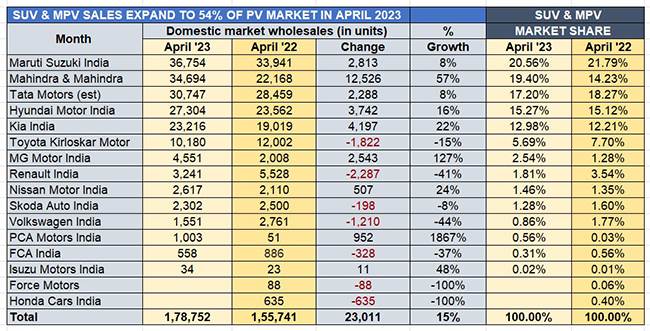

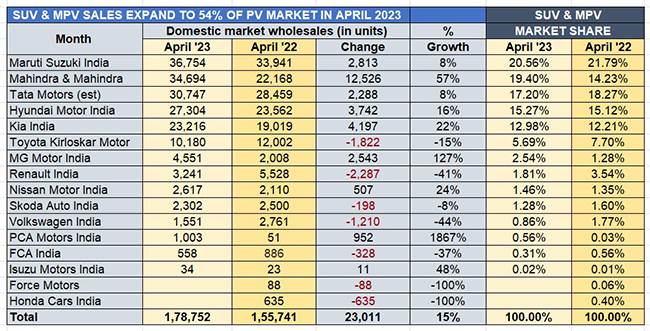

India Passenger Vehicle India opened FY2024 with overall April 2023 wholesales at 331,377 units, up 13% year on year (April 2022: 293,168), surpassing the 330,000 mark for the fourth straight month. What different in the two Aprils is that April 2023 sees the booming utility vehicle (UV) segment contribute 178,752 units or 54% of total PV wholesales compared to 53% in April 2022. In FY2023, UVs accounted for 51.50% of the record 3.89 million PVs sold in the country.

Achieving success in India’s booming SUV and MPV market, which has all of 30 marques with 100 models and a mind-boggling 726 variants, gives companies bragging rights. Here’s delving into the top six UV makers’ market performance in April 2023.

Maruti Suzuki India:36,754 units, up 8% YoY

UV market share: 20.56%

Maruti Suzuki India, the UV market leader for the past two fiscals, has opened FY2024 on a strong note with 36,754 units, as per SIAM’s UV industry wholesales data. This constitutes an 8% increase year on year (April 2022: 33,941 units) and comes on the back of March 2023’s 37,054 units. The April 2023’s UV numbers are the company’s second-best performance in the past 13 months. The company had averaged monthly sales of 30,510 UVs in FY2023, when it sold 366,129 units.

Expect Maruti Suzuki’s UV numbers, and in turn over PV numbers, to keep increasing this fiscal. That’s because its UV portfolio has expanded to five models with the premium Fronx SUV joining the Brezza, Ertiga, XL6 and Grand Vitara. The Fronx, retailed from the premium Nexa channel, in its first month of sales, clocked an estimated 8,784 units, the third highest amongst the UV siblings after the Brezza (11,836 units) and the Grand Vitara (7,742 units).

With the five-door Jimny, which Maruti Suzuki has been displaying in some Nexa showrooms since March, set for launch in June 2023, expect the company to breach the 40,000-unit monthly wholesales mark regularly in FY2024. It is learnt that the Jimny has already received over 25,000 bookings and of the planned production of 100,000 units this fiscal, the monthly allocation for domestic market is 7,000 units. The waiting period for the manual gearbox-equipped variants currently stands at around six months, while it’s seven to eight months for the Jimny automatic.

Mahindra & Mahindra – 34,694 units, up 57% YoY

UV market share: 19.40%

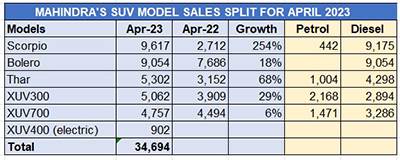

Mahindra & Mahindra, which was ranked third in FY2023’s UV sales, having missed the No. 2 position by only 288 units, has taken second place in FY2024’s first month, driving ahead of Tata Motors by a little over 3,900 units. Its wholesales of 34,694 units, are a strong 57% YoY increase (April 2022: 12,526 units). The second-highest monthly numbers after March 2023’s 35,976 units, they are indication of the company’s ramped-up production aimed to fulfil the sizeable order backlog for its popular models.

A close look at the model-wise split for M&M’s sales (see data table below) reveals that the Scorpio was the best-seller in April with 9,617 units, followed by the Bolero with 9,054 units. The Scorpio-Bolero combine accounted for 54% of total SUV sales. The Thar takes third place with 5,302 units, up 68% YoY. The XUV300, with 5,062 units, is ranked fourth amongst the SUV maker’s sixth models. In early May, the XUV300 surpassed sales of over 200,000 units since its launch on Valentine’s Day in 2019.

M&M’s tech-laden flagship XUV700, which has a waiting period of nearly 13 months for the top-end AX7 and AX7L variants, recorded sales of 4,757 units, up 6% YoY (April 2022: 4,494 units). Launched in August 14, 2021, the XUV700 has till end-April 2023, registered total wholesales of 97,491 units comprising 26,261 units in FY2022, 66,473 units in FY2023 and 4,757 units in April 2023.

Considering the XUV700, priced between Rs 14.01 lakh-26.18 lakh (ex-showroom). has been averaging monthly sales of 5,039 units or 168 units a day for the past four months, this model would have crossed the 100,000 milestone in the first fortnight of May 2023.

Tata Motors – 30,747 units, up 8% YoY

UV market share: 17.20%

Tata Motors, which recorded estimated UV wholesales of 30,747 units from its four models – the Nexon, Punch, Harrier and Safari – in April 2023, saw an increase of 8% over the year-ago 28,459 units. The Nexon, India’s best-selling UV for the past two fiscals, was April’s best-seller too with estimated sales of 15,001 units. The Punch, with 10,934 units, was the second highest-selling SUV for the carmaker.

Together, the two compact SUVs accounted for 84% of total UV sales for Tata Motors. On May 12, the 200,000th Punch rolled out from the Ranjangaon plant, 20 months after the compact SUV was launched. The Punch is now firmly established as Tata’s second-best-selling product after the Nexon. Punch sales will get added traction when the CNG and EV variants, which are slated for launch, enter the market.

Hyundai Motor India – 27,304 units, up 16% YoY

UV market share: 15.27%

Hyundai Motor India is ranked fourth in the OEM standings for April 2023 with 27,304 units, up 16% YoY (April 2022: 23,562 units). The Hyundai Creta, India’s second-best-selling SUV, remains the bulwark for the Chennai-based Korean company. With sales of 14,186 units, the Creta accounted for 52% of sales for Hyundai. The Venue compact SUV, with 10,342 units, was next best and has a 38% share of total UV sales last month. In end-March 2023, the Venue drove past the 400,000 sales milestone in the domestic market, 47 months since its launch.

Hyundai’s UV numbers should accelerate once its launches its new micro-SUV – the Exter – around July or August this year. The Exter, for which bookings have opened, will be positioned below the Venue and is slated to be Hyundai’s most affordable SUV in India, squarely aimed at the Tata Punch and Citroen C3.

Kia India – 23,216 units, up 22% YoY

UV market share: 12.98%

Kia India reported wholesales of 23,216 units in April 2023, which marks 22% YoY growth (April 2022: 19,019 units) and 8% month-on-month growth (March 2023: 21,501 units).

The Kia Sonet compact SUV has emerged as Kia’s best-seller last month with 9,744 units and accounts for 42% of total wholesales. This is the third month in a row that it has surpassed the longstanding best-seller, the Seltos midsize SUV which clocked 7,213 units. In February 2023, the Sonet had sold 9,836 units to the Seltos’ 8,012 and 8,677 units in March 2023 compared to the Seltos’ 6,554 units.

The Carens MPV, which has turned out to be growth driver for Kia in India, clocked sales of 6,107 units last month. All three products were among India’s best-selling utility vehicles in FY2023 – while the Seltos was ranked eighth and the Sonet ninth, the Carens took 11th position among the Top 30.

Toyota Kirloskar Motor – 10,180 units, down 15%

UV market share: 5.69%

Toyota Kirloskar Motor (TKM), which reported PV wholesales of 14,162 units in April 2023, down 4.16% YoY (April 2022: 14,777 units), saw its UV numbers down 15% last month at 10,180 units. Combined Innova and Hycross sales at 4,836 units accounted for 47.50% of overall UV sales in April 2023. The Urban Cruiser Hyryder is estimated to have clocked sales of 2,618 units last month.

The company had undertaken a week-long maintenance shutdown at its manufacturing plants in Bidadi, Karnataka from April 24 to 28, 2023 for the upkeep of machinery and equipment to sustain operational efficiencies, productivity and safety.

Expect TKM’s numbers to progressively increase in the months to come. From May 1, 2023, the company has commenced three-shift operations at its manufacturing plant in Bidadi to cater to demand. This is expected to help increase production for the Innova, Fortuner and Hycross production from 380 units per day to 510 units per day and boost TKM’s cumulative capacity in India from 320,000 to 400,000 units per annum.

Last month saw TKM launch ‘Wheels on Web’, an online retain sales platform for the Bangalore region. This enables customers to book, purchase and get delivery of models like the HyCross (petrol), Hilux, Legender, Camry, Fortuner and Innova Crysta (GX) digitally.

Growth outlook for UV industry

The big positives for the UV segment are that consumers are spoilt for choice – be it styling, powertrain and even fuel. Automakers are fast expanding buyer options. In early January, Maruti had launched the Grand Vitara CNG, followed by Toyota Kirloskar Motor with its Hyryder CNG. And in early March, the Maruti Brezza became the first compact SUV in India to get CNG power. With the slashing of CNG prices in early April, demand for CNG-powered UVs will only increase in FY2024.

While compact SUVs continue command the bulk of demand, there is a growing shift towards midsize SUVs. This year will see at least 10 new SUVs being launched and there’s one for every budget, ranging from Hyundai’s Ai3 sub-compact SUV to Honda’s midsize SUV and through to the premium Lexus RX.

With a much-improved supply chain for semiconductors and an estimated backlog of around half-a-million UVs (most of them with the top six SUV and MPV manufacturers), OEMs are putting their shoulder to the production wheel to keep their assembly lines busy and cater to demand.

While overall PV industry growth might be taper down to single-digit growth, FY2024 should be yet another big-number year for the UV industry in India. While the YoY growth may not match that of FY2023 (35%) or FY2022 (40%) because of the large base, market size per se will expand. Stay tuned in updates from this extremely exciting albeit hugely competitive marketplace where the mantra for success is SUV-ival of the fittest.