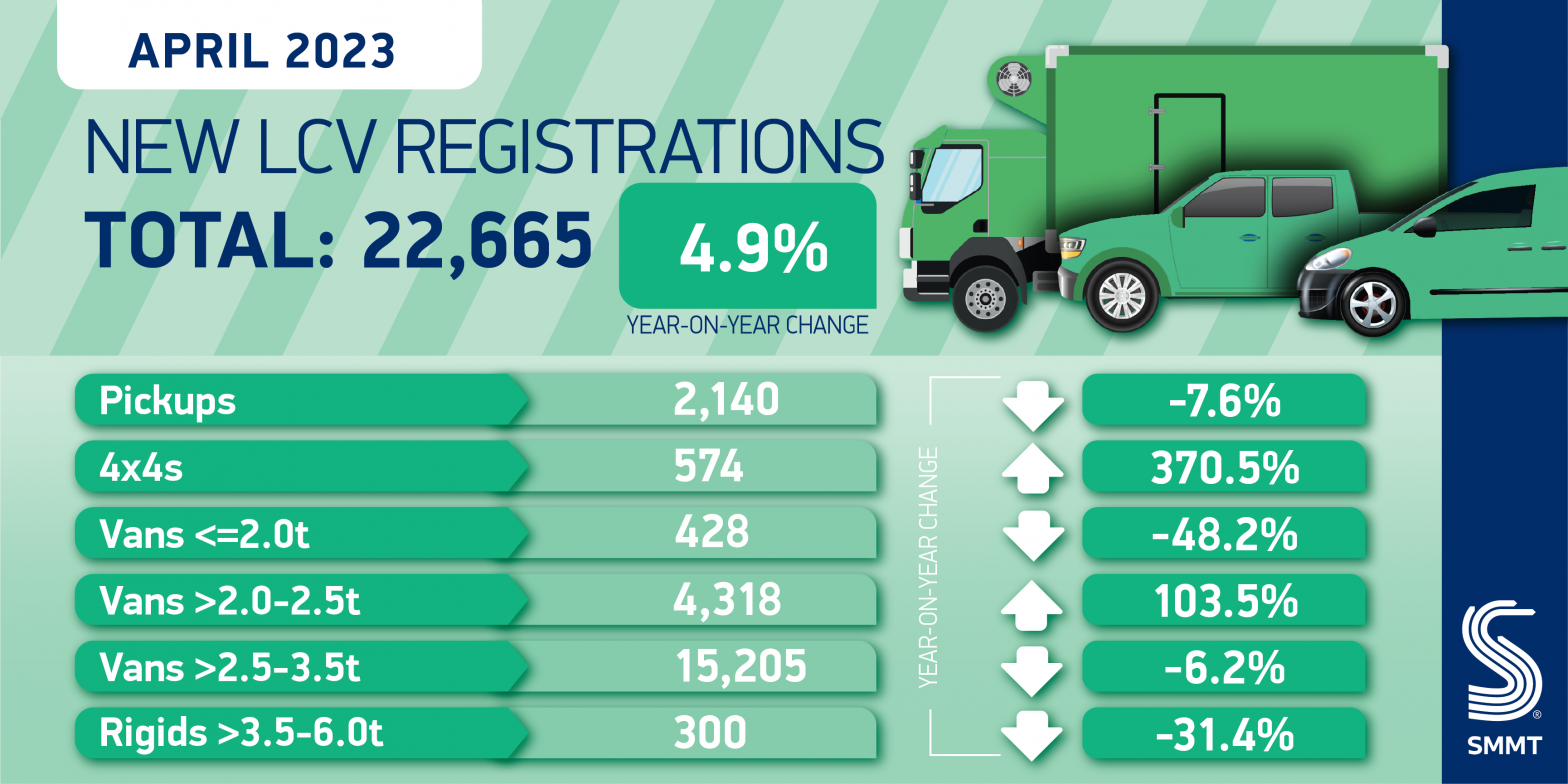

- New van registrations rise 4.9% to reach 22,665 units in April.

- 109,937 new vans registered during first four months of the year, closing the gap to -13.7% on pre-pandemic levels.

- Growing confidence bolsters outlook to 15.4% growth on 2022, but battery electric vehicle market share downgraded against challenging economic backdrop and paucity of dedicated infrastructure.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

The UK new light commercial vehicle (LCV) market recorded its fourth straight month of growth with 22,665 new units registered in April, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Registrations in the month grew by 4.9%, regaining ground on pre-pandemic levels. In the year to date, 109,937 new LCVs have been registered, just -13.7% off 20191, down from -15.1% last month.

The largest volume growth was recorded for vans weighing greater than 2.0 to 2.5 tonnes, which more than doubled to reach 4,318 registrations. The 4×4 segment also grew, by 370.5%, to leapfrog ahead of vans weighing up to and including 2.0 tonnes, which became the smallest sector as registrations fell -48.2% to 428 units. Deliveries of pickups also declined, by -7.6%, while vans weighing greater than 2.5 to 3.5 tonnes fell by -6.2% – although at 15,205 units this remained the largest market segment with a 67.1% market share, reflecting the general trend towards larger vehicles.

The market’s transition towards zero emission vehicles also received a boost with a 62.6% increase in battery electric vehicle (BEV) uptake – an uplift to 1,494 units and a market share of 6.6%. However, with BEV registrations in the year to date broadly in line with overall market growth at 14.8%, BEV market share for 2023 remains static at 5.4%.

Easing supply chain disruption means that, while the economic situation remains challenging, the overall market outlook for the year has been revised upwards from January. The industry anticipates 326,000 new LCV registrations by the end of the year, a 15.4% increase on 2022 and a 1.4% increase on January’s outlook.

However, the anticipated BEV market share for 2023 has been revised downwards from 8.6% to 7.4%, as operators continue to face challenging conditions with high energy costs, limited incentives and inflationary pressures meaning that the important total cost of ownership calculations are often negative. Added to this is the paucity of dedicated infrastructure and delays to grid connections which combine to inhibit operators’ ability to make the switch. BEVs are still expected to comprise 11.3% of registrations, equal to some 39,000 units, by the end of 2024, but tackling these obstacles will be essential to more rapidly deliver a zero emission transition given this is a downward revision from January’s outlook of 12.2%.

Mike Hawes, SMMT Chief Executive, said,

Four months of growth signals recovery is in sight for the van market, with easing supply chain issues raising confidence and boosting the overall market outlook. Ongoing economic uncertainty, however, must be addressed to help sustain and expand EV uptake. To ensure green growth that decarbonises the UK, the ever-growing choice of electric vans delivered by manufacturers must be backed by the right infrastructure and incentives so more businesses can confidently make the switch.

Notes to editors

1 January – April 2019: 127,347 units