Indonesia-listed tech giant PT GoTo Gojek Tokopedia Tbk (popularly GoTo) narrowed its net loss by 41% on a year-on-year in the first quarter of 2023, showing progress towards profitability, the company announced on Tuesday.

GoTo’s loss for the three months ended March 31, 2023 stood at 3.9 trillion rupiah ($265 million), compared with 6.6 trillion rupiah in the same period of 2022.

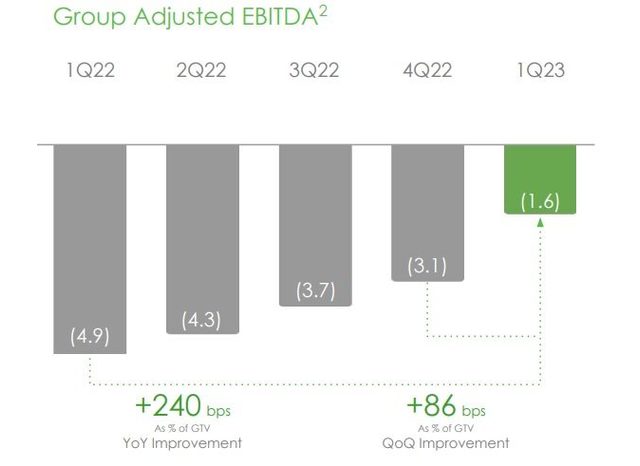

The group’s adjusted EBITDA loss improved by 67% to 1.6 trillion rupiah in the quarter, from 4.9 trillion a year ago, on the back of an improved performance in its on-demand services and e-commerce segments.

“We continued to make considerable progress toward profitability in the first quarter of 2023, with adjusted EBITDA improving by 67% year-on-year and 49% quarter-on-quarter, meaning we are halfway towards becoming Adjusted EBITDA positive within Q4,” CEO Andre Soelistyo said in a statement.

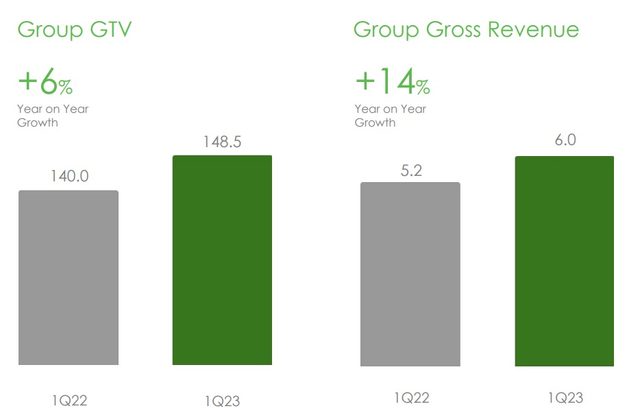

GoTo posted net revenue of 3.3 trillion rupiah for the Jan-March period, compared with 1.5 trillion rupiah a year ago. Its gross revenue in the latest quarter stood at nearly 6 trillion rupiah, up from 5.2 trillion rupiah in Q1 2022.

GoTo’s Group GTV reached 148.5 trillion rupiah in the first quarter 2023, a 6% growth year-on-year from 140 trillion rupiah in the corresponding period a year earlier.

“Our focus on high-quality, profitable consumers along with a disciplined approach to costs has significantly increased our efficiency and gives us a glimpse of what the future looks like for GoTo. As we continue to implement our strategy, slower GTV growth is expected in the near term, as we reduce low-quality transactions on our ecosystem, although we will continue to focus on building the foundational product infrastructure that will drive sustainable growth for our company over the longer term,” added Soelistyo.

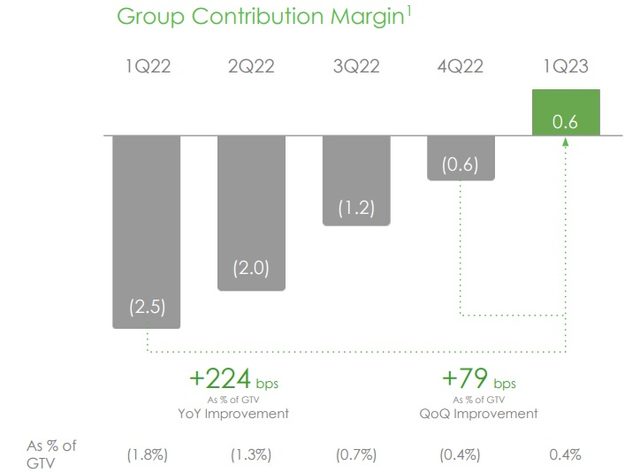

Group contribution margin, GoTo reported, turned positive at 0.4% of the gross transaction value (GTV), up 224 bps year-on-year to reach 636 billion rupiah. Jacky Lo, GoTo Group CFO, credited the positive group contribution margin in the first quarter of 2023 to improved revenue growth and incentive rationalisation.

“The strict management of our fixed cost structure is also driving profitable outcomes, significantly reducing our OpEx base and reducing our cash burn. As we look ahead, maintaining cost discipline is central to our longer term strategy, as a lower cost base will provide us with additional flexibility to allocate capital for the acceleration of growth in the future,” Lo said.

At the end of March 2023, GoTo’s total assets reached nearly 136 trillion rupiah, with its cash and cash equivalents at 26.8 trillion rupiah. That compared with 139.2 trillion rupiah in total assets at the end of December 2022 and 29 trillion in cash and cash equivalents.

GoTo’s liabilities dropped to 15.6 trillion rupiah at the end of March 2023, from 16.5 trillion rupiah at the end of December 2022.

Niko Margaronis, a research analyst at BRI Danareksa Sekuritas, said GoTo’s Q1 2023 net loss is better than he expected. “The results are mainly due to strong containment of promotions and S&M marketing costs,” he added.

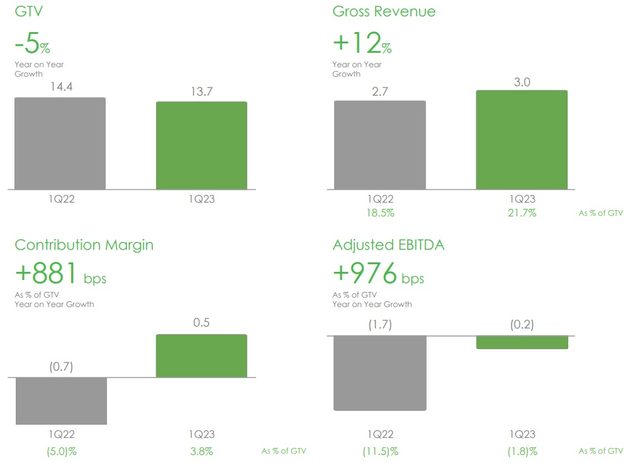

In GoTo’s on-demand services business, GTV fell by 5% year-on-year to 13.7 trillion rupiah in Q1, while gross revenue rose 12% to 3 trillion rupiah in the same period. The contribution margin of the division turned positive, and adjusted EBITDA also showed improvement.

Key metrics at GoTo’s on-demand services business

There was a 4% YoY fall in GTV in GoTo’s E-commerce division to 62.8 trillion rupiah in Q1 2023, while revenue rose 21% to 2.3 trillion rupiah. The division posted a positive contribution margin in Q1 and adjusted Ebitda also improved.

Key metrics at GoTo’s E-commerce division

GTV improved by a significant 18% YoY in GoTo’s financial services segment to 91.5 trillion rupiah in Q1 2023.

Key metrics at GoTo’s financial technology division

GoTo released its full-year 2022 earnings report in March. The company’s annual losses swelled due to adjustments in the goodwill impairment. The headline numbers, however, belie what is going on underneath the tech giant.

On its last earnings call in March, GoTo executives expressed concerns over a potential slowdown in growth in the first half of 2023 due to moderation in on-demand service and e-commerce. They had expected a pickup later in the year.

“Looking ahead to the rest of 2023, despite macroeconomic headwinds, we remain very optimistic on our overall long-term growth opportunities, given GoTo’s position as the largest digital ecosystem in Indonesia, within a huge addressable market in Southeast Asia. Indonesia’s digital economy gross merchandise value grew 22% to reach $63 billion in 2021 and is expected to reach $130 billion by 2025,” GoTo said in its annual report.

“As such, we are confident of our ability to attract and retain users without heavy subsidies,” the report reads.

GoTo went public in April 2022, raising around $1.1 billion, which made it among the biggest initial public offerings (IPO) in Asia and the world.

The company’s IDX-listed shares closed at 99 rupiah apiece on Thursday, up over 4.2% from its previous close before the results were announced. The company’s shares have shed over 73% in value since they listed in April 2022.