Read by: 100 Industry Professionals

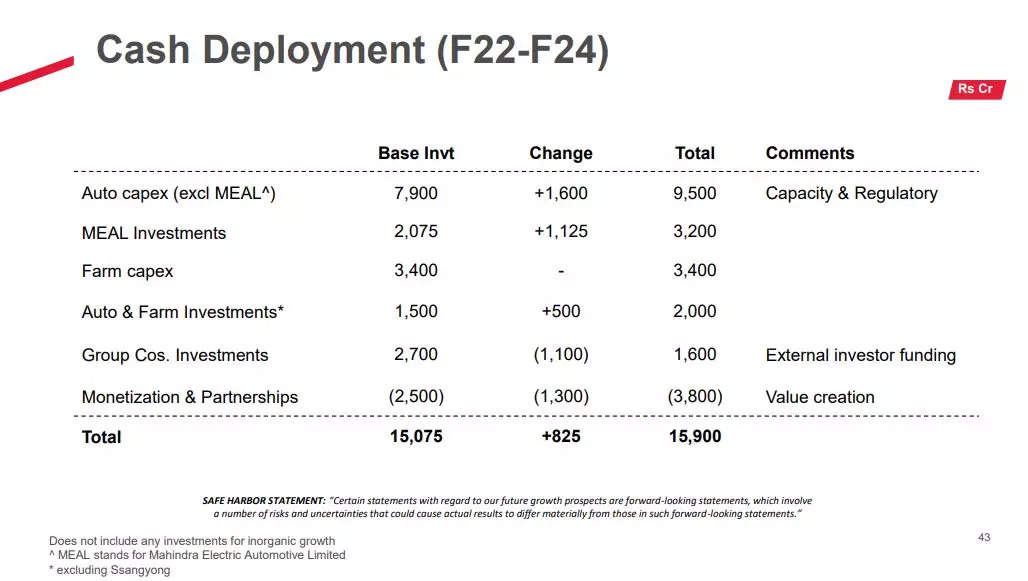

The automotive ICE business investments has been increased 20% to INR 9,500 crore from INR 7,900 crore earlier. The capex for its EV arm, Mahindra Electric Automobile Limited (MEAL) has been revised 54% to INR 3,200 crore as against INR 2,075 crore.

“As we have gone through a combination of strong demand and what we are seeing in terms of the demand outlook going forward, we are upping the forecast in terms of capex for the same period…but because of the external funding, we think that we don’t need to invest so much in the other group companies,” Rajesh Jejuriker, Executive Director & CEO (Auto and Farm Sector), M&M said.

The company’s Group company investments were revised downwards to INR 1600 crore from INR 2700 crore.

Mahindra reported growth of 18% in its consolidated profit after tax (PAT) at INR 2,637 crore for the January- March 2023 quarter. It had posted a PAT of INR 2,237 crore in the year-ago period.

Revenue increased to INR 32,366 crore for the fourth quarter ended March 2023, as compared to INR 25,934 crore in the corresponding quarter of the previous fiscal.

Anish Shah, Managing Director & CEO, M&M said, “It has been a blockbuster year for the group. Auto led the way with record-breaking launches, as we regained the #1 position for SUV revenue market share.”

Going forward, the company is set to scale up its capacity to 49,000 units per month, from 39,000 units earlier. Jejurikar said that basis this the waiting period for the company’s vehicle models is expected to reduce substantially by the next six months.

However, it noted that the chip shortages prevented the company from meeting its monthly SUV production target of 39,000 units.

The auto major has no plans to launch any new product this year. It is focused on consolidating the product range, and will launch the 5-door Thar in the CY 2024. Maruti Suzuki has also unveiled its 5-door Jimny this year and is set to announce the prices next month.

Jejuriker said the company is looking at scaling its farm machinery business to 10X and grow its exports by 1.6X by FY26.

The company is expanding its Zahirabad facility and setting up a new battery assembly line over there. It has also set up a new Trio line in Haridwar facility.

Currently, Mahindra gets batteries from a Korean supplier. It has no immediate plans of making cells for its EV batteries on its own and is still evaluating production via its Volkswagen tie-up.