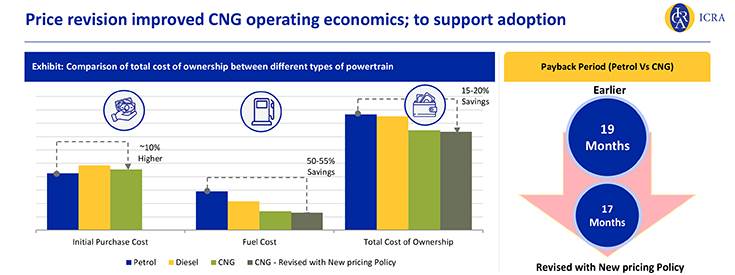

The proportion of CNG, EVs and hybrids is likely to materially increase as a proportion of new vehicles sales over the next 3-4 years, even as petrol-based vehicles are likely to continue to constitute a significant portion of the new vehicle sales.

The Cabinet Committee on Economic Affairs (CCEA) has approved a new domestic gas pricing plan that resulted in reduction of CNG prices by up to Rs 8 per kilogram across cities in India.

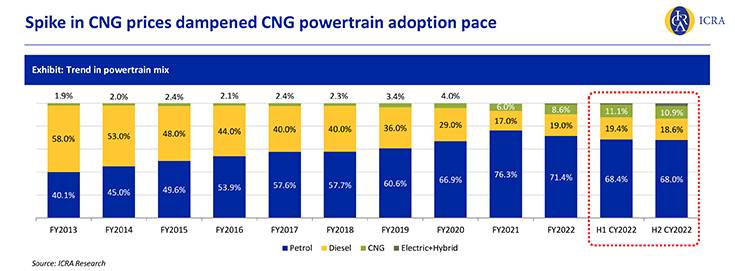

While a notable increase in the prices of CNG, which had seen as many as eight hikes in CY2022, had slowed down demand for CNG-powered passenger vehicles in India, the recent reduction in prices of the greener fuel is set to give a fillip to CNG vehicle sales in the country.

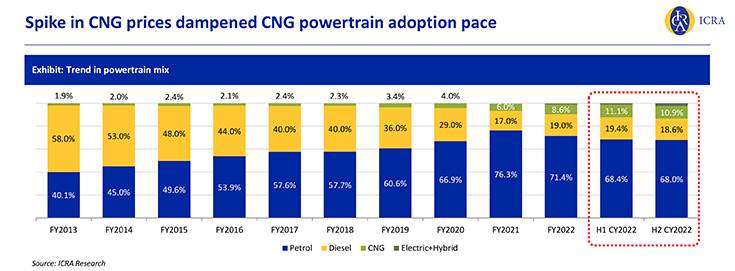

According to an ICRA report, the slashing of CNG prices on April 8 by up to Rs 8 per kilogram across cities, will lead to lowering of total cost of ownership for motorists of CNG-powered vehicles and accelerate adoption for CNG-powered vehicles in the near future.

The latest downward revision in CNG prices is a result of the April 6 approval of the new domestic natural gas pricing plan by the Cabinet Committee on Economic Affairs (CCEA). The revised guidelines put domestic gas prices at 10% of the monthly average of the Indian Crude Basket, and is to be notified monthly. The Cabinet also set a floor ceiling price at US$ 6.5 per mmBtu for the gas produced by ONCG and Oil India Ltd. The prices are mandated to be maintained at the same level until FY25, and then revised by US$ 0.25 per mmBtu every year thereafter.

While the CCEA guidelines enabled an up to 10% reduction in CNG prices across cities in India and are also likely to limit material increases in the future, the spurt in CNG prices over the past year was driven by factors such as increase in blending cost, as well as the depreciation of the Indian currency. The significant price reduction has pulled down CNG prices in major cities in India to year-ago levels, thereby bringing significant respite to motorists.

According to Shamsher Dewan, SVP and Group Head, Corporate Ratings, ICRA, “The new gas pricing policy has led to CNG prices declining to levels seen nearly a year ago, thereby providing relief to the consumers. Rising gas prices slowed down the adoption of CNG powertrains in H2 CY2022, led by a decline in the running cost differential between petrol and CNG powertrains and a consequent increase in the payback period for the latter.”

While sales were gathering pace since CY2021, the smart uptick in CNG passenger vehicle sales in the country was curbed in H2 CY2022 due to rising gas prices. India’s largest carmaker Maruti Suzuki India (MSIL) too recorded a decline in demand for its CNG-equipped models, particularly since June 2022 when the price gap between petrol and CNG started narrowing significantly. The contribution of CNG powertrains in the order backlog of MSIL declined from 43% in June 2022 to about 32%, in December 2022, the ICRA report suggests.

In a recent interaction with Autocar Professional, Shashank Srivastava, senior executive director, MSIL, said, “While there was a dip in demand, the introduction of six new models with CNG in FY2023 compensated our overall numbers. The new launches led to our CNG penetration increasing from 15.5% to 19% in FY2023.”

As per the ICRA study, the pace of CNG adoption during this period could have further slowed down in the absence of introduction of CNG-equipped variants by MSIL.

Price cut to spur fresh demand

The report further states that the CNG price correction will improve CNG operating economics and further drive adoption of the greener fuel. The study reveals that the lowered CNG prices will now enable a payback of the additional acquisition cost of a CNG vehicle within 17 months, compared to 19 months earlier.

The superior fuel efficiency of CNG compared to petrol, wherein the former inherently tends to offer up to one-and-a-half times better economy, is also set to drive CNG adoption in the future as it further lowers the vehicle’s total cost of ownership.

Moreover, the ICRA report points out that the strengthening CNG infrastructure in the country with the government’s plan to set up 8,000 CNG stations over the next two years will also drive demand for CNG vehicles. At present, there are an estimated 1,332 CNG stations in the country, with increasing availability in Tier-II cities as well, and the government’s long-term plan eyes establishment of 17,700 such stations across the country by 2030.

CNG share in PV market to grow to 18% over five years

According to the ICRA report, the proportion of CNG, EVs and hybrids is likely to increase in proportion of new vehicle sales over the next 3-4 years, even as petrol-powered vehicles are likely to continue constituting a significant portion of the new vehicle parc. CNG penetration in India is likely to grow from 11% in CY2022 to 18% in CY2027.

“A decline in CNG prices has led to a reduction in the total cost of ownership – about 10-15% lower than petrol powertrain – for the powertrain and is likely to aid adoption for the same going forward. ICRA estimates CNG powertrain penetration to increase to levels of about 18% by CY2027, up from about 11% in CY2022,” Dewan said.

The price reduction is going to give a fillip to demand for CNG cars with OEMs likely to introduce more models with the greener fuel option. While Maruti Suzuki currently has a portfolio of 14 factory-fitted CNG models and a 20% market penetration, No. 2 carmaker Hyundai Motor India has an 11% penetration on the back of two models. Tata Motors, with its Tiago and Tigor CNG models, has 9% penetration, as per the ICRA study.

ALSO READ:

CNG vehicle sales surge by 46% to over 650,000 units in FY2023