Sonic Automotive, Inc. SAH registered first-quarter 2023 adjusted earnings per share of $1.33, missing the Zacks Consensus Estimate of $1.84. Lower-than-expected sales from the wholesale vehicle segment led to the underperformance. Also, the bottom line fell 43% from the $2.33 per share reported in the year-ago quarter. Total revenues amounted to $3,491.2 million, marking an increase of 1%. The figure surpassed the Zacks Consensus Estimate of $3,487 million.

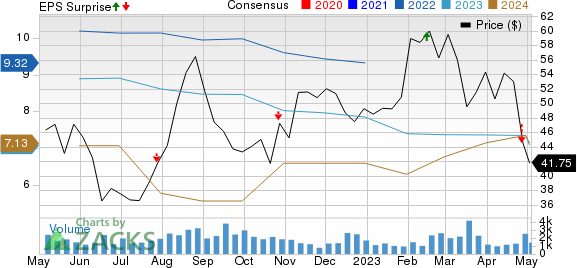

Sonic Automotive, Inc. Price, Consensus and EPS Surprise

Sonic Automotive, Inc. price-consensus-eps-surprise-chart | Sonic Automotive, Inc. Quote

Quarter in Detail

In the reported quarter, revenues from retail new vehicles increased 7% year over year to $1,442.8 million, outpacing the consensus mark of $1,404 million. Gross profit totaled $138.1 million, falling 17.7% year over year, surpassing the consensus mark of $136 million. Same-store unit sales volume fell 1% to 24,465. Gross profit per unit dipped 17% to $5,434.

Revenues from the sales of used vehicles went down 2% from the prior-year level to $1,344.9 million, surpassing the consensus mark of $1,319 million. Gross profit totaled $30 million, declining 37.4%, missing the consensus mark of $41.53 million. Same-store unit sales decreased 8% to 25,023 in the quarter under review. Gross profit per unit declined 12% to $1,560.

The EchoPark segment reported quarterly revenues of $650.5 million, marking a 5% increase from the year-ago figure, beating the consensus metric of $584 million. Its stores sold 19,980 used vehicle units, up 34% on a year-over-year basis. The segment reported a gross profit of $39.4 million, down 9% from the previous quarter on a year-over-year basis, lagging the consensus mark of $43.09 million.

Wholesale vehicle revenues fell 49% on a year-over-year basis to $85.6 million, missing the consensus mark of $112 million. Revenues from parts, services and collision repair were up 13% to $430.5 million, crossing the Zacks Consensus Estimate of $416 million. Finance, insurance and other revenues were $168.6 million, up 1% from the corresponding quarter of 2022 and topping the consensus estimate of $167 million.

Financials

Selling, general and administrative expenses fell 7% year over year to $412.8 million in the quarter. The board of directors approved a hike of 3.6% on the quarterly cash dividend, which amounted to 29 cents, payable Jul 14, 2023, to all stockholders of record as of Jun 15, 2023. In the first quarter of 2023, Sonic repurchased 1.6 million shares of its Class A Common Stock for an aggregate purchase price of $90.7 million.

Zacks Rank & Key Picks

SAH currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few better-ranked players in the auto space are Geely Automobile Holdings Limited GELYY, BYD Company Limited BYDDY and Mercedes-Benz Group AG MBGAF, all of which currently sport a Zacks Rank #1.

Geely is engaged in automobile manufacturing and related areas. The Zacks Consensus Estimates for GELYY’s 2023 sales and earnings implies year-over-year growth of 57.5% and 7.4%, respectively.

BYD is engaged in the research, development, manufacture and distribution of automobiles, secondary rechargeable batteries, and mobile phone components. The Zacks Consensus Estimate for BYDDY’s 2023 sales indicates year-over-year growth of 209.6%.

Mercedes-Benz develops, manufactures and sells passenger cars, including premium and luxury vehicles. The Zacks Consensus Estimate for MBGAF’s 2023 sales suggests year-over-year growth of 6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonic Automotive, Inc. (SAH) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Mercedes-Benz Group AG (MBGAF) : Free Stock Analysis Report