Declining new-vehicle prices, increasing incentives, improving incomes, and a lower average new auto loan rate reduced the average payment to the lowest level since September 2022.

Graphic: Cox Automotive

New-vehicle supply closed March at its highest level in two years despite surprisingly brisk sales, according to a recent Cox Automotive’s analysis of vAuto Available Inventory data.

Days of supply has remained relatively steady while the average listing price edged lower.

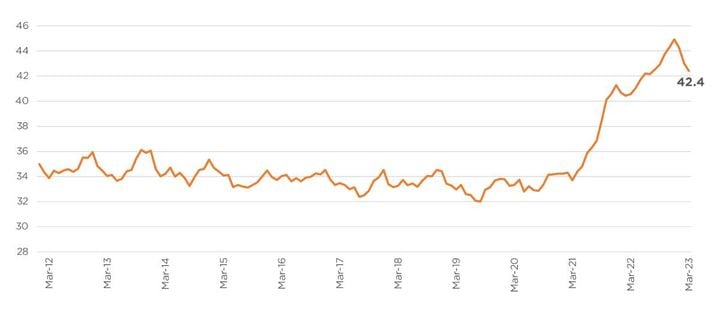

That means new-vehicle affordability improved again in March and contributed to improving new-vehicle sales, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index. All factors helped as declining new-vehicle prices, increasing incentives, improving incomes, and a lower average new auto loan rate reduced the average payment to the lowest level since September 2022. The number of median weeks of income needed to purchase the average new vehicle in March declined to 42.4 weeks from an upwardly revised 43 weeks in February.

Highest Level of Supply Since April 2021

The total U.S. supply of available unsold new vehicles on dealer lots and some in transit stood at 1.89 million units at the end of March, up from a revised 1.80 million at the end of February. The end of March marked the highest level of supply since April 2021. Supply was up 70% from a year ago, or 780,000 units higher.

Days’ supply was 56, down only a day from the end of February but up 58% from the same time a year ago. Historically, a 60 days’ supply across the industry was considered normal and ideal.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period that ended March 27, when about 1.02 million vehicles were sold, up 8% from the same period in the previous year.

For the full calendar month of March, total new-vehicle sales were up 9% from a year ago for a sales pace, or seasonally adjusted annual rate (SAAR), of 14.8 million, up from 13.6 million a year ago but down from February’s revised 15 million. Total sales in March were buoyed by double-digit increases in fleet sales, as has been the case for the past few months.

“During March, we saw sales surpass the 1-million mark for a 30-day period for the first time since early September 2021,” said Charlie Chesbrough, Cox Automotive senior economist, in a news release. “Higher sales have been boosted, in part, by improving inventory, which has been running at around 1.8 million or so for the past several weeks.”

While inventory is up substantially from 2022 levels, it remains low by historical standards. At the end of pre-pandemic March 2019, the total supply was 3.87 million vehicles for a 94 days’ supply.

Estimated Typical New Car Monthly Payment Declined to $754

The average transaction price (ATP) for a new vehicle fell to $48,008 in March and was below the manufacturer’s suggested retail price for the first time in 20 months, according to data released by Kelley Blue Book.

The March ATP decreased by 1.1% ($550) compared to February. Meanwhile, the median income grew by 0.3%, and incentives from manufacturers increased to the highest level in a year. The average new-vehicle loan interest rate declined 141 basis points to 8.77%. As a result of these changes, the estimated typical monthly payment for a new vehicle declined 1.1% to $754 from a downwardly revised $762 in February. The average monthly payment peaked at $791 in December 2022.

“Even with three consecutive months of improvement, affordability challenges are limiting access to the new-vehicle market by lower income and lower credit quality buyers, said Cox Automotive Chief Economist Jonathan Smoke in a news release. “Subprime lending in the new market has decreased substantially since 2019, and deep subprime has disappeared. This trend induces automakers to focus on profitable products for consumers who can afford to buy, which keeps less affluent consumers out of the new-vehicle market altogether and limits what is available and possible in the used market for years to come.”

New-vehicle affordability in March was worse than a year ago when prices and rates were lower. The estimated number of weeks of median income needed to purchase the average new vehicle in March was up 5% from last year.

Originally posted on Automotive Fleet