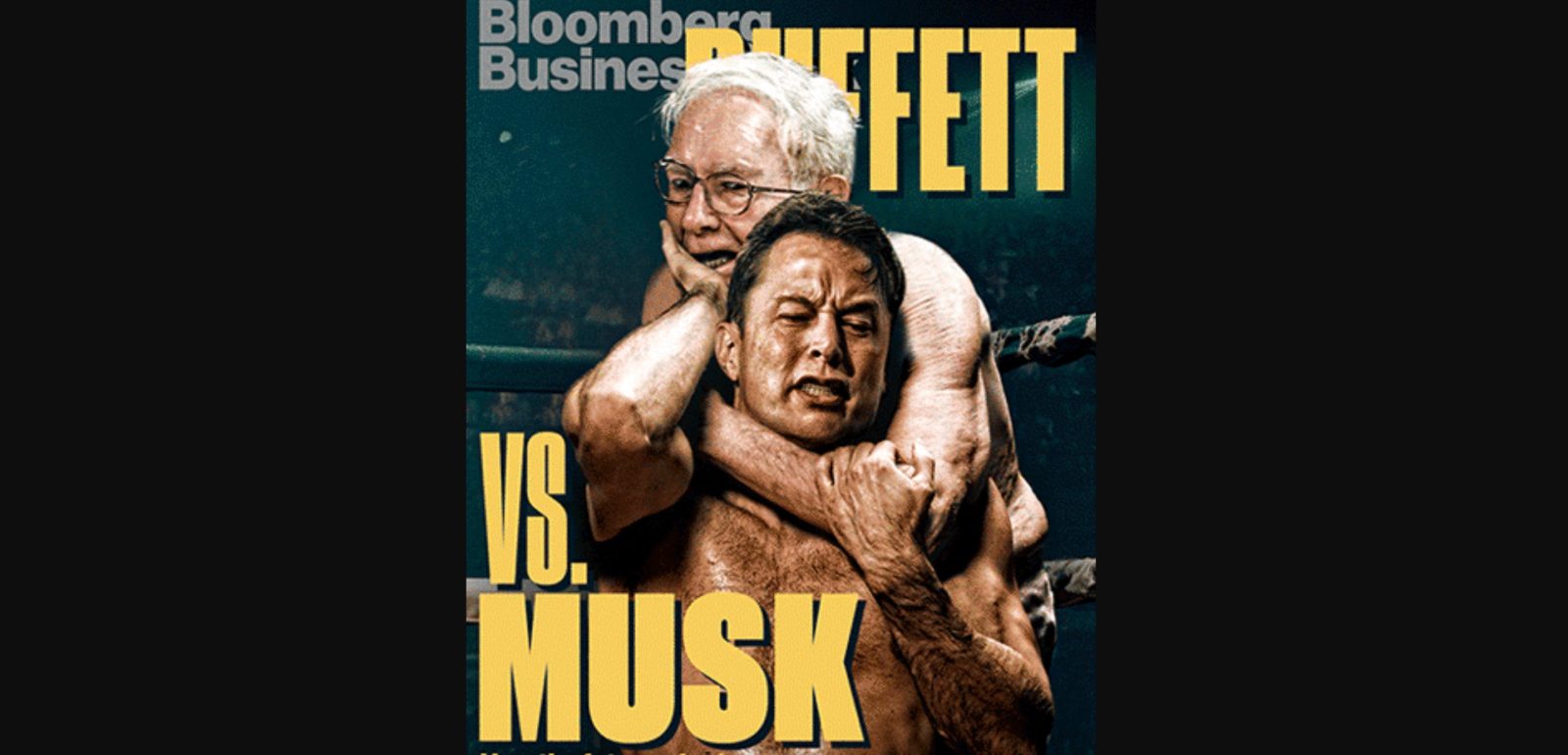

Warren Buffett says that he doesn’t want to compete with Elon Musk – and especially Tesla – as he divests from BYD.

Over the last year, Warren Buffett’s Berkshire Hathaway has been divesting from Chinese automaker BYD. Last week, Berkshire Hathaway sold two million BYD shares again.

Following the last sale, Buffett and his number two, Charlie Munger, said that they don’t want to compete with Elon Musk, Tesla CEO, during their annual shareholder meeting (via Business Insider):

“We don’t want to compete with Elon in a lot of things,” Buffett said on Saturday. Munger quickly added on to Buffett’s comment, [saying] “We don’t want that much failure.”

But it’s not just competing with Musk or Tesla. Buffett added that he doesn’t like the auto industry amid the electric transition:

You will see a change in the vehicles, but you won’t see anyone that owns the market because they changed the vehicles.

He added:

Charlie [Munger] and I long have felt that the auto industry is just too tough. It’s just a business where you’ve got a lot of worldwide competitors, they’re not going to go away, and it looks like there are winners at any given time, but it doesn’t get you a permanent place.

It sounds like BYD might have been a one-off, and we will not see Berkshire Hathaway invests its billions in the auto industry again.

Electrek’s Take

To be honest, I wouldn’t take this as a bad sign for BYD or even a compliment to Musk or Tesla.

That’s just Buffett. He doesn’t like high-tech competition other than Apple, probably mostly because he doesn’t understand it very well. He made most of his money from oil stocks, banks, and Coca-Cola.

He notoriously prefers safe investments, and in this case, he is literally saying that the auto industry is just too difficult for him to invest in.

Personally, I don’t respect that. It’s just about making money for the sake of making money. I prefer people who invest in things because they believe it should be the future, like electric vehicles.

FTC: We use income earning auto affiliate links. More.