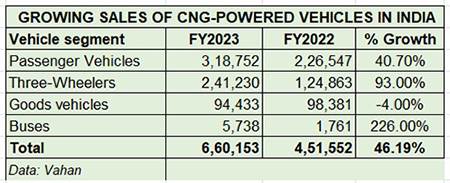

Demand for alternative fuel vehicles in India is on the upswing and clearly seen in the increasing sales of CNG-powered vehicles. Given the favourable price arbitrage of CNG versus petrol and diesel, retail sales of CNG vehicles, across four sub-segments, crossed the 650,000-unit mark for the first time in a fiscal in FY2023. Cumulative sales of 660,153 units (see data table below) translate into strong double-digit YoY growth of 46% (FY2022: 451,552 units).

CNG passenger vehicles (PVs), with 318,752 units, account for 48% of the total retail sales in FY2023 and surged by 40.71% year on year (FY2022: 226,547 units) and took an 8.80% share of overall retail sales of 36,20,039 PVs in India.

Maruti Suzuki commands 69% share of CNG car market

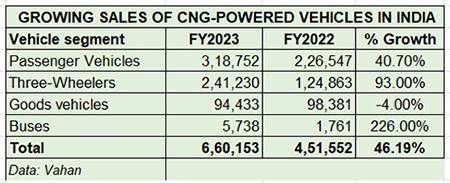

PV market leader Maruti Suzuki India has a strong grip on the CNG sub-segment with 219,717 units, which marks 24% growth (FY2022: 176,691) and gives the company a commanding share of 69% in the segment. The company, which introduced CNG in the S-Presso, Brezza, Grand Vitara, Swift, Dzire, Baleno and XL6 in FY2023, now offers the factory-fitted CNG option in all of 14 cars, the largest for any carmaker in India.

At end-March 2023, Maruti Suzuki had a pending order backlog of a total of 380,000 PVs of which CNG models account for 121,000 units or 32%, with the popular Ertiga CNG MPV comprising for nearly 68,000 units of 56% of pending CNG variant orders.

Hyundai Motor India, which currently has the Aura sedan and Grand i10 Nios as its CNG offerings, sold 55,992 units, recording strong 38% YoY growth (FY2022: 40,434). This performance gives Hyundai a 17% market share.

Hyundai Motor India, which currently has the Aura sedan and Grand i10 Nios as its CNG offerings, sold 55,992 units, recording strong 38% YoY growth (FY2022: 40,434). This performance gives Hyundai a 17% market share.

Tata Motors, which had entered the CNG market in FY2022 with the Tiago and the Tigor, is already making strong gains. In FY2023, the company saw retails of 40,323 units, which a 471% YoY increase albeit on a low-year-ago base (FY2022: 7,059). What is creditable is that despite its recent entry into the CNG market, Tata Motors has already grabbed 13% of the CNG car market.

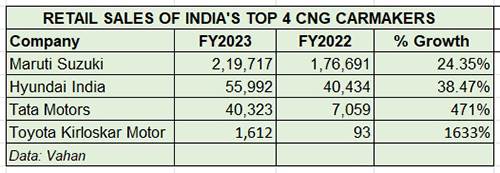

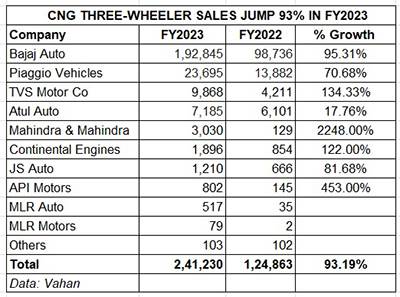

Bajaj Auto maintains stranglehold on 3-wheeler market

While three-wheelers clocked 93% growth with retails of 241,230 units (FY2022: 124,863), demand for CNG goods vehicles was down by 4% YoY to 94,433 units. The goods vehicle segment is seeing greater demand in the form of electric mobility, where the lower cost of ownership, compared to CNG, is driving demand from last-mile mobility and logistics operators.

Bajaj Auto with retails of 192,845 units, which marks YoY growth of 95% (FY2022: 98,736), maintains a vice-like grip on the CNG three-wheeler market. The company has increased its market share to 80%. Piaggio Vehicles, with 23,695 units, recorded 70% growth and currently has a 10% market share. TVS Motor Co saw a 134% YoY increase in sales to 9,868 units, more than doubling its FY2022’s sales of 4,211 units.

CNG-only three-wheelers accounted for 222,505 units and comprised 92% of overall sales, with the balance 18,725 units being petrol-CNG three-wheelers.

With the Central and state governments pushing demand for CNG buses, while also expanding the CNG filling network across the country, CNG bus sales rose sharply by 226% to 5,738 units (CY2022: 1,761 units)

Latest price cut to spur sales in FY2024

Clearly, the smart increase in consumer demand for CNG vehicles continues to be driven by the lower cost of ownership mantra that the greener fuel offers in the face of high petrol and diesel prices.

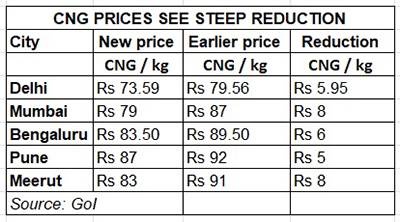

What will help accelerate demand and sales for CNG vehicles across segments is the steep price cut effective April 8, 2023. The Rs 8 per kg cut is the biggest-ever in recent times and takes the price of CNG in Mumbai to Rs 79 per kg from Rs 87 per kg. The steep price cut is the result of the Union Cabinet’s decision on April 6 to revise the pricing methodology of naturas gas produced in the country.