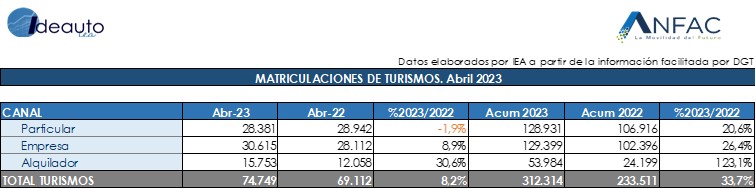

Sales of passenger cars and SUVs accumulate 312,314 registrations in the first four months, an improvement of 33.7% compared to the previous year

Registrations of light commercial vehicles achieved an increase of 12.9% in the month in April, with 10,635 sales

Sales of industrial vehicles, buses, coaches and minibuses grew 13.5% in April with 2,201 units

Madrid, May 2, 2023. The market for passenger cars and SUVs managed to close April on the up, with growth of 8.2%, with a total of 74,749 sales in the month. In this way, it accumulates the fourth positive month of this year, driven by the improvement both in the rate of vehicle production and in the transport of these, which has allowed greater agility in the delivery of orders. In any case, although there is growth compared to last year, accumulating a total of 312,314 units in the first quarter, which represents an increase of 33.7%, it is still far from the rhythms and sales volumes prior to the pandemic. , which were above 100,000 units in the month of April and that compared to 2019 the market is 28.4% below.

The average CO2 emissions of passenger cars sold in April remain at 119.1 grams of CO2 per kilometer traveled, 2.2% lower than the average emissions of new passenger cars sold in the same month of 2022. During 2023, emissions stand at 119.1 grams of CO2 per kilometer travelled, 0.9% less than the same period of the previous year.

Regarding registrations by channels, sales of passenger cars and SUVs aimed at companies and rental companies managed to improve compared to the previous year. Companies are the main sales channel, with 30,615 units, 8.9% more than in 2022. Similarly, rental car registrations improved notably by 30.6%, to 15,753 units. On the other hand, sales directed to individuals are reduced compared to last year, decreasing by 1.9%, with a total of 28,381 registrations.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles totaled 10,635 units in the fourth month, which represents a growth of 12.9% compared to last year. In the first quarter of this year, the market improved by 25.8%, reaching 44,796 units. By channels, only sales to companies managed to increase compared to the previous year, growing by 40.2%, with 7,565 sales. For their part, both sales to the self-employed and to rental companies fell by 27.7% and 19.2%, respectively.

INDUSTRIAL AND BUSES

In April, the registrations of industrial vehicles, buses, coaches and minibuses managed to grow by 13.5%, with a total of 2,201 units. In the first four months, 10,150 sales were added, representing an increase of 19.3%. By type, industrial vehicles obtained 1,923 new registrations in April, growing by 11.5%, likewise sales of buses, coaches, and minibuses improved by 29.9% on the previous year, with 278 sales.

STATEMENTS

Félix García, director of communication and marketing at ANFAC, explained that “sales of new passenger cars also closed April positively. The first four months of the year have produced positive figures. However, if we compare the data with those of April 2019, we see with concern that we are still a third below and that families continue to buy passenger cars, but also at a rate of 30% less than they did in the same month of 2019. The buyer continues to have immense doubts about which car to buy by continuing to listen to messages that demonize the car. Spain, as the second largest European vehicle producer, must bet on a sustainable mobility model but one that includes the private vehicle as part of the solution and not of the decarbonisation problem”.

Raúl Morales, communication director of FACONAUTO, indicated that “The registrations for the month of April make us remember with nostalgia when, before the pandemic and as summer approached, the market easily exceeded 100,000 registered units. In this month of April we have fallen far short of those 100,000 units and we have also noticed a certain slowdown in growth that we had been seeing in the first three months of the year. The dealers tell us that these growths were due to an improvement in the supply of vehicles and also to operations from the end of 2022. Now it is necessary to confirm if factory orders are being produced, which would guarantee a stock of registrations for the second quarter of the year, which would confirm the recovery of the market. As the market has behaved in this first four-month period, it seems that we are going to exceed 900,000 registered units with some doubt. This also leaves us at the door of that million cars sold, which for us is the objective so that neither competitiveness nor employment in the sector suffers.

According to GANVAM’s communication director, Tania Puche, highlighted that “this month we could say that we have had the calendar “against”. We have had one business day less to sell than in April of last year and this circumstance has contributed to a slowdown in registrations that has been noticeable, especially in the private channel. If we compare it with the pre-pandemic reference, this “calendar effect” worsens, since April 2019 had two more working days than this year. On the other hand, the rental companies had already made their fleet supplies to respond to the demand for Easter, so their growth has also slowed down. The behavior of this second quarter will be key to determining the progressive return to normality”.