Genuine Parts Company GPC reported first-quarter 2023 adjusted earnings of $2.14 per share, up 15.1% year over year. The bottom line also surpassed the Zacks Consensus Estimate of $2.02 per share. Higher-than-expected sales across both of its segments resulted in this outperformance.

The company reported net sales of $5,765.1 million, outpacing the Zacks Consensus Estimate of $5,686 million. The top line rose 8.9% year over year. The upside resulted from growth in comparable sales across both segments and benefit from acquisitions, partly offset by a net unfavorable impact of foreign currency translation of 2.2%.

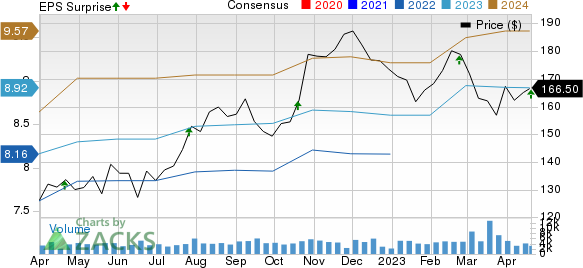

Genuine Parts Company Price, Consensus and EPS Surprise

Genuine Parts Company price-consensus-eps-surprise-chart | Genuine Parts Company Quote

Segmental Performance

The Automotive segment’s net sales totaled $3,505.8 million in the reported quarter, surpassing the Zacks Consensus Estimate of $3,462 million. The top line was also up 7% year over year on the back of comparable sales growth and acquisition benefits. The segment’s comparable sales rose 6.6% year over year. Operating profit was unchanged at $264 million, lagging the Zacks Consensus Estimate of $291 million. The profit margin was at 7.5%, down 60 basis points from the year-ago period.

The Industrial Parts segment’s net sales totaled $2,259.2 million, surpassing the Zacks Consensus Estimate of $2,218 million. The top line also rose 11.9% year over year on comparable sales growth and acquisition benefits. The segment’s comparable sales climbed 12.1% in the reported quarter. Operating profit rose 39.1% from the prior-year quarter to $262 million, which beat the Zacks Consensus Estimate of $225 million. The profit margin of 11.6% expanded by 230 basis points from the first quarter of 2022.

Financial Performance

Genuine Parts had cash and cash equivalents worth $651.2 million as of Mar 31, 2023, declining from $653.5 million as of Dec 31, 2022. The company exited the first quarter with $2.1 billion in total liquidity, comprising $1.4 billion on the revolving credit facility and the remainder as cash/cash equivalents. Long-term debt increased to $3,094.3 million from $3,076.8 million as of Dec 31, 2022. The company generated free cash flow of $109.4 million for the three months ended Mar 31, 2023.

Revised Guidance for 2023

Genuine Parts expects revenues from automotive and industrial sale to witness year-over-year upticks of 4-6% and 4-6%, respectively, same as the previous guidance. Overall sales growth is projected to be 4-6%, same as the earlier projection. Full-year adjusted earnings are envisioned to be $8.95-$9.10 per share, up from the previously mentioned $8.80-$8.95 per share. The operating cash flow is estimated to be $1.3-$1.4 billion, up from the previously stated $1.2-$1.4 billion, whereas the FCF is estimated to be $900-$1,000 million, up from $800-$1,000 million stated earlier.

Zacks Rank & Key Picks

GPC currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked players in the auto space are Geely Automobile Holdings Limited GELYY, BYD Company Limited BYDDY and Ferrari N.V. RACE, all of which currently sport a Zacks Rank #1.

Geely is engaged in automobile manufacturing and related areas. The Zacks Consensus Estimates for GELYY’s 2023 sales and earnings implies year-over-year growth of 57.5% and 7.4%, respectively.

BYD is engaged in the research, development, manufacture and distribution of automobiles, secondary rechargeable batteries, and mobile phone components. The Zacks Consensus Estimate for BYDDY’s 2023 sales implies year-over-year growth of 175%.

Ferrari is engaged in designing, manufacturing and selling sports cars. The Zacks Consensus Estimates for RACE’s 2023 sales and earnings implies year-over-year growth of 14% and 19.8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Ferrari N.V. (RACE) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report