Roy Cohen believes that there’s a severe underinvestment in tech within the airline industry, with airlines continuing to rely on legacy systems and outdated infrastructures that date back decades. Coming from the e-commerce industry, Cohen felt that airlines weren’t making the most of emerging technologies, particularly AI, which he thought had the potential to bolster profits while cutting costs.

It’s these perceptions that led Cohen to co-found Fetcherr, a platform that attempts to optimize prices for airfare using AI algorithms. Fetcherr today closed a $12.5 million funding round led by Left Lane Capital with participation from M-Fund, binging the company’s total raised to $31 million across equity and debt.

Cohen, who co-founded Fetcherr in 2019 alongside Shimi Avizmil, Uri Yerushalmi and Robby Nissan and serves as the company’s CEO, says that the company will put the funds toward supporting business development and market expansion and growing its U.S. presence. (Fetcherr is based in Tel Aviv.)

“Traditional revenue management systems that currently exist are fragmented and not able to keep up with volatility, rising demand, changing consumer behaviors, manpower issues and more,” Cohen told TechCrunch in an email interview. “Fetcherr predicts demand using real-time, sophisticated models and automatically provides pricing recommendations.”

Fetcherr, which counts Azul Airlines among its customers, predicts and prices airfare using algorithms tailored to each airline’s demographic. Cohen says that the algorithms are trained on “several years” of bookings, flight schedules, availability, fares, events, weather, capital markets and “other macroeconomic and microeconomic data points taken from global markets and various verticals.”

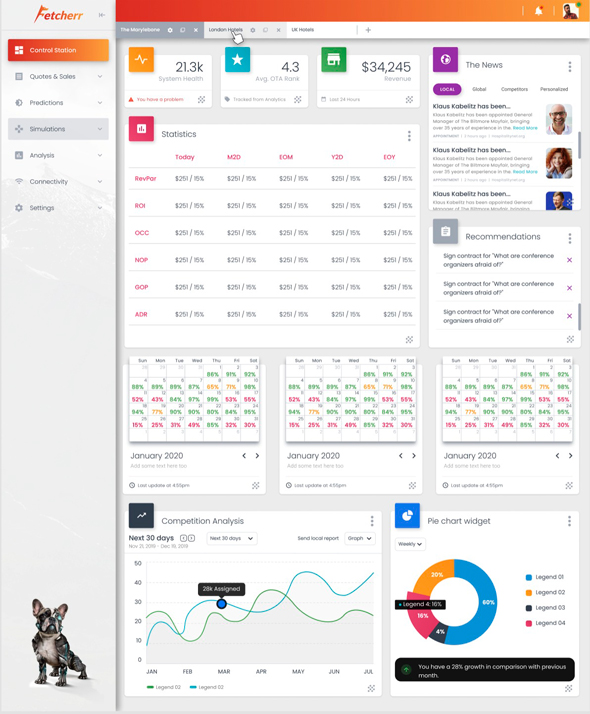

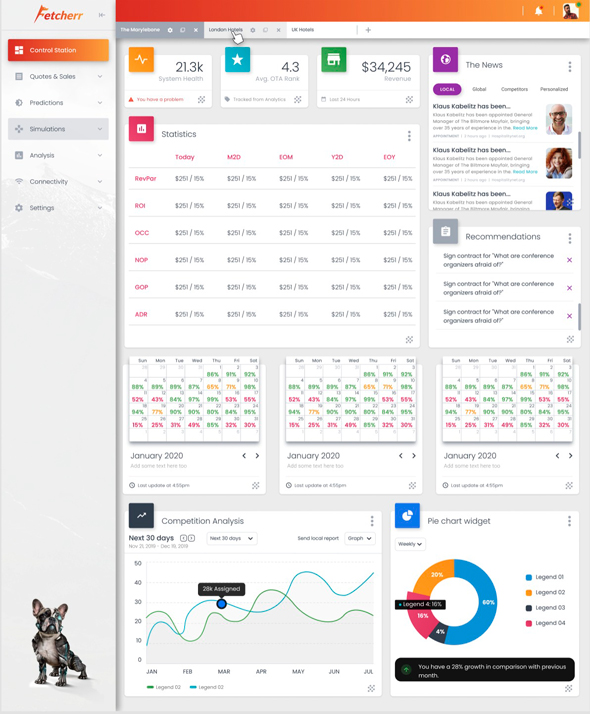

Once Fetcherr trains an algorithm, it uses it to predict purchasing behavior in the air travel market within the context of an airline customer’s business. Powered by the algorithm, the Fetcherr platform essentially simulates flights and seats being sold by a given carrier.

A mockup of Fetcherr’s software. Image Credits: Fetcherr

Using algorithms to predict pricing certainly isn’t a new idea. There’s vendors like Pricefx, which take into account factors like customer survey data and segments, competitor data, operating costs, inventories and historical pricing to help companies price products.

But dynamic pricing — particularly pricing powered by unpredictable, prone-to-economic-shocks algorithms — isn’t always well-received by the air traveling public. Harvard Business Review relates the story of how United Airlines replaced its frequent flier mileage tables with an algorithmic pricing model, which resulted in higher award prices for high-demand flights — leading to pushback.

More problematic is the mounting evidence that algorithmic pricing can lead to unfair discrimination between consumers and encourage what Financial Times’ John Thornhill calls “implicit collusion” between firms, raising prices overall. Companies with sophisticated pricing algorithms tend to instantly match their rivals’ price cuts, giving competitors with inferior technology no incentive to lower prices.

Cohen, for his part, paints Fetcherr as a net good for airline carriers (but not necessarily customers), arguing that the platform can save manpower by updating fares across different channels and predicting demand “in volatile times.”

“Fetcherr aims to disrupt traditional, rule-based legacy revenue systems through deep learning methodologies, beginning with the airline industry,” he added. “We’re able to seamlessly incorporate our technology into all existing systems, offering a zero-risk onboarding that doesn’t interfere with airline’s current IT infrastructure and enables airlines to seamlessly migrate outdated infrastructure into a complete cloud-based retailing environment and a user-centric customizable dashboard.”

That’s a lot to promise. We’ll have to see if Fetcherr lives up to it.