumer demand for SUVs has meant that OEMs with strong UV/SUV/MPV portfolios have surfed the wave successfully, which is reflected in their record sales in FY2023. Hyundai Motor India, Tata Motors and Kia India have all recorded their best-ever sales in a fiscal year. However, as FY2023 came to a close, industry observers were keen to see if there would be a change in the balance of power for the No. 2 position. But that wasn’t to be.

Market leader Maruti Suzuki India, with sales of 1.6 million units in FY2023, remains unassailable. The battle in question is the one between the longstanding No. 2 PV OEM, Hyundai Motor India and the hard-charging Tata Motors which entered FY2023 as the third-placed player but at some distance from the Korean carmaker.

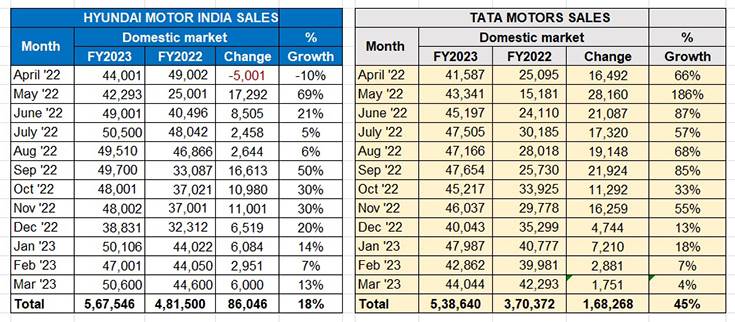

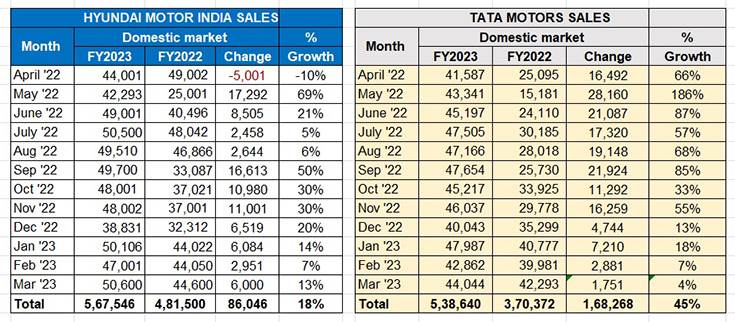

In FY2022, Hyundai had sold a total of 481,500 units, which was a good lead of 108,362 units over Tata Motors’ 373,138 units. However, as the months in the new fiscal logged out, Tata Motors’ speedier month-on-month growth meant that Hyundai’s lead had whittled down to just 16,092 units in end-December 2022 with Hyundai selling 419,839 units to Tata Motors’ 408,087 units.

But Q4 FY2023 (January-March 2023) saw Hyundai press the sales pedal to increase its lead with sales of 147,707 units to Tata’s 134,893 units – a difference of 12,814 units in Q4. This, when added to the first three quarters’ lead of 16,092 units, helped Hyundai take an overall and strong lead of 28,906 units to maintain its No. 2 position in the booming Indian PV market. The hard-charging Tata Motors will have to take another shot at that rank.

Hyundai Motor India, with a lead of 28,906 units, kept a hard-charging Tata Motors at bay in FY2023. Both clocked their best-ever sales in a fiscal.

Hyundai Motor India, with a lead of 28,906 units, kept a hard-charging Tata Motors at bay in FY2023. Both clocked their best-ever sales in a fiscal.

Hyundai-Tata battle to turn even more exciting

The race between Hyundai and Tata Motors looks set to get even more exciting in FY2024. While Hyundai Motor India currently retails nine products – five SUVs (Creta, Venue, Alcazar, Tucson, Kona), two hatchbacks (i10 Grand, i20) and two sedans (Verna, Xcent /Aura), Tata Motors sells seven – four SUVs (Nexon, Punch, Harrier, Safari), two hatchbacks (Tiago and Altroz) and one sedan (Tigor).

Both companies, which have hugely benefited from the surging demand for SUVs in the Indian market, have two high-selling products each – the Creta and Venue for Hyundai, and the Nexon and Punch for Tata. All four products from the two rivals rank among the monthly best-selling UVs.

It is to be noted that Hyundai, with a manufacturing capacity of 850,000 units, is also India’s No. 2 PV exporter and shipped 153,019 units, up 18% in FY2023. In comparison, Tata Motors has far lesser overseas shipments which enables it to focus more on the domestic market. Tata is set to get a manufacturing capacity boost of 300,000 units, scalable to 420,000 units per annum, when its newly acquired Sanand plant of Ford India goes on stream.

While it can be expected that Hyundai Motor will go all out to protect its No. 2 position and turf, Tata Motors has the EV advantage with the Nexon, Tigor and the just-launched Tiago EVs. What’s more, being India’s most affordable electric hatchback, the Tiago EV (for which Tata has already received 20,000 bookings) can be expected to eat into ICE hatchback sales as well as of CNG models, given the high price of petrol, diesel as well as CNG. Given the sales momentum it is seeing, expect Tata to record 50,000-unit monthly sales for the first time ever early in FY2024. MEanwhile, the Nexon EV sees its first proper rival in the form of the Mahindra XUV400 electric SUV. And the MG Comet EV is also to be launched soon.

Plotting new models for 2023 and beyond

Hyundai, whose bold six-model EV programme for India on the E-GMP platform is still some years away from seeing production, has six new models planned for 2023 – two SUVs (facelifted Creta and an entry-level micro-SUV), one hatchback (facelifted Grand i10 Nios), two sedans (facelifted Aura and next-gen Verna) and one EV (Ioniq 5) which will be its flagship product. The new Verna was launched on March 21.

Tata Motors’ new model programme for this year will see three SUVs (Punch EV, facelifted Harrier and Safari). Clearly, the battle between the No. 2 and No. 3 PV OEMs is set to intensify in the Indian market.

ALSO READ: Indian PV market posts 27% growth to 3.88m units, growth to slip to 5-7% in FY2024