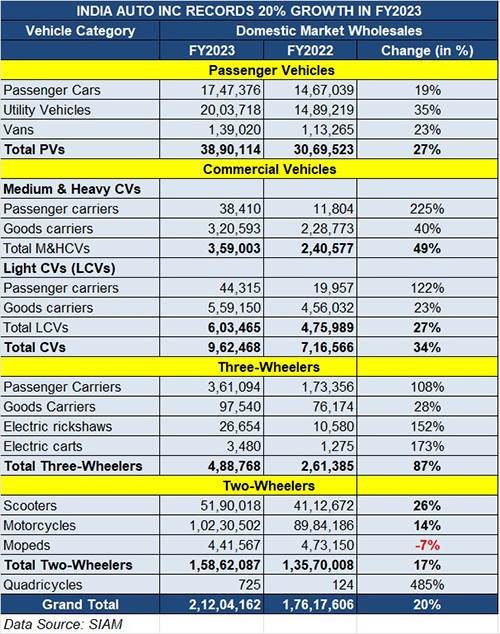

India Auto Inc’s wholesales report card for FY2023 is out. As per the numbers released by apex industry body SIAM, cumulative sales of four vehicle segments – passenger vehicles, commercial vehicles, and two- and three-wheelers – totalled 2,12,04,162 units or a shade over 21 million units.

While this constitutes 20% year-on-year growth (FY2022: 1,76,17,606 units), it is still to match pre-Covid FY2020 levels of 2,15,48,494 units and considerably below the best-yet FY2019’s 2,62,66,179 units. Nevertheless, after two consecutive fiscals of below 20-million sales, overall numbers are back in growth mode.

Commenting on the industry’s performance, Vinod Aggarwal, President, SIAM said: “2022-23 has been a year of consolidation, post Covid. The year started with supply chain disruptions from the Ukraine conflict. However, with efficient management of supply chains and better availability of commodities, especially for the electronics items, prices have moderated over the year though it remains a concern. Favourable policy initiatives ranging from impact of new PLI schemes, encouraging announcements in the Budget, forward-looking logistics and foreign trade polices and the recently announced gas pricing guidelines would go a long way in supporting the growth of the Industry.”

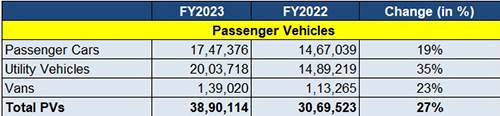

Passenger Vehicles: 38,90,114 units / up 27%

The passenger vehicle segment is the sole segment which has maintained a strong growth trajectory over the past few years, recording high-level double-digit growth. Pin that down to the surging demand for UVs, SUVs and MPVs. Of the total 3.89 million units sold in FY2023, the UV sub-segment accounted for a shade more than 2 million units or 51.50% of total PV sales, registering 35% YoY growth.

The pace of growth in the UV segment can be gleaned from the fact that in FY2014, UV sales were 525,942 units. A decade down the line, sales numbers have quadrupled. What’s more, they have helped buffer the slower growth of the car market whose numbers have been impacted by tepid demand for entry-level hatchbacks.

According to SIAM president Vinod Aggarwal, “Within the PV segment, while some categories of vehicles are doing well, others are not. There are some concerns, particularly in the entry-level segment, and we are hopeful and optimistic that those would be resolved and customers will come back. Having said that, the overall industry is doing well.”

Overall though, the PV segment continued to fire on all cylinders in FY2023 surpassing the previous best of 3.37 million units in FY2019 by a sizeable margin and bids fair to cross the 4-million mark in FY2024, given the sustained demand for UVs.

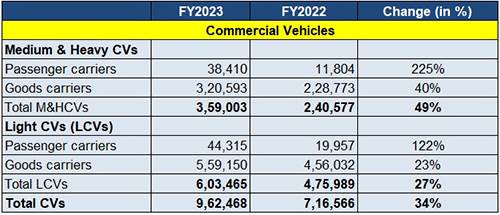

Commercial Vehicles: 962,468 units / up 34% YoY

This is the sector which spells the health of the country’s economy. From passenger-ferrying small and large buses through to the medium and heavy goods carriers, they are the vehicles traversing the length and breadth of the country with essential goods as well as the ones implementing the last-mile mobility mantra of business.

Growth for the CV industry comes in four-year cycles and thus, when FY2023 data reveals that combined commercial vehicle sales clocked 962,468 units, an increase of 34% over FY2022’s 716,566 units, there is reason for cheer. This is the industry’s best performance in four years but a tad less than the industry’s best-yet show in FY2019 when it surpassed a million units: 10,07,319.

The massive government as well as private sector spend in infrastructure development, mining and related activities is leading to fresh demand, particularly for HCVs, even as replacement demand is up and about with a vengeance as MCV operators scramble to update their fleets.

The huge boom in e-commerce activity and the resultant demand for optimised hub-and-spoke-driven last-mile deliveries across the country is reflected in 554,585 LCVs being retailed in FY2023, accounting for 59% of total CV sales.

While a total of 359,003 M&HCVs were sold in FY2023, up 49% (FY2022: 240,577), LCVs accounted for 603,465 units, up 27% (FY2022: 475,989 units). Club the goods carriers from the two sub-segments and you get 879,743 units or 91% of total CV sales, a clear indicator of just how speedy demand is for goods transporting vehicles.

Commenting on the segment’s performance, Vinod Aggarwal said: “The CV sector is doing extremely well and is almost nearing the earlier peak of FY2019. There is potential for further growth as a lot of investment is happening on infrastructure development, which will drive demand for construction trucks. As the country’s road infrastructure is also consistently evolving, it is leading to the migration of fleets to better trucks and thus an uptick in replacement demand. The CV industry is poised for growth in the coming future.”

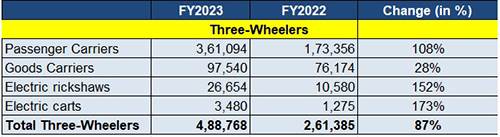

Three-wheelers: 488,768 units / up 87% YoY

Look at the data table below and one sees growth across all four sub-segments. With India back on the move, across town and country, demand for passenger-ferrying autorickshaws for short distances is on the rise. This is reflected in sales of passenger carriers (361,094 units, up 108%) and electric rickshaws (26,654 units). Three-wheeled goods carriers have crossed the 100,000 mark with total sales of 101,020 units, up 30% YoY.

Three-wheelers, along with two-wheelers, are the growth drivers of the electric vehicle industry in India and that’s reflected in total EV sales of 30,134 units, up 155% (FY2022: 11,855 units). This also means the share of EVs in this segment is now at 6.16%, up from 4.53% a year ago.

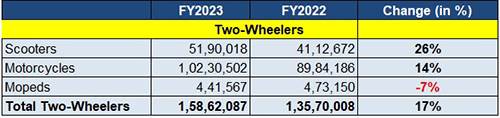

Two-wheelers: 1,58,62,087 units / up 17% YoY

The segment on two wheels only clocked total wholesales of over 15.8 million units with 17% YoY growth. While this is better than FY2022’s 13.5 million units, it is less than FY2021’s 15.1 million units, FY2020’s 17.4 million units and considerably less than the best-yet number of 21.1 million units in FY2019.

Motorcycles, with 1,02,30,502 units, accounted for 65% of total sales and saw YoY growth of 14%. Scooters, with 51,90,018 units, recorded YoY growth of 28%. Mopeds, with 441,567 units, was the sole segment in FY2022 to record a sales decline – it is down 7% on FY2022’s 473,150 units. Let’s see if products like Kinetic Green’s upcoming electric Luna puts a fresh charge into moped sales.

According to the SIAM president, “The overall numbers in the two-wheeler segment are still quite low. FY2023 sales at 15.8 million units are about 25% lower compared to the peak of 21 million units in FY2019. Two-wheelers are an important aspect of personal mobility in India and there will be recovery in future. While rural distress is a key impediment, a lot of potential customers are also getting converted into fence sitters by remaining unable to decide between an ICE and an EV product. Since costs in the two-wheeler segment have gone up significantly, a GST reduction from the government’s side can really help spur demand.”

India Auto Inc on growth road in FY2024

Given the current momentum, FY2024 is looking good at this stage albeit the rate of growth will moderate from the high double digits to single digit on the high base of FY2023.

According to SIAM president Vinod Aggarwal, “While there are challenges, we expect the entire automobile industry to overcome them and grow in FY2024. The government’s move to lower CNG prices is a positive move as it will now drive more sales of CNG trucks and cars, as their operating cost will be lesser, and customers will increasingly opt for this greener fuel option.”