- New car market records ninth consecutive month of growth, up 11.6%

- Battery electric vehicles (BEVs) take 15.4% market share, with additional investment needed for more drivers to make the switch.

- SMMT upgrades 2023 outlook from 1.79m units to 1.83m as supply chain disruption eases, but BEV forecast softens.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

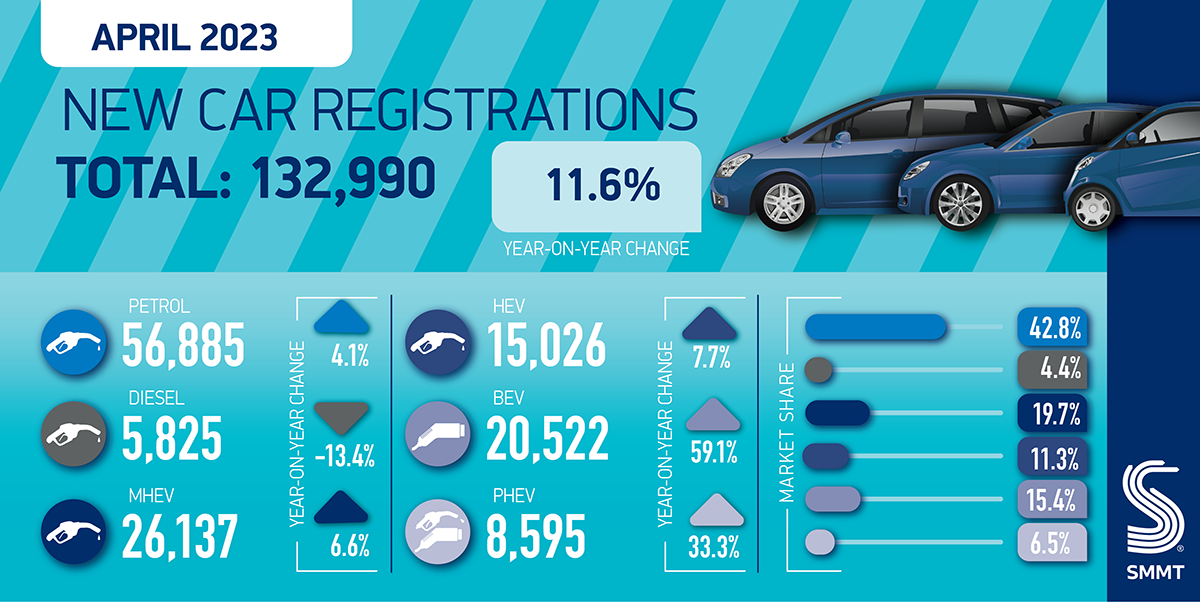

The UK new car market recorded its ninth successive month of growth in April, with an 11.6% increase to reach 132,990 registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The performance marks the best April since 2021’s 141,583 units but remains -17.4% down on 2019 volumes.1

Large fleet registrations grew by a third (33.1%) to 68,537 units as the market naturalised following weaker volumes last year, while deliveries to private buyers fell by -5.5% to 61,342 units. Smaller business fleets accounted for 3,111 registrations, rising 13.3%.

Battery electric vehicles (BEVs) remained the second most popular fuel type, with deliveries up by more than half to 20,522 and 15.4% of the market. Plug-in hybrid vehicles (PHEVs) also posted strong growth, up 33.3% with 8,595 registered in the month, while hybrid electric vehicles (HEVs) recorded a 7.7% increase to 15,026 units. As a result, electrified vehicles accounted for more than one in three registrations in April. Petrol-powered cars retained their best-selling status, comprising 58.1% of all registrations.2

As supply chain pressures have begun to ease, the overall market is now up 16.9% in the first four months – the best start to a year since the pandemic,3 with growth worth £3.2 billion.4 This has led to an upward revision of the quarterly market outlook, the first positive revision since 2021, with 1.83 million new car registrations expected in 2023, up from 1.79 million anticipated in January. That puts expected market growth this year at 13.5%, which would be the best percentage gain since 1983.5

The sector is, however, less optimistic about growth in demand for BEVs, downgrading their expected 2023 market share from 19.7% to 18.4%, with high energy costs and insufficient charging infrastructure anticipated to soften demand. The latest outlook for 2024, meanwhile, suggests that 22.6% of new car registrations will be BEVs, a downward revision from the 23.3% forecast in January. With a zero emission vehicle mandate due to come into effect next year, greater and faster investment in infrastructure, and more incentives to encourage purchase are essential to drive consumer confidence and accelerate uptake.

Mike Hawes, SMMT Chief Executive, said,

The new car market is increasingly bullish, as easing supply chain pressures provide a much-needed boost. However, the broader economic conditions and chargepoint anxiety are beginning to cast a cloud over the market’s eagerness to adopt zero emission mobility at the scale and pace needed. To ensure all drivers can benefit from electric vehicles, we need everyone – government, local authorities, energy companies and charging providers – to accelerate their investment in the transition and bolster consumer confidence in making the switch.

Notes to editors

1 April 2019: 161,064 units

2 Petrol and MHEV Petrol

3 Jan-April 2019 registrations: 862,100

4 Based on a JATO average new car value of £35,096

5 1983 market growth: 15.2%