This weekly newsletter chronicles top digital themes and trends playing out in SE Asia, especially Indonesia. We will decode policy and regulatory changes affecting digital economy sectors, crunch earnings data of top players, track developments related to gig economy workers and attempt to piece together ecosystem buildouts in some of the fastest-growing, venture-backed plays. You can access the previous editions of the Vantage Point weekly posts here.

Executive Summary

- Blibli’s upper hand in e-commerce

- Healthcare gets a shot in the arm

- Mainstream banks dominate digital banking in Indonesia

- ASSA gears up for a smooth ride with ecosystem play

Blibli’s upper hand in e-commerce

Indonesia-listed Blibli is a different animal compared with peers such as Shopee, Tokopedia, Lazada, and Bukalapak as its operations go beyond e-commerce.

The company’s business also encompasses online travel through tiket.com. It also has a growing offline presence with over 200 stores that sell mainly electronic goods and a number of mono-brand outlets including an Apple reseller under the Hello brand.

Blibli also has high-quality exposure to the groceries space through its 51%-owned Ranch Market, which had 70 stores in 2022, including 18 Ranch Market stores, 35 Farmers Market, two Gourmet stores, three day-to-day stores, 11 Farmer’s Family, and one Pasarina store.

Other than providing an offline presence, these stores also act as the supply chain for their online presence through BliBli, which provides customers with a wide choice of products.

Blibli recently released its Q1 2023 results last week, with losses reducing by 17.8% YoY to 884 billion rupiah in Q1 2023, while the company recorded a revenue increase of 20.9% YoY to 3.8 trillion rupiah.

The company recorded growth in Total Processing Value (TPV) of 78% to 17.9 trillion rupiah in Q1 2023 driven by improved performance across its business segments, with a strong recovery in the online travel business in Indonesia.

In e-commerce, it recorded increasing demand in digital and other product categories, which had a positive impact on 3P Retail TPV, which grew by 136% YoY.

Revenue growth was mainly driven by online retail revenue to third parties of 2.64 trillion rupiah, physical store revenue of 1 trillion rupiah, and institutional revenues of 423.6 billion rupiah.

Direct discounts and promotions provided by the company in Q1 2023 amounted to 293.9 billion rupiah, while Blibli recorded a 13.4% YoY increase in the cost of revenue to 325.2 billion rupiah.

The management stated that BliBli recorded a more efficient cost structure, in particular a decrease in marketing and advertising expense ratios, as well as general and administrative expense ratios versus TPV.

Both of these contributed to an increase in its consolidated EBITDA performance during the first quarter. According to the management, Blibli’s cash position together with available credit facilities is sufficient to enable the company to carry out its strategies to grow sustainably and strengthen the path to profitability.

Blibli remains the wild card among listed e-commerce players with a differentiated omnichannel approach with its offline stores across groceries through Ranch Market and electronics through both its own multi-brand Blibli and Ranch Market Stores plus other mono-brand stores.

This diversity gives the platform interesting exposure to the recovering offline Indonesian economy, as well as domestic and international tourism recovery, which continues to flourish.

These numbers are interesting as the company has been able to grow its TPV and revenues, while reducing losses. This reflects both its focus on more affluent consumers, who are less sensitive to inflationary pressures plus its exposure to travel. It is also well-served by an offline presence.

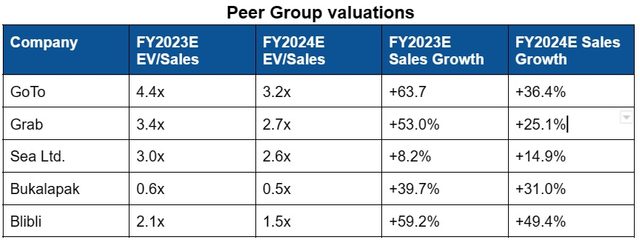

Blibli’s valuations versus its growth also look attractive compared with peers, with the company trading at 1.5x FY2024E EV/Sales, with projected sales growth of 59% and 49% for FY2023 and FY2024 respectively.

Healthcare gets a shot in the arm

The healthcare sector in Indonesia is at an interesting juncture. The growing health awareness, low hospital penetration, uptick in health insurance and a predominantly private healthcare system have spurred additional growth opportunities for the private sector.

The COVID-19 pandemic period proved to be a two-edged sword for Indonesian hospitals. On one hand, it severely reduced the number of regular inpatients and outpatients visiting hospitals and, on the other, it brought in patients who would have otherwise travelled to countries like Singapore, Malaysia, or Thailand for treatments.

After an uncertain start, the pandemic proved to be a boon for Indonesia’s local hospitals, which set aside capacities to treat COVID patients and also provided testing services.

The treatment costs of COVID patients was fully borne by the government and paid at the full whack making it extremely profitable, whilst testing services were also very lucrative and highly profitable. The revenues generated from pandemic-related treatment and testing more than offset losses from regular treatments.

The period was also a catalyst for existing healthcare players to rapidly digitalise their normal activities to reduce patients’ need to visit hospitals physically and also made remote consultations much easier.

There was also an increase in the incidence of home visits booked through digital means, as well as for prescriptions to be ordered through digital apps.

Standalone digital health providers such as Halodoc, Alodokter, and Klikdokter also benefited from accelerated adoption of digital health options including doctor consultations, testing services, and ordering medicines.

The hospital companies also used the pandemic as a period to unify pricing across networks, which made a significant positive impact on profitability, with Siloam Hospitals being the best case in point.

Siloam has 17 newer hospitals described as “ramping-up” hospitals, whiuch were loss-making in 2020 but and by the end of Q1 2023, all of them were booking positive EBITDA.

FY 2022 was a transition year for the hospital sector when there was a decline in headline revenues, as COVID revenues fell off sharply, and regular revenues picked up.

This applied in varying degrees to the listed players including Mitra Keluarga Karyasehat Tbk, Medikaloka Hermina and Siloam International Hospitals. But all of them posted expect a strong rebound in revenues in 2023 and 2024.

This is driven by addition of hospital beds, greater efficiencies due to ongoing digitalisation, and accelerated customer acquisition through digital apps.

The pandemic also pushed hospital operators to focus on cost efficiencies including consolidating suppliers, negotiating more favourable pricing for consumables and pharmaceuticals.

There has also been an ongoing trend towards greater specialisation of hospitals as well as higher complexity of treatments that are boosting returns and increasing the utilisation of medical equipment.

There has been some buzz that Mitra Keluarga Karyasehat may look to raise new capital for its expansion while CVC is looking to exit Siloam after seven years of holding a 26% stake. We have already seen Astra International increase its stake to 7.45% in Women & Children specialist Medikaloka Hermina, and it is possible that this could be increased further. Brawidjaya Women & Children Hospital may also see its PE shareholder Falcon look for an exit, according to a recent report on Reuters.

One very interesting area in healthcare is diagnostic medicine, dominated by listed player Prodia, which has around 40% market share. It is the only company in Indonesia to be accredited by the College of American Physicians.

Prodia was also a huge beneficiary of COVID testing and, as a result, saw its revenues decline in 2022 as COVID testing revenues collapsed. But it has seen a rebound in regular testing and a greater trend toward preventative medicine. Prodia is investing up to 45% of this year’s capex in its digital strategies through Prodia Digital.

Prodia, whose major shareholders are medical professionals, trades on very attractive valuations on 6x FY2023E EV/EBITDA versus Indian peers such as Dr Lal PathLabs on 32x FY2023E EV/EBITDA, making an attractive prospect for potential investors.

Investors continue to circle around the healthcare segment in Indonesia, given the growth potential, as well as potentially high returns. The case for digitalisation to boost effieciencies is further adding to the sector’s attractiveness.

Mainstream banks dominate digital banking in Indonesia

Although they no longer command the inflated valuations of the past, standalone digital banks continue to play a crucial role in Indonesia’s move towards mobile banking. However, it is the mainstream banks that have emerged as the true beneficiaries of the digital revolution.

The benefits have come through easier and cheaper customer acquisitions, as it is now possible to open a savings account with all the major banks, including Bank Central Asia, Bank Mandiri, Bank Negara Indonesia, and Bank Rakyat Indonesia, through mobile banking.

The acquisition of new customers has also meant a surge in low-cost CASA deposits, which have in turn helped the major banks keep their cost of funds at historically low levels of under 2% despite rising interest rates.

Other than the increase in deposits, a large customer base allows banks to offer products such as personal and mortgage loans, car and motorcycle finance, insurance, and wealth management as well as a host of lifestyle offerings through digital banking.

Bank Central Asia (BCA) has seen a spectacular rise in its digital transactions, with the number of customers increasing 42% in the last two years and the number of transactions on mobile banking surging 3.6x in the last three years.

In Q1 2023, BCA had 79% of mobile banking users with a CASA account and 67% of new account openings coming through mobile banking, underscoring its rising demand.

Online channels made up 91% of volume transactions in Q1 2023, versus 8.7% through ATMs and only 0.3% through branches. From a value perspective, mobile and Internet banking made up 59.9% of value transactions in Q1 2023, with 34.3% through branches and 5.7% through ATMs.

Bank Mandiri paints a similar picture with its Livin’ superapp and the core part of its development strategy for consumer banking. Livin’ provides a full suite of banking and financial services besides running an open ecosystem.

To give an idea of the numbers involved, Mandiri’s Livin’ app has seen 25 million downloads since its launch, with 17.5 million registered users. In Q1 2023, the bank saw a 40% YoY increase in its user base, with a 45% YoY increase in transaction volume and value.

With digital transactions taking over from ATMs in volume terms in Q2 2021, online and mobile transactions are now 2.4x those of ATMs in volume terms and 3.9x in value terms.

Forty per cent of incremental retail loan balances now come through Livin’, along with 80% of credit card installments and 20% of cash advances. Mandiri has now made the app available for remittance transfers from abroad, further broadening its service offering.

The bank’s Sukha by Livin’ app also offers multiple services from concert and sports event tickets to flight and train bookings.

Bank Mandiri has also seen a leap in investment activity since the launch of Livin’, with the number of mutual fund retail investors increasing more than 4x. It has also captured around 60% of bond sales through the app.

Meanwhile, Bank Negara Indonesia’s registered mobile banking users surged 24.3% YoY in Q1 2023 to 14.26 million, with transaction value increasing 52.7% YoY and transaction frequency surging 52% YoY.

BNI also runs an open ecosystem, with 401 API services utilised by 4,000 partners offering a multitude of services to customers as well as the spectrum of its own banking and financial services.

Leading micro-lender and MSME bank Bank Rakyat Indonesia runs its mobile banking through its BRIMO app, which already has 25.7 million users. This translates to a 59% YoY jump in Q1 2023, with transactions up 99.1% and value up 87%.

BRIMO offers a whole range of banking services, including loan applications; savings; international transfers; plus an open API connecting to transport, e-commerce, fintech, healthcare, and its agri ecosystem. Bank Rakyat has a total of 130 million depositors given its exposure to rural areas, which means there is still a significant upside to those using digital banking services.

To provide some perspective, Bank Jago had 7.5 million KYCed digital and bank lending customers at the end of Q1 2023, while PT Bank Neo Commerce had 22.3 million accumulated users at the end of the quarter, with its monthly active users continuing to record more transactions.

Given that Indonesia is a massively underbanked market, there is room for a number of new digital players such as Bank Jago, Bank Neo Commerce, Sea Bank Indonesia, and Allo Bank Indonesia, which all have significant ecosystems to plug into, but competition from existing mainstream banks should not be discounted, given that digital banking is now a core focus for all of them.

ASSA gears up for a smooth ride with ecosystem play

Adi Sarana Armada (ASSA) describes itself as a technology-based mobility ecosystem, spanning car leasing to used car sales and auctions, logistics through ASSA logistics, and last-mile delivery through Anteraja.

There are numerous synergies across the ecosystem, where the car leasing business not only provides multi-year recurrent revenues but also a steady annual supply of used cars. The company has the largest car-leasing fleet of 29,195 in Indonesia, with 4,000-5,000 cars a year becoming available for sale.

This provides ASSA with a steady supply for both its online and offline used car business under Caroline.id as well as its auction business under JBA BidWin. It is the largest car auction house in Indonesia with around a 40% share, auctioning over 19,373 vehicles in Q1 2023, an increase of 8.8% QoQ.

Caroline competes directly with Carro and Carsome but has the advantage of already having access to a network of physical assets. It has also been ramping up its operations, with a 172% YoY increase in sales in Q1 2023 to 610 units.

Caroline now has 12 showrooms and 12 customer touchpoints, with the intention of ramping up its outlets further this year.

Outside its auto ecosystem, the real growth driver for ASSA is its logistics business, with its first, middle, and last mile providing an end-to-end logistics solution.

The first mile provides transport from warehouses to distribution centres, the middle mile from distribution centres to shops, and the last mile from stores to end users, with the final leg under Anteraja.

ASSA logistics provides fleet management, trip management, and delivery systems for corporate customers under its B2B business. It continues to add value for its customers, more recently building its fulfillment capacity under Titipaja as well as a cold-chain logistics capability.

Anteraja is the company’s last-mile express delivery business, which has thrived from the growth in e-commerce, providing both intra- and inter-city delivery as well as collaborating with GoTo and Grab, but it is now looking to increase the non-e-commerce contribution too.

Logistics behemoth SF Express of China holds a 20% stake in Anteraja and provides strong technical expertise. GoTo commissioner Eric Thohir also owns a 10% stake in Anteraja, offering a strong connection with GoTo and, therefore, Tokopedia.

Anteraja and ASSA Logistics together make up the largest portion of ASSA’s total revenues, with a combined 46% share as of Q1 2023.

Soure: Adi Sarana Armada (ASSA IJ)

Anteraja currently delivers 500,000-600,000 parcels per day and is forecast to break even this year, which will help drive overall profitability for ASSA given that it already contributes to the largest share of its revenues.

With logistics increasingly becoming a crucial tool in grabbing a larger portion of the supply chain in e-commerce, ASSA is well-positioned to harness its strength here.

Angus Mackintosh, a consulting editor with DealStreetAsia, is responsible for the publication’s Southeast Asia digital economy weekly newsletter and its monthly research reports. Angus is also the founder of CrossASEAN Research and publishes on Smartkarma.