Adient ADNT reported adjusted earnings per share of 32 cents for the second quarter of fiscal 2023, lagging the Zacks Consensus Estimate of 41 cents. The underperformance largely stemmed from lower-than-anticipated profits from the Americas segment. The bottom line, however, reversed the year-ago loss of 13 cents per share. In the reported quarter, Adient generated net sales of $3,912 million, up 12% from $3,506 million recorded in the prior-year period and surpassed the Zacks Consensus Estimate of $3,717 million.

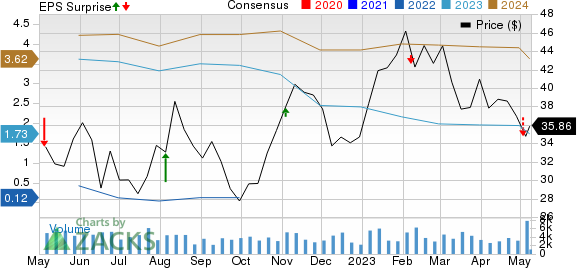

Adient Price, Consensus and EPS Surprise

Adient price-consensus-eps-surprise-chart | Adient Quote

Segmental Performance

Adient currently operates through three reportable segments — the Americas, including North America and South America; Europe, the Middle East and Africa (EMEA) and Asia Pacific/China (Asia).

In the reported quarter, the Americas segment recorded revenues of $1,761 million, an increase of 10.3% from the year-ago period, topping the consensus metric of $1,745 million. The segment posted an adjusted EBITDA of $72 million, up from $46 million recorded in the prior-year period. The increase was driven by favorable volume and mix, net material margin, improved foreign exchange and low freight costs. The figure, however, fell short of the consensus metric of $75 million.

In the fiscal second quarter, the EMEA segment registered revenues of $1,401 million, which increased 15% year over year and outpaced the consensus mark of $1,284 million. The segment recorded EBITDA of $53 million in the quarter under review, higher than the $30 million generated in the year-ago period. Improved material margins and favorable volume and mix resulted in the upside. The reported EBITDA outpaced the consensus metric of $39.2 million.

In the reported quarter, revenues in the Asia segment came in at $774 million, up 7% year over year and topping the consensus mark of $673 million. The segment’s adjusted EBITDA grew 7.6% to $113 million, beating the consensus mark of $93 million. Improved product and volume mix led to the upswing.

Financial Position

Adient had cash and cash equivalents of $826 million as of Mar 31, 2023 compared with $947 million on Sep 30, 2022. Long-term debt amounted to $2,531 million in the reported quarter, down from $2,564 million as of Sep 30, 2022. Capital expenditures totaled $56 million in the fiscal second quarter of 2023 compared with $57 million in the prior-year quarter.

Outlook

Adient updated its fiscal 2023 forecast. It envisions revenues of $15 billion, the same as its previous estimate. The adjusted EBITDA forecast remains unchanged at $850 million for the year. Expected equity income and Capex also remained unchanged at $70 million and $300 million, respectively. FCF is now estimated to be $215 million, up from the previous estimate of $200 million. Interest expenses and cash tax are now estimated to be $180 million, up from prior guidance of $160 million and $95 million, up from the previous guidance of $90 million, respectively.

Zacks Rank & Key Picks

ADNT currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few top-ranked players in the auto space are Geely Automobile Holdings Limited GELYY, BYD Company Limited BYDDY and Mercedes-Benz Group AG MBGAF, all of which sport a Zacks Rank #1.

Geely is engaged in automobile manufacturing and related areas. The Zacks Consensus Estimates for GELYY’s 2023 sales and earnings imply year-over-year growth of around 57.5% and 7.4%, respectively.

BYD is engaged in the research, development, manufacture and distribution of automobiles, secondary rechargeable batteries and mobile phone components. The Zacks Consensus Estimate for BYDDY’s 2023 sales implies year-over-year growth of around 209.6%.

Mercedes-Benz develops, manufactures and sells passenger cars, including premium and luxury vehicles. The Zacks Consensus Estimate for MBGAF’s 2023 sales implies year-over-year growth of 6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Adient (ADNT) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Mercedes-Benz Group AG (MBGAF) : Free Stock Analysis Report