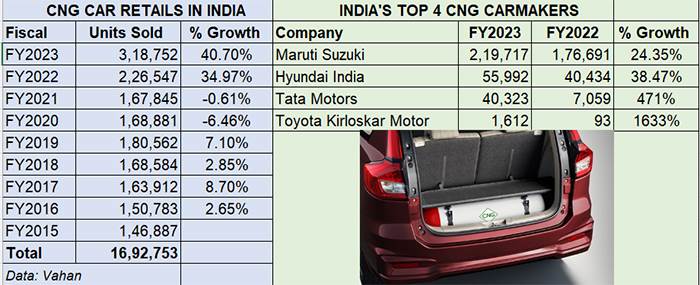

Sales of CNG-powered passenger vehicles (PVs) in the just-ended FY2023 have surged by 40.71% year on year to 318,752 units (FY2022: 226,547 units), accounting for 8.80% of overall retail sales of 36,20,039 PVs in India. This also means CNG car and utility vehicle sales have scaled a new high in the domestic market, surpassing the previous best of FY2022.

These findings are as per data sourced from the Vahan website albeit the final tally and growth should be marginally higher given that a couple of states do not provide retail data. Expect retails to have surpassed 320,000 units.

Clearly, the smart increase in consumer demand for CNG cars and utility vehicles continues to be driven by the lower cost of ownership mantra that the greener fuel offers in the face of high petrol and diesel prices. The continued growth of the CNG PV sector is also why vehicle manufacturers are gradually expanding their product portfolios to include CNG variants.

The YoY growth of the CNG car market is reflected in its growing share of the overall PV market. From 6.30% in FY2021, the CNG share increased to 8.60% in FY2022 and is expected to between 9-10% in FY2023.

With retail sales of 219,717 units, Maruti Suzuki commanded a 69% share of the CNG car market, followed by Hyundai (17%), Tata Motors (13%) and Toyota Kirloskar Motor (0.50%).

With retail sales of 219,717 units, Maruti Suzuki commanded a 69% share of the CNG car market, followed by Hyundai (17%), Tata Motors (13%) and Toyota Kirloskar Motor (0.50%).

PV market leader Maruti Suzuki India has a strong grip on the CNG segment. The company sold a total of 219,717 units, which marks 24% year-on-year growth (FY2022: 176,691). This gives the company a commanding share of 69% in the segment.

Maruti Suzuki, which introduced CNG in the S-Presso, Brezza, Grand Vitara, Swift, Dzire, Baleno and XL6 in FY2023 (April 2022-March 2023), now offers the factory-fitted CNG option in all of 14 cars, the largest for any carmaker in India.

In what was a market-driving statement, in October 2022, Maruti Suzuki expanded its factory-fitted CNG offerings to its premium Nexa channel – to the Baleno and XL6. In January 2023, the new Grand Vitara also got the CNG treatment.

At end-March 2023, Maruti Suzuki had a pending order backlog of a total of 380,000 PVs of which CNG models account for 121,000 units or 32%, with the popular Ertiga CNG MPV comprising for nearly 68,000 units of 56% of pending CNG variant orders.

Hyundai Motor India, which currently has the Aura sedan and Grand i10 Nios as its CNG offerings, sold 55,992 units, recording strong 38% YoY growth (FY2022: 40,434). This performance gives Hyundai a 17% market share.

Tata Motors, which had entered the CNG market in FY2022 with the Tiago and the Tigor, is already making strong gains. In FY2023, the company saw retails of 40,323 units, which a 471% YoY increase albeit on a low-year-ago base (FY2022: 7,059). What is creditable is that despite its recent entry into the CNG market, Tata Motors has already grabbed 13% of the CNG car market.

Wallet- and eco-friendly fuel

From a consumer’s point of view, other than the environment-friendliness of CNG, a CNG-powered vehicle provides considerable savings compared to its petrol or diesel-engined siblings. What’s also driving the consumer shift to CNG models is the high price of petrol (Rs 106.29 a litre in Mumbai) and diesel (Rs 94.25 a litre in Mumbai on April 7, 2023).

What will come as welcome news to motorists using CNG-powered vehicles is the Cabinet having approved revised domestic gas pricing guidelines on April 6. Following the slashing of CNG price today by Rs 8 a kg to Rs 79 per kg, CNG price now stands Rs 27.29 cheaper than petrol and Rs 15.25 cheaper than diesel. After seeing all of eight hikes in CY2022, CNG had hit its all-time high of Rs 89.50 a kg in November 2022. Four months later, a price cut of Rs 2.50/kg on February 1, 2023 made CNG available at Rs 87/kg in Mumbai.

Lauding the latest CNG price cut, Vinod Aggarwal, president, SIAM and MD and CEO of VE Commercial Vehicles, said: “Realignment of the gas pricing mechanism by insulating the Indian consumers from the spikes in global prices will soften prices in India and will provide much-needed relief to the transportation sector. This measure will also help in re-igniting interest in CNG vehicles in India and would go a long way in promoting a clean alternative fuel in various parts of the country. Incentivising greater production of natural gas will result in reduction in import dependence of conventional fuels, thereby enabling expansion of CNG infrastructure across the country and facilitating wider availability of CNG for vehicles.”

CNG power vs shift towards EVs

While it is difficult to say as to when CNG prices will be further reduced, the fact remains that CNG vehicle running costs are significantly lower compared to petrol or diesel as a CNG vehicle inherently delivers better fuel economy.

A few challenges remain though. Refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. That’s set to change. At present, there are an estimated 1,332 CNG stations and plans are to substantially increase the existing parc of 4,500 CNG stations to 8,000 over the next two years. Also, servicing costs of CNG-powered cars are higher compared to petrol siblings with the CNG filter requiring scheduled replacement in factory-fitted CNG kits.

CNG vehicle manufacturers also face competition from electric vehicles, which are seeing demand accelerate. While the initial cost of an EV is higher than a CNG or petrol/diesel model, the much lower cost of EV ownership in the long run remains a very attractive buying proposition. With the Central and state governments offering a host of subsidies, the fast-expanding EV charging infrastructure and also banks and financing institutions plugging into the EV growth story, it is likely the CNG sector’s loss could be the EV segment’s gain.