This weekly newsletter chronicles top digital themes and trends playing out in SE Asia, especially Indonesia. We will decode policy and regulatory changes affecting digital economy sectors, crunch earnings data of top players, track developments related to gig economy workers and attempt to piece together ecosystem buildouts in some of the fastest-growing, venture-backed plays. You can access the previous editions of the Vantage Point weekly posts here.

Executive Summary

- Digital banking race heats up as SeaBank Indonesia books profit

- Alfamart: Leading the charge in convenience

- Increased scrutiny for crypto is much-needed

- Indonesia bets on tax incentives to drive EV adoption, boost ecosystem

Digital banking race heats up as SeaBank Indonesia books profit

There is no doubt that the race is on in digital banking in Indonesia, as new entrants scramble to raise funds by offering attractive time deposit rates to customers. At this stage, most of their lending activity is through channelling of loans to P2P and BNPL players.

PT Bank Seabank Indonesia, a subsidiary company of Sea Ltd, just released a positive financial performance for FY2022. For the first time since its digital transformation in 2020, the bank booked a profit before income tax of 59.5 billion rupiah for Q4 2022, compared with a loss in the same period of the previous year.

SeaBank Indonesia also posted a net profit of 269.2 billion rupiah in FY2022, an increase of 186% compared with a loss of 313.4 billion in FY2021. The management suggested that SeaBank’s success in 2022 was in a large part due to customer support and trust.

The bank’s performance was influenced by several factors, including an increase in lending activity through the group ecosystem, with total loans disbursed recorded at 15.9 trillion rupiah in FY2022, an increase of 160% over 6.1 trillion rupiah in FY2021.

SeaBank was also prudent in loan disbursement, which is reflected in the ratio of non-performing loans (NPLs), with gross non-performing loans at 2.03% for FY2022 and, more importantly, net non-performing loans at 0.13%.

In terms of funding, SeaBank Indonesia continued to grow its third-party funds through customer deposits by offering more attractive interest rates and other promotions compared with its competitors throughout 2022. SeaBank Indonesia recorded a 158% YoY increase in customer deposits in 2022 to 21.6 trillion rupiah versus 8.3 trillion rupiah in 2021.

The bank has provided an even more optimistic outlook for 2023 and promises to continue to provide innovative products, services, and attractive programmes for all its customers in Indonesia. The bank targets both SMEs within the Shopee ecosystem and beyond as well as consumers.

These look like a positive set of results for what is one of the leading digital banking hopefuls, with access to the attractive Shopee ecosystem which provides it with extensive data on potential customers through their consumption behaviour.

The other leaders among the new standalone digital banks, including Bank Jago Tbk PT, PT Bank Neo Commerce, and Allo Bank Indonesia Tbk PT, have also booked small profits in Q4 2022, and in some cases FY2022, but all are forecasting to be profitable in FY2023.

These early profits reflect that banks can still fund growth internally at this early stage, although Bank Jago already has a CASA ratio of just over 70% and a cost of funds of around 2%, suggesting it is well positioned to grow its loan book plus it is generating a net interest margin of 10%, which is significantly above the top four banks in Indonesia whose NIMs range between 4.6-7.8%.

Allo Bank, which is backed by the CT Group, along with the likes of Bukalapak, Salim Group, Grab Holdings, Traveloka Indonesia, and Carro giving it a rich online and offline ecosystem with the potential to touch 100 million customers, also reported its FY2022 results recently.

The bank booked a net profit growth of 40% YoY in FY2022 to 270 billion rupiah, driven by a net interest income which skyrocketed by 221% YoY to 627.2 billion rupiah from only 195.32 billion rupiah in FY2021.

Allo Bank Indonesia disbursed 6.99 trillion rupiah of loans to third parties, up 222% YOY in 2022, with 162 billion rupiah loans to related parties. The bank’s assets also rose 138% to 11.06 trillion rupiah following the successful move to increase capital early last year.

At the same time, the bank’s liabilities saw an increase of 39% YoY to 4.65 trillion rupiah, mainly supported by the company’s success in increasing customer deposits, which rose 108% to 4.4 trillion rupiah, while the bank’s equity increased 392% YoY to 11.06 trillion rupiah.

It is still early days for AlloBank, but it is already showing promise and has the strong potential to be one of the “Big Four” digital banks, given the ecosystem it is plugged into.

For the broader market, it is unclear whether Indonesia is ready for the wholesale adoption of digital banks, but they certainly have a strong role to play in consumer banking and MSMEs. The key competition is coming from existing banks, which have already gathered a vast number of digital banking customers both through their existing customer bases as well as through mobile banking, where accounts can be opened directly.

Alfamart: Leading the charge in convenience

Despite rising inflation following the fuel price hikes in Indonesia last year, Sumber Alfaria Trijaya, which operates the Alfamart mini-market brand, posted impressive earnings for the fourth quarter and the full year 2022.

The earnings, announced last week, reflected growth in the number of stores, improvement in the company’s digital capabilities as well as a push into the convenience store space under the Lawson brand.

Sumber Alfaria Trijaya booked total sales of 96.9 trillion rupiah in FY 2022, a growth of 14.1% YoY. Gross profit was up by 14% YoY and EBITDA improved by 18.7%. The company saw its operating margins in Q4 2022 improve to 5.8% versus 2.7% a year earlier due to greater efficiencies, scale benefits, and better employee productivity reflecting the strong finish to the year.

Net profit in Q4 2022 improved to 1.104 billion rupiah, an increase of 121.5% YoY, which lifted net profit for the full year by 48.2% YoY to 2.9 trillion rupiah.

Alfamart has come out of the pandemic with a strong performance and continues to generate improving returns as reflected in its RoE, which improved to a lofty 27.3% versus 22.1% in FY2021.

Sumber Alfaria Trijaya added 1,657 stores in FY2022, bringing the total store count to 20,647 across Indonesia. Around 27% of the stores are in Greater Jakarta, 39.9% in Java, and 33.1% in the Outer Islands. Around 23% of the total stores are franchised stores and the rest are wholly-owned.

The expansion included 1,321 new Alfamart stores, 129 Alfamidi stores, 12 Alfamidi Fresh and Alfa Supermarkets, 127 Lawson Stores, and 68 Dan & Dan health and beauty stores.

In FY2023, the company aims to increase the number of convenience stores under the Lawson brand significantly. Convenience stores is a format where 7-Eleven tried and failed a few years ago but maybe Indonesia is now in a better position to adopt the Lawson model, which provides consumers a wide range of ready-to-eat and ready-to-cook options, especially Japanese dishes, with a smaller number of SKUs.

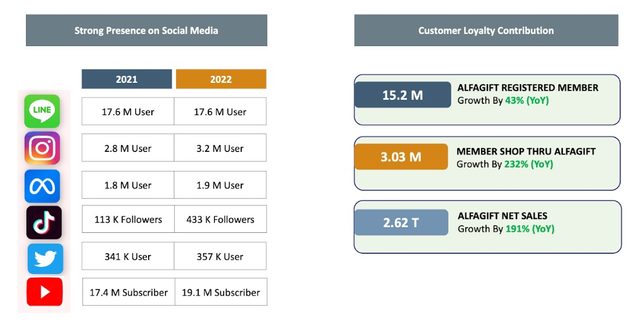

Sumber Alfaria Trijaya continues to highlight its digital presence across social media and online service through Alfagift. Alfamart has 17.6 million users online, 2.3 million Instagram followers, 1.8 million Facebook users, and 17.4 million YouTube subscribers.

Alfamart has 15.2 million Alfagift registered users, which grew by 43% YoY in FY2022 plus 3.03 million members that shop through Alfagift, a growth of 232% YoY, with Alfagift net sales up 191% YoY in FY2022.

Indonesian consumption saw growth across all categories in FY2022 other than cooking and seasoning (-4% YoY), a sign of the post-pandemic environment. Other categories such as beverages (+12% YoY), personal care (+13% YoY), and home care (+10% YoY) saw strong growth, as did indulgences (+15% YoY), show data from Nielsen Indonesia. This bodes well for Sumber Alfaria Trijaya.

Increased scrutiny for crypto is much-needed

The move to place more scrutiny on Indonesia’s crypto industry is most interesting since the industry’s supervision will be transferred to the financial services authority OJK from Bappebti, the commodities regulator.

OJK will also see the appointment of a dedicated commissioner to oversee the nascent sector. The move is in line with Indonesia’s Omnibus Law, which aims to strengthen the financial services industry.

Crypto trading, a popular instrument for retailers in Indonesia, saw a significant rise in investor participation during the pandemic. The number of crypto investors grew by 81% YoY in 2022. However, limited regulatory oversight has meant increased instances of fraudulent behaviour, triggering the need for greater protection for retail and first-time investors.

The increased scrutiny should provide a more stable environment for the industry. Indonesia will also set up a crypto exchange for increased transparency in trading. The country has a surprisingly large crypto investor base of 17 million investors, with 25 registered crypto trading platforms such as ToKoCrypto, Pintu, and Luno Indonesia.

Indonesia allows a total of 383 crypto assets and 10 local coins to be traded while another 151 assets and 10 coins are under review.

More recently, there has been a predictable compression of trading volumes, which fell 67% YoY in February 2023. The issue also is that a large portion of retail investors was probably drawn into crypto assets at higher levels.

Given the complexity of crypto assets, there is an enormous need for education to protect retail investor interests. Having a far more focused oversight will not only provide a level-playing field for the industry but also protect investors from players which do not comply with the stricter regulations.

The OJK has recently banned financial service institutions ranging from banking, and insurance, to multi-finance institutions from facilitating cryptocurrencies, including using, marketing, and or facilitating the trading of crypto assets.

The key principle behind this is that digital currency, including crypto assets, is not considered legal tender in Indonesia. The OJK has stated that banks may own cryptocurrency provided they meet the risk-weighted assets regulations.

The regulator has also publicly appealed to the public to be aware of allegations of crypto investment Ponzi scheme fraud to enhance the understanding of the risks of crypto assets given crypto is viewed as a commodity with inherent volatility.

With the stricter regulation from the OJK, there will be some reverberations through the local industry but longer term it should provide a more stable base for the industry.

Indonesia bets on incentives to drive EV adoption, boost ecosystem

Indonesia’s steep reduction of value-added tax on sales of battery-based electric vehicles from 11% to 1% comes as no surprise given the country’s aim to boost EV adoption as well as become a global manufacturing hub for the entire ecosystem including batteries, four-wheelers (4W) and two-wheelers (2W).

For Indonesia, the 2W market is especially important given the ubiquity of bikes in the country – over 6 million motorcycles are sold every year in the country.

The tax incentive, issued in March and mandated by the Ministry of Finance, is effective from this month until the end of the year. The incentive programme applies to electric cars and buses powered by at least 40% locally manufactured components. The government will roll out the tax relief gradually and measurably as it takes significant steps to boost EV adoption in the country.

In 2021, the government began the exemption of luxury tax on EVs, making them more affordable for consumers. The two companies with a significant output of 4W EVs currently are Hyundai Motor and Wuling Motors. The government has also been trying to attract Tesla Motors to invest in the country and establish a presence in Southeast Asia.

In March, the government rolled out a subsidy programme worth $110 million for EV manufacturers, retailers, and individual users. Indonesia has a key advantage over other countries in SE Asia, given its access to some of the key raw materials for battery production.

The country also has a well-developed local automobile industry, with 1.476 million vehicles manufactured in 2022 (up 31% YoY), with 1.0 4 million sold domestically (up 18.1% YoY) by numerous auto brands, including Toyota, Daihatsu, Honda, Mitsubishi, Honda, Suzuki, Hyundai, KIA, and Wuling.

The main competitor in the region for Indonesia is Thailand, which already has a well-developed auto export industry versus Indonesia and produced 1.88 million cars in 2022. Indonesia’s exports grew 61% YoY to 473,602 units that are shipped to over 70 countries.

Indonesia’s key advantage lies in its access to the main raw materials for EV batteries, which makes it an obvious choice for building an EV battery ecosystem, with the next stage being attracting EV manufacturers, whilst also creating an attractive domestic EV market.

To do this, Indonesia needs to make the country an attractive place to invest with incentives to set up manufacturing plants and provide incentives to boost the demand for EVs locally.

The government is currently finalising regulations regarding the use of electric vehicles. The plan is to provide an electric motorcycle incentive of IDR7 million on the purchase of every bike or conversion while electric car incentives are still under consideration.

In Thailand, the incentives for electric cars are the equivalent of IDR80 million for each vehicle that is produced domestically. The decision to apply this incentive was taken to encourage the downstream industries of the electric vehicle ecosystem in order to improve its manufacturing ecosystem.

In Indonesia, there has already been some success in generating demand for EVs despite the lack of charging infrastructure. Wuling Air EV, a new electric vehicle from Chinese car manufacturer Wuling Motors, was launched in September 2022 and saw sales of 8,000 units in the first three months.

South Korea’s Hyundai Motor and China’s BYD are investing in building EV manufacturing in Indonesia. Tesla is also reportedly on the verge of closing in on a deal to build an Indonesian EV manufacturing plant, which would have the capacity to produce 1 million cars a year.

Indonesia is an attractive place for auto manufacturing given its skilled worker base of over 1.5 million. The other advantage Indonesia has is not just a large domestic auto market but one with relatively low penetration rates versus its neighbours. Although there has been some early success with EVs, it still remains niche both for cars as well as motorbikes with some local brands such as Electrum likely to emerge as winners.

Indonesia’s lack of dedicated charging infrastructure presents a longer-term issue that needs a solution.

Indonesia is the third largest market for motorcycles globally after China and India, making it a potentially huge market for EV bikes if it can get the infrastructure right. Indonesia sold 5.2 million motorcycles last year, with scooters making up 88% of that number.

The country has around 125 million motorcycles in circulation currently.

Indonesia is well-positioned to become a hub for EV batteries, with a number of companies in the process of restructuring and in some cases listing to prepare for this potentially imminent ramp-up in production. It also has the potential to become a manufacturing hub for EVs. That coupled with its EV export ambitions could be a game changer for Indonesia’s economy.

Angus Mackintosh, a consulting editor with DealStreetAsia, is responsible for the publication’s Southeast Asia digital economy weekly newsletter and its monthly research reports. Angus is also the founder of CrossASEAN Research and publishes on Smartkarma.