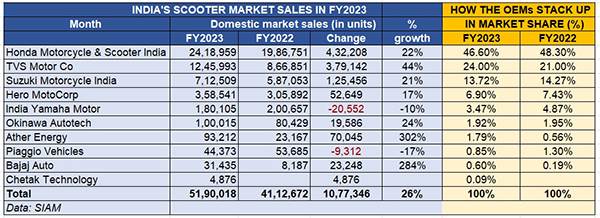

TVS Motor Co, which sold a total of 12,45,993 scooters in FY2023 and recorded 44% year-on-year growth, also saw its scooter market share expand to 24% from 21% in FY2022. The key drivers of this growth are its flagship Jupiter and the NTorq, which together contribute the bulk of its scooter sales.

In FY2023, total wholesales of the NTorq in India were 290,539 units, up 16.55% YoY, and its best-ever domestic market performance in a fiscal year since launch a little over five years ago. With this performance, the NTorq maintains its status as India’s fourth best-selling scooter after the Honda Activa, TVS Jupiter and the Suzuki Access.

The NTorq, TVS Motor Co’s vehicle of entry into the 125cc scooter market, was launched on February 5, 2018, crossed the million-unit sales milestone in the first few days of April 2022, and has gone on to clock a total of 12,89,171 units till end-March 2023 (see data table below). Add the 165,947 units exported since FY2019 and the cumulative sales add up to 1.45 million units.

Within two months of its launch in February 2018, the NTorq snapped up 19,809-unit sales and went on to clock 213,039 units in FY2019, its first full year of sales and one in which it bagged Autocar India’s ‘Scooter of the Year’ award.

In FY2020, it recorded sales of 265,016 units, up 24% YoY. Then, even as the Covid pandemic took grip across the country and despite the lockdowns across the country in FY2021, the scooter sold 251,491 units – which is a monthly average of 20,957 units. FY2022 added sales of 249,277 units, down YoY by less than one percent. And FY2023’s 290,539 units have now raised the 12-month sales bar for the snazzy scooter.

Walking the NTorq with young India

Targeted at millennials, the NTorq, which is the production version of the Graphite concept showcased at Auto Expo 2016, is powered by a CVTi-REVV 124.79cc, single-cylinder, 4-stroke, 3-valve, air-cooled SOHC engine that develops 9.4hp at 7500rpm and 10.5 Nm at 5500rpm.

The NTorq was introduced at a time when the scooter buyer preference for 125cc models was just about taking shape in India. Over the past few years, TVS has at regular intervals introduced new variants to retain model freshness and also to rev up sales.

The NTorq’s snazzy looks notwithstanding, what stands out for the product is the many segment-first features including the TVS SmartXonnect, which offers Bluetooth connectivity with the rider’s mobile phone (via a mobile app) in the form of navigation assist, location assist, call / SMS alerts, rider stats and more. The TVS NTorq set the pace in its segment by offering a fully digital console with over 50 features.

The NTorq 125 Race XP gets a slightly more powerful engine (10.2hp and 10.8Nm) than the standard NTorq (9.4hp and 10.5Nm).

The NTorq 125 Race XP gets a slightly more powerful engine (10.2hp and 10.8Nm) than the standard NTorq (9.4hp and 10.5Nm).

The NTorq is now available in a total of five variants – NTorq, Race Edition, Super Squad Edition, Race XP and Race XT. While the Race XP and Race XT gets a slightly more powerful engine at 10.2hp and 10.8Nm, the rest aren’t too far behind at 9.4hp and 10.5Nm. The differences between the Disc, Race Edition and Super Squad Edition are purely cosmetic. Estimated prices start at Rs 77,300 (on-road Mumbai) for the most-affordable drum brake-equipped variant and go up to Rs 103,000 for the XT (on-road New Delhi).

The NTorq XT variant, launched in May 2022, is now the range-topper. While it costs Rs 14,000 more than the quick-and-fun NTorq Race XP, the XT offers the user an instrument cluster that sports a hybrid design featuring a TFT screen accompanied by an LCD display.

The TFT screen opens up a world of new possibilities and TVS says it can show social media notifications, food delivery tracking information, weather forecasts and AQI data, along with cricket and football scores, while the rider awaits the green light at a traffic stop. This is also the first version of the NTorq to feature the company’s IntelliGo stop-start system. The XT stands out with its blue-and-neon yellow colour scheme, as well as a new design for the 12-inch alloy wheels.

TVS launched the tech-laden XT variant in May 2022.

Helping TVS grow scooter market share to 24%

The NTorq, which was India’s fourth best-selling scooter in FY2022 (249,277 units), FY2021 (251,491 units) and also in FY2020 (265,016 units), up from sixth place in FY2019 (213,039 units) has retained its position in FY2023.

While flagship Jupiter remains the biggest contributor to TVS’ scooter sales with an estimated 60% share, the NTorq has contributed 23% to the company total in FY2023. The other scooters in TVS’ stable are the Zest, Pep+ and the electric iQube.

The NTorq’s strong showing is creditable considering it’s part of a competitive sub-segment which also has the Honda Activa, sibling Jupiter, Suzuki Access, Hero Destini and Maestro, Yamaha Ray ZR and Fascino, Aprilia SR 125 and the Vespa 125

The NTorq’s strong showing in the competitive Indian scooter marketplace, along with the Jupiter’s sustained growth, has helped TVS increase its market share. From FY2018 through to FY2023, the company has expanded its footprint from 18.52% to 24%, enabling it to take No. 2 position after Honda. Third-placed Suzuki has a 14% scooter market share.

TVS’ scooter market share rose to 24% in FY2023 from 21% in FY2022.

A close look at scooter industry wholesales data (above) reveals that TVS Motor Co is the only one among the major scooter manufacturers to have increased its market share in FY2023 and also recorded the highest YoY growth rate of 44% compared to HMSI, Suzuki, Hero MotoCorp and India Yamaha Motor.