Nasdaq-listed Grab Holdings Ltd on Thursday reported that its losses narrowed to $250 million for the first quarter of 2023, a 43% improvement year-on-year [YoY] from $435 million in the same period of 2022.

The company attributed the performance to an improvement in group-adjusted EBITDA and a reduction in net interest expenses, it said in its press statement.

Loss for the quarter included a $37-million non-cash loss from fair value changes on investments and $103 million in non-cash stock-based compensation expenses.

Grab’s adjusted EBITDA loss was $66 million for the January to March period, a 77% improvement compared to $287 million for the same period last year.

The company booked revenue of $525 million in the quarter, up 130% YoY from $228 million in Q1 2022 thanks to growth across all business segments, a reduction in incentives and a business model change for certain delivery offerings in one of the markets.

“This quarter, we reported another solid set of results which reflects our disciplined focus to drive sustainable growth and profitability,” said Grab co-founder and group CEO Anthony Tan.

With five sequential quarters of adjusted EBITDA improvements, the firm remains on track on its path to profitability, and to achieve group-adjusted EBITDA breakeven in the fourth quarter of this year, said Tan.

“We are confident that we can drive growth for mobility and deliveries, and create more income opportunities for our partners to meet the growing demand from both travelers and domestic consumers,” added the CEO.

Grab’s GMV grew modestly at 3% YoY, or 7% YoY on a constant currency basis.

The company reduced its incentives to 7.9% of GMV in the first quarter, compared to 11.6% in the same period in 2022 and 8.2% in the previous quarter.

Grab’s headcount across its core segments and corporate functions has fallen over the past two quarters, which the company reduce corporate costs to $216 million, compared to $212 million in the same period in 2022, and $223 million in the previous sequential quarter (Q4 2022).

At the end of the first quarter of 2023, Grab had $5.8 billion of cash liquidity, compared to $6.5 billion at the end of the previous quarter. This was due to the prepayment of Term Loan B in the aggregate principal amount of $600 million completed in February 2023.

Its net cash liquidity was $5 billion in Q1 2023, compared to $5.1 billion at the end of the previous sequential quarter. As of March 31, 2022, Grab had a cash liquidity of $8.2 billion

Grab’s guidance for revenue for the financial year 2023 remains unchanged at $2.20-2.30 billion [54% – 60% YoY]. It also expects adjusted EBITDA breakeven by the fourth quarter of 2023.

However, its adjusted EBITDA losses expectation is decreased to $195 million-235 million from $275-325 million.

“We are pleased with our first quarter results, with strong revenue growth and profitability improvements across all of our segments, supported by a strong balance sheet,” said Grab CFO Peter Oey.

The company saw an improvement in expenses. Its net cash flow from operating activities was negative $157 million in three months ended in March 2023, which was down significantly from negative $446 million in the same period last year.

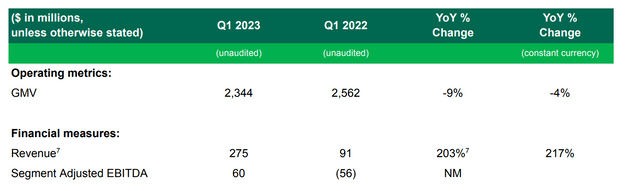

Deliveries

Revenue for deliveries grew 203% YoY, or 217% YoY on a constant currency basis, to $275 million in the first quarter from $91 million in the same period in 2022. This growth was attributed to contributions from Jaya Grocer and a reduction in incentives.

Its GMV declined by 9% from $2.56 billion in Q1 2022 to $2.34 billion in Q1 2023 due to slowing demand during Chinese New Year and Ramadan.

The segment’s adjusted EBITDA as a percentage of GMV expanded to an all-time high of 2.6% in the first quarter of 2023 from 2.0% in the fourth quarter of 2022 and negative 2.2% in the first quarter of 2022 due to the optimisation of its incentive spend.

Users of its subscription programme, GrabUnlimited, accounted for over a quarter of deliveries GMV in the first quarter of 2023. GrabUnlimited subscribers spend 3.7x more on food deliveries relative to non-subscribers.

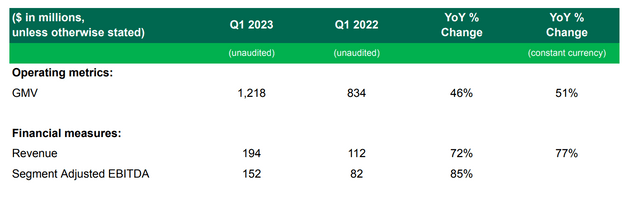

Mobility

Revenue for the mobility business unit rose 72% YoY or 77% YoY on a constant currency basis from $112 million in Q1 2022 to $194 million in Q1 2023. Its GMV increased to $1.2 billion in Jan-March 2023 period from $834 million in the same period last year.

Mobility’s adjusted EBITDA also increased to $152 million in Q1 2023 from $82 million in Q1 last year.

Grab also saw growth in its driver pool as monthly active driver supply increased by 10% YoY and 2% QoQ, while total active driver online hours increased by 14% YoY and 3% QoQ in the first quarter of 2023.

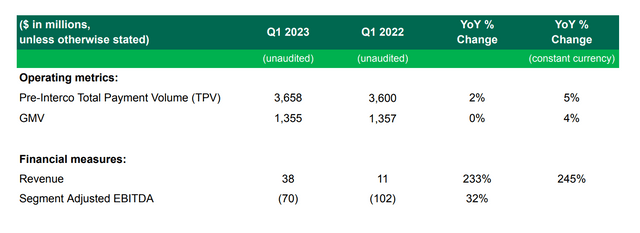

Financial Services

Revenue for this segment grew 233% YoY, or 245% YoY on a constant currency basis, to $38 million in the first quarter of 2023, thanks to lowered consumer incentives and higher contributions from lending.

The GMV’s growth remained stable while segment-adjusted EBITDA for the quarter improved by 32% YoY to negative $70 million.

Grab also said that the loan disbursements from GrabFin grew by 45% YoY in the first quarter of 2023. In April, its digital bank in Singapore, GxS Bank launched its first lending product GxS FlexiLoan.

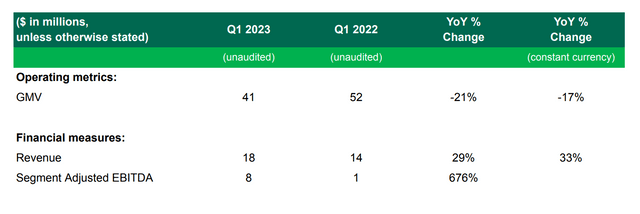

Enterprise and new initiatives

Revenue rose 29% YoY, or 33% YoY on a constant currency basis to $18 million in the first quarter of 2023 but GMV declined significantly by 21% YoY to $41 million in Q1 2023 from $52 million in Q1 last year.

Segment-adjusted EBITDA grew 676% YoY in the quarter compared to the same period in 2022 due to a reduction in expenses.