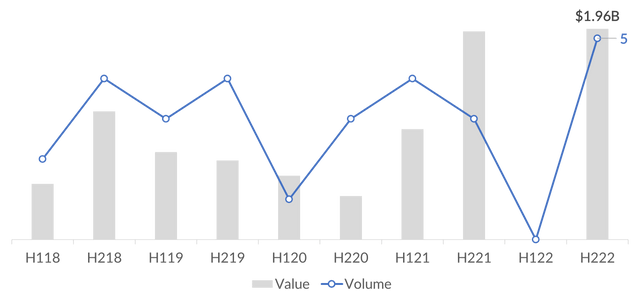

Five Southeast Asia-focused private equity (PE) funds held a final close in the second half of 2022 and raised $1.96 billion among them, according to DealStreetAsia – DATA VANTAGE’s latest report.

Following a complete lull in the first six months, the year ended a billion dollars short of 2021’s eye-watering $2.97 billion haul, finds Private Equity in SE Asia: H2 2022 Review. That said, 2022 still topped the fundraising performance witnessed in pre-pandemic years.

The H2 2022 performance by SE Asia’s PE funds was remarkable, given a dramatic change in liquidity supply last year due to soaring inflation and rapid monetary tightening.

Malaysian PE major Creador was the top performer last year, securing $700 million for its fifth growth vehicle. Other general partners (GPs) that closed funds in 2022 include Dymon Asia Private Equity ($650 million), Tower Capital Asia ($379 million), Mitsubishi-backed AIGF ($126 million) and Heliconia Capital-Yangzijiang Financial ($109 million).

Final closes by SE Asia-focused PE funds

Profound acceleration

Fund managers believe macroeconomic challenges and heightened geopolitical risks will continue overshadowing private capital investments well into the following year. However, they argue there are reasons to be optimistic about Southeast Asia.

“[General partners] going to market today have a higher hurdle to cross, and we believe this trend will continue in 2023-24, reflecting the growing maturity of private markets in Southeast Asia. To raise successive funds, GPs need to demonstrate a solid track record, proven strategy, and cohesive team. We believe LPs will continue to allocate capital to an asset class with a track record of outperformance,” said COPE Private Equity managing director Azam Azman.

Azman said his fund is looking to invest in companies within the industrial, technology and consumer products and services sector, specifically businesses that will thrive in an inflationary environment.

Navis Capital Partners managing partner Nicholas Bloy said the region would see a “pronounced acceleration of private capital” in the next two years.

“It’s the world’s third-largest population and the fifth-largest economic area, and yet today private capital formation sits at about 1.5% of GDP vs 7% for APAC as a whole,” said Bloy, highlighting the region’s potential for growth.

The recent collapse of Credit Suisse and mid-tier banks in the US, such as Silicon Valley Bank and Signature Bank, could be a harbinger of new opportunities for PE firms in the region.

“I think banks in Southeast Asia have been cautious lenders, and they will be more cautious still. This creates a bigger vacuum for private credit to fill, particularly in the SME space, which accounts for 50% of the region’s GDP but only about 17% of bank sector lending. This is why Navis is moving into this sector over the coming months,” Bloy said.

More funds in the market

SE Asia-focused PE funds have raised at least $7.76 billion in the last five years, of which 80% was raised by 25 growth capital funds. Only two buyout funds and one real estate fund achieved a final close during the period.

Singapore-based PE firms dominated fundraising in the last five years, gathering $4.55 billion in total. Malaysia ranked second with $2.93 billion, followed by the Philippines, Thailand and Vietnam.

So far, only one non-SE Asia-headquartered PE firm has raised a fund focused on the region – Morgan Stanley Private Equity Asia with its $440 million North Haven Thai Private Equity LP. This will soon change as eight foreign firms are currently in the market to raise funds dedicated solely to markets in SE Asia.

These foreign funds include Hong Kong-based Strategic Growth Holdings, Dubai-headquartered TVM Capital Healthcare and Zurich-based SUSI Partners. These firms are seeking to raise $500 million, $250 million and $250 million, respectively, for their SE Asia funds.

According to the report, at least 43 SE Asia-focused funds are currently in the market to raise at least $11.47 billion. Of the target corpus, $3.6 billion had been secured as of March-end.

Private Equity in SE Asia: H2 2022 Review covers fundraising by private equity firms based in Southeast Asia and their regional and global counterparts with a mandate to invest in the region. It offers:

- Fundraising data for SE Asian PE firms since 2018

- Fundraising data for Asian, APAC and global funds with SE Asia allocations since 2018

- Fundraising performance across strategies since 2018

- List of funds currently in the market

- Insights from prominent investors on the region’s PE landscape