India, a fossil fuel dependent country has set a huge emissions target for itself. At the 26th session of the Conference of the Parties (COP26) of the United Nations Framework Convention on Climate Change (UNFCCC) in November 2021, Prime Minister Narendra Modi reiterated that the country will achieve the target of net zero emissions by 2070. Then at an India-focused discussion on the sidelines of the 77th United National General Assembly (UNGA), panellists, policymakers and private sector executives said that India could turn net zero even before the 2070 deadline set by PM Modi.

In February 2022, India pushed the envelope further with the introduction of a landmark Green Hydrogen Policy to aid in the deployment of green hydrogen projects in India. The policy encourages the production and use of green hydrogen, establishes manufacturing zones, and incentivises green hydrogen/ammonia manufacturers to obtain renewable energy through the power exchange or establish their own renewable energy projects.

More recently, in January 2023, the Union Cabinet approved Rs 19,744 crore for the National Hydrogen Mission. This amount included Rs 17,490 crore for the Sustainable India Green Hydrogen and Technologies (SIGHT) programme, Rs 1,466 crore for pilot projects, Rs 400 crore for research and development, and Rs 388 crore for other mission components. These programmes, along with the recently announced Production Linked Incentive (PLI) Plan for solar photovoltaic, the manufacturing of advanced cell chemistry (ACC) batteries, and FAME subsidies for EVs, are tangible policy pushes toward realising these ambitions, experts claim.

Net zero, or becoming carbon neutral, implies not adding greenhouse gases to the atmosphere. For India, it’s a tall order. And to achieve it will need a clearer direction to move away from fossil fuels.

“India has just set a net zero target for itself. But it lacks concrete sectoral targets and a trajectory and short-term milestones and targets. There is much work for India to do,” Sunil Dahiya, an analyst from Centre for Research on Energy and Clean Air (CREA), told media.

The Swiss firm IQAir’s ‘World Air Quality’ report says India was the world’s eighth most polluted country in 2022. India is home to some of the world’s most polluted cities and accounts for a large number of pollution-related deaths. Vehicular movement, including private and public vehicles that run on petrol or diesel, contribute to these statistics in a big way.

As it happens, the country is still heavily dependent on coal for its energy requirements. This fossil fuel makes up for over half the installed energy capacity in the country and is expected to touch around 266 gigawatts by 2029-2030, according to the projections by climate group Climate Action Tracker.

Currently, India spends more than US$160 billion in forex each year on energy imports. It is anticipated to rise significantly in the next 15 years. Experts reckon that to achieve its 2070 zero emissions target, India needs to invest at least US$10.1 trillion right now and if the deadline is advanced to 2050, the amount will be US$13.5 trillion.

Notwithstanding, India has started on the road to get there. While there has been some progress in diverting two-wheeler, three-wheeler and passenger cars from internal combustion engines (ICE) to greener solutions like hybrids or electric vehicles (EVs), the bigger chunk of diesel trucks and buses is where a lot more has to be done. India must “invent an entirely new method of progress, which will be extremely difficult,” said Gurmit Singh Arora, Chairman of the Confederation of Indian Industries (CII) Indian Green Building Council. For the clean movement to progress further, India’s key stumbling block till now has been the availability of funding and future technologies.

Autocar Professional takes an in-depth look at where the automotive industry stands now and the way forward.

Highway to Hydrogen

With India on the verge of announcing a bid for incentives to set up green hydrogen and electrolyser manufacturing by May 2023, industrial conglomerates, as well as automakers eyeing a foray into space are closely tracking the developments.

Realising the commercial opportunity in the green hydrogen segment, India’s private sector has, in fact, laid out some grand plans already. Take for instance, oil-to-telecom conglomerate Reliance Industries which is working on the entire green hydrogen ecosystem with an investment of more than US$ 4.4 billion, which it plans to accomplish by 2030.

Tata Group, on the other hand, intends to infuse over US$ 5 billion in the entire green-hydrogen value chain. Other major private companies include Larsen & Toubro (L&T) and Vedanta. JSW, among others, seems not far behind although the suspension of the potential US$ 50 billion renewable energy collaboration between the Adani Group and French energy giant Total Energies SE, over allegations of fraud by Hindenburg Research, a short seller on the former, has come as a stumbling block.

The government companies too are leading from the front. The Gas Authority of India (GAIL) — the country’s largest natural gas refining and handling company plans to build India’s largest green hydrogen plant and has already started mixing hydrogen into natural gas in one of the cities on a pilot basis.

Similarly, the National Thermal Power Corporation (NTPC), the country’s largest power utility company, has drawn up plans to produce green hydrogen on a commercial scale. Its pilot project is making the gas, which is estimated to cost in the range of US$ 2.8-3 per kilogramme. Furthermore, Indian Oil recently announced its plans to build a green hydrogen plant at its Mathura refinery in Uttar Pradesh and will use electrolyser-based processes to create the gas.

According to PK Banerjee, Executive Director of the Society of Indian Automobile Manufacturers (SIAM) and Convener of the Government of India’s Mobility M3 Group on Renewable Energy on Hydrogen: “The pace at which we are progressing, we are much faster than most global economies.” Banerjee goes on to say that the Ministry of Renewable Energy is looking into every possible application for hydrogen, including two-wheelers, three-wheelers, public transit systems, rail locomotives, and even the construction equipment sector, which could be powered by hydrogen in the future. “SIAM, along with the government, is looking at every aspect of the hydrogen economy and has submitted a report to the Renewable Energy Ministry stating the interventions required for each industry constituent to scale up,” Banerjee said.

The news comes months after the National Green Hydrogen Mission was created in January. The mission was promoted as providing numerous benefits, including the creation of export opportunities for green hydrogen and its derivatives, the decarbonisation of the industrial, mobility, and energy sectors, the reduction of reliance on imported fossil fuels and feedstock, the development of indigenous manufacturing capabilities, cutting-edge technologies, and creation of job opportunities.

Green hydrogen target and policies

India will need 125 GW of renewable energy capacity- to produce 5 MMTPA green hydrogen. The targets are anticipated to draw over Rs 8 lakh crore in investments and create over six lakh jobs by 2030, when the government also forecasts that the country will be able to avoid emitting nearly 50 MMT of CO2 into the atmosphere.

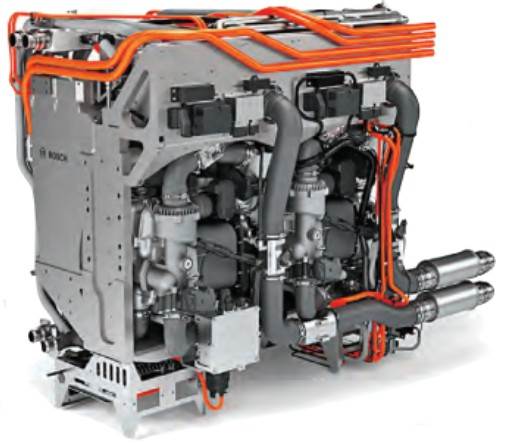

Besides use in ICE, hydrogen can also be used to create electricity in Fuel Cell type of applications in EVs.

Besides use in ICE, hydrogen can also be used to create electricity in Fuel Cell type of applications in EVs.

The initiative, the government said, will facilitate the generation of demand for the production, use, and export of green hydrogen. The Strategic Interventions for Green Hydrogen Transition Programme or SIGHT will offer two distinct financial incentives targeted at domestic electrolyser manufacturing and green hydrogen production. In addition, the mission will finance pilot projects in emerging end-use sectors and manufacturing pathways. Green hydrogen hubs will be discovered and established in areas with large-scale hydrogen production and or utilisation capabilities. An enabling policy framework will be developed to aid in the creation of a green hydrogen ecosystem.

Electrolysers is key

Electrolysers is key

- A kilogramme of green hydrogen can be produced by electrolysis using nine litres of water and energy.

- Global electrolyser manufacturing capacity reached almost 8GW per year in 2021.

- Europe and China account for 80 percent of global manufacturing capacity of electrolysers.

- Electrolyser investment costs are difficult to compare across systems as often there is a lack of information about key system parameters.

Rajendra Petkar, President and Chief Technology Officer, Tata Motors, stated that while India has vowed to be carbon neutral by 2070, recent government announcements have laid out a clear framework for the use of green hydrogen. Petkar went on to say that hydrogen, which was once thought to be a distant future, is rapidly approaching reality. “There is only one direction, that is to embrace green hydrogen technology,” Petkar added. At the AutoExpo 2023 in New Delhi, Tata Motors had showcased its Starbus Fuel Cell EV which is claimed to be India’s first hydrogen fuel-cell bus for commercial use. The PRIMA E.55S and PRIMA H.55S concepts, which are hydrogen fuel-cell driven tractors and hydrogen ICE powered concept cars, respectively, were also on display for technology demonstration by the Indian automaker.

Hype aside, massive challenges remain

With all these grand plans, India will have to address numerous challenges along the way. The main reasons for the lack of mass-scale adoption of green hydrogen in India include water and land availability, capital intensiveness, policy challenges, and technology dynamics, amongst others. For instance, a kilogramme of green hydrogen can be produced by electrolysis using nine litres of water and energy, implying India will need approximately 50 billion litres of demineralised water supply to execute the national hydrogen mission. Secondly, a lot of land will be required for establishing renewable energy plants.

Furthermore, the production of hydrogen from renewable sources is an energy-intensive process that should always be avoided whenever feasible. This is because hydrogen produced by consuming 10 units of electricity only yields seven units of equivalent energy as 3 units are lost towards the compression and transportation of the fuel. As a result, using electricity directly to power vehicles, rather than converting it to hydrogen is considered by experts as a more energy efficient process.

Another area that needs to be factored in is whether the automotive industry should use green power to create hydrogen while still using coal to generate energy. The life cycle emissions of coal-based power as compared to hydrogen produced from coal gasification, may need to be calculated. Making green hydrogen mandatory in refineries will increase the cost of finished products because green hydrogen is more expensive than regular hydrogen currently being generated from steam methane reforming (SMR). As is being talked about, requiring implementation in the fertiliser sector will add to the cost of subsidies, according to industry stakeholders.

A matter of cost

Says Dr RK Malhotra, President, National Hydrogen Association (NHA), “Manufacturing green hydrogen is dependent on renewable energy sources. Wind and solar energy is used in the electrolysis process to separate the hydrogen and oxygen from water (H2O). Electrolysers are costly equipment and have to be imported as there are very few manufacturers of this specialised equipment in India. All these factors play a big role in determining the final cost of green hydrogen.” Although the government has announced its support for waiving the transmission charges and allowing the banking of green power, there are still issues of inter-state taxes and accounting for transmission losses, among others, that need to be fixed. He pointed out that the government needs to support the industry by providing production linked incentives (PLI) benefits for electrolyser manufacturing, and R&D support for improving the technology and efficiency of electrolysers. “Industry needs to also invest in developing or acquiring the best innovative and efficient technologies and plan for capacities to have economies of scale. Despite best efforts, the cost of green hydrogen may come down to around US$ 2.5 to US$ 3.0 per kg by 2030. Though many have announced a target of US$ 1 per kg, even the price of US$2 per kg will be quite attractive for the hydrogen market to grow fast,” said Malhotra, who earlier worked as R&D head and CMD of Indian Oil Corporation (IOCL).

Cummins designed B6.7H hydrogen powered ICE engine offers up to 290 hp (216 kW) output and 1,200 Nm peak torque and is suited for commercial vehicles.

Says Dr N Saravanan, President and Chief Technology Officer of commercial vehicle maker Ashok Leyland, “The situation is still some distance away from reaching a tipping point, even though the government is strongly supporting the move towards hydrogen mobility, with all the right policies and businesses are eager to get into hydrogen and its related infrastructure. While OEMs work on developing the technologies from the production side, they will be accelerated once there is more proof on the ground, such as investments, the production of green hydrogen at a commercial scale, and setting up of refuelling stations.”

“Therefore, while it is a wait-and-watch situation, one could expect to see some investments in the next few months. That could be the point of inflection and propel us in the direction of finding measures to accelerate development of such vehicles to offer options to the end consumer,” Dr Saravanan explained.

The CTO added that the second-most-significant factor would be how the economics would work out. It must not only be the hydrogen production and related infrastructure, but also the expense to the final customer per kilogramme. “That will be important,” Dr Saravanan added.

Different types of hydrogen

As of now, only a handful of Indian companies are involved in making hydrogen for mostly industrial applications. Most of India’s hydrogen output is categorised as ‘grey hydrogen’ which is produced from natural gas or methane, with carbon dioxide as a by-product. Reliance Industries is one of the largest producers of grey hydrogen for industrial applications.

Secondly, red hydrogen is hydrogen that is produced as a result of a highly-complicated thermo chemical reaction that involves the high-temperature catalytic splitting of water with iodine and sulphur at a high temperature (usually around 900° C). Thermal energy of this calibre is usually available from a nuclear reactor. On the other hand, blue hydrogen is also extracted using the steam reforming process, but it differs from grey hydrogen in the sense that the carbon emissions released are captured and stored. Blue hydrogen is also sometimes christened ‘low-carbon hydrogen’ as the production process does not avoid the creation of greenhouse gases. Similarly, white hydrogen is extracted through a process called fracking that involves drilling into the earth.

The best option out of all for mobility applications is green hydrogen, which does not generate any emissions in its entire life cycle as it uses renewable energy in the production process. It is made by electrolysing or splitting water molecules using clean electricity created from surplus renewable energy from wind or solar power systems. No carbon emissions are released in the process.

While it is a strong alternative to grey or blue hydrogen, for now the main challenge is in reducing the production costs for practical reasons.

Investing in green hydrogen infrastructure

Industry experts say unless we move on from vehicle architecture to developing the green hydrogen infrastructure, it’s highly unlikely that green hydrogen as a fuel will take off in the medium- or long-term.

Besides water, other known sources of hydrogen include natural gas, bio-hydrogen, ethanol, biofuels, methane, gas from biomass and fossil fuels. Pramod Choudhary Executive Chairman of alternative fuels biotechnology major, Pune-based Praj Industries says, “Upstream challenges in green hydrogen production, midstream challenges in storage and transportation, and downstream challenges of a hydrogen-based component ecosystem will take time for the green hydrogen ecosystem to develop, which in the case of biofuels is already well developed.”

Nitin Seth, Chief Executive Officer, New Mobility, Reliance Industries, admitted that getting 50 billion litres of water is truly challenging and India can turn to SWROs (Saline water reverse osmosis plants) to get India’s source of pure demineralised water required

for electrolysis.

Investments from the private sector are also looking up. From a consumer’s perspective, Seth has highlighted that hydrogen will work for trucks and buses for intra-city and inter-city applications when their daily run is above 200 kms. To start with, hydrogen with fuel dispensing stations ready for refuelling in every 200 km range are required every 200 kms on main highways. India currently has only two hydrogen pumps, one at Indian Oil’s R&D Centre in Faridabad and the other at the National Institute of Solar Energy in Gurugram. Reliance Industries will be India’s first private sector firm to launch a hydrogen dispensation station in Jamnagar in the first week of April 2023.

Hydrogen versus other fuels

Comparing the hydrogen ICE technology with the conventional fuels, Seth said: “Hydrogen has an edge over other fuels like diesel or CNG as it is three times more efficient than these fuels. Hence the price of hydrogen has to be closer to Rs 250 (vis a vis Diesel at Rs 92 , CNG at Rs 84) and if that is achieved, then hydrogen as a fuel can be very popular and save lot of foreign exchange for the country.” Furthermore, he said that India needs to invest in more hydrogen dispensing stations across the highways.

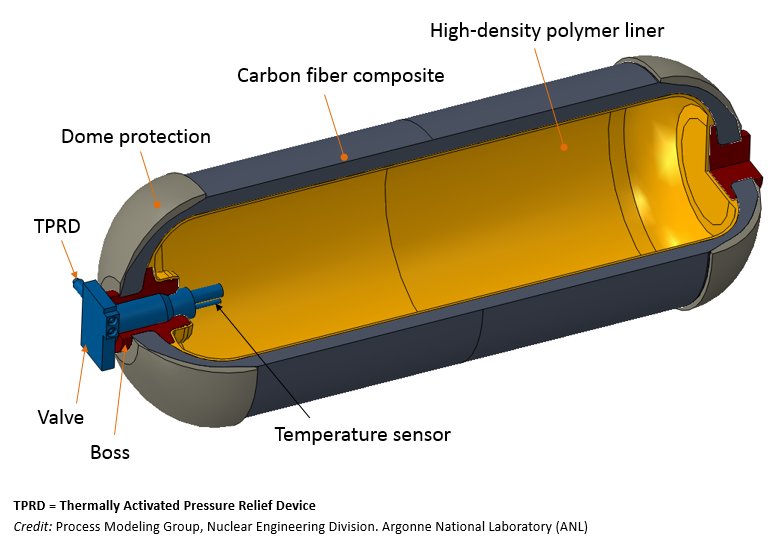

Storage and transportation Hydrogen storage tanks have to comply with a complex set of specifications to be safe and secure for static or transportation.

Hydrogen storage tanks have to comply with a complex set of specifications to be safe and secure for static or transportation.

As a gas, hydrogen is difficult to store under normal conditions and it requires specialised technologies and applications. Seth says specialised tanks (350 Bar and 700 Bar) are required for on board (vehicle) and pump storage for gaseous hydrogen. The raw material for these carbon fibre tanks is not yet manufactured in India and has to be imported. Importing carbon fibre raw material is very costly and will make it more expensive than other traditional fuel vehicles.

These type of storage systems are not made in India and as of now, they also have to be imported. The same is with electrolysers, which makes the technology very expensive as carbon fibre tanks have to be loaded on the vehicle itself.

Reliance’s Dhirubhai Ambani Green Energy Giga Complex, that is spread over 5,000 acres in Jamnagar is among the world’s largest integrated renewable energy manufacturing facilities with an investment of Rs 75,000 crore in the next three to five years. As the country is in the early stages, it does not have any regulatory framework currently in place for the transportation of hydrogen. Hydrogen projects in the domestic market should be made aware of the technical and safety aspects of storage and transportation of the fuel.

Outlook

If India is meet its zero carbon neutral targets by 2070, all sectors (automotive and non-automotive) will require building up the resources and infrastructure. This is where investment and participation of both government and private sector is vital to ensure the mission is successful. It’s becoming obvious that building a hydrogen-based ecosystem is not an overnight process and it has to be done step by step.

Storage of H2 requires high-pressure tanks (350–700 bar) and for H2 as a liquid requires cryogenic temperatures because the boiling point of H2 at one atmosphere pressure is -252.8°C.

Storage of H2 requires high-pressure tanks (350–700 bar) and for H2 as a liquid requires cryogenic temperatures because the boiling point of H2 at one atmosphere pressure is -252.8°C.

The big question is whether hydrogen alone can solve all the emission problems.

As of now, there’s a big debate all over the world and opinions are varied. Germany and the rest of the European Union have just announced that they have reached an agreement in the dispute over the future of cars with ICE. They will now allow the registration of new passenger vehicles with such engines after 2035 provided they use climate-neutral ‘e-fuels’ only. In April, the European Parliament approved a law to effectively ban the sale of any new car with a combustion engine including petrol, diesel and hybrid models in the European Union from 2035.

It seems that cleaner fuels — hydrogen or biofuels like ethanol will hold the key for the future energy applications and more. This is just the beginning.

(Editorial contributors: Mayank Dhingra, Shruti Mishra, Shahkar Abidi, Amit Vijay M and Chandan B Mallik)

This feature was first published in Autocar Professional’s April 1, 2023 issue.