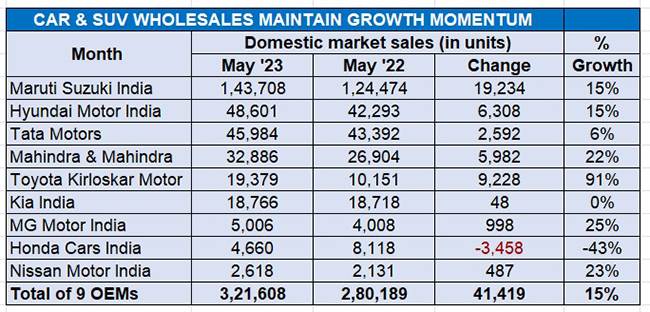

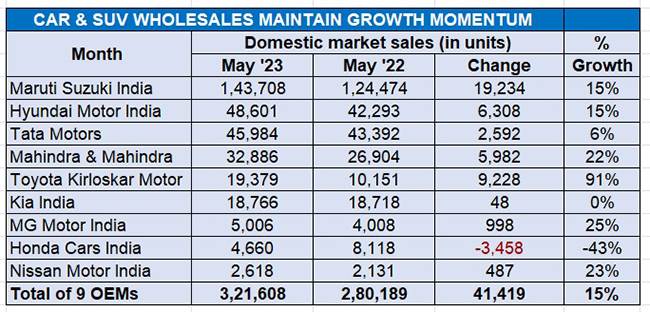

Passenger vehicle wholesales are estimated to have crossed the 330,000-unit mark for the fourth month in a row in May 2023. As per the data released by nine PV manufacturers, a total of 321,608 units were despatched from factories to dealer showrooms last month. The cumulative wholesales of the remaining seven OEMs should add another 10,000-odd units to the overall total. This performance comes on the back of April 2023’s wholesales of 331,378 units.

May 2023 is the fourth month in a row this year that PV despatches from factories to showrooms have crossed the 330,000-unit mark, following January (346,080 units), February (334,790 units), March (336,074 units) and April (331,378 units).

With sustained demand for utility vehicles – SUVs and MPVs – which now account for every second PV sold in the country, most of the companies with strong UV portfolios have recorded double-digit gains year on year. Let’s take a closer look at the company-wise performance.

Vehicle despatches in May 2023 would have been higher but for Maruti Suzuki and M&M production being impacted by chip supply constraints.

Vehicle despatches in May 2023 would have been higher but for Maruti Suzuki and M&M production being impacted by chip supply constraints.

Maruti Suzuki India

143,708 units – up 15% YoY, 7.27% MoM

India’s passenger vehicle market leader despatched 143,708 units in May 2023, a 15% year-on-year increase (May 2022: 124,474 units) and a 7.27% month-on-month increase (April 2023: 137,320 units). Strong sales of its six-pack of SUVs helped buffer the 30% YoY decline in sales of its two budget hatchbacks.

Combined sales of the Alto and S-Presso at 12,236 units are down a substantial 30% on year-ago sales (May 2022: 17,408 units) and also 13% down on April 2023’s 14,110 units. This is the sole sub-segment amongst the company’s 16 models to see a sales decline. Clearly, demand from rural India continues to be tepid, which is somewhat worrying for both Maruti Suzuki as well as India Auto Inc.

The seven-model pack of the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R together account for 71,419 units, up 5% (May 2022: 67,947 units) but down 4.69% on April 2023’s 74,935 units. Expect the Baleno, India’s best-selling premium hatchback in FY2023 and the utilitarian Wagon R, the best-selling passenger vehicle last fiscal, to have sizeable contributions. The premium Ciaz sedan clocked wholesales of 992 units, up 69% on a low year-ago base of 586 units. The Eeco van did well to sell 12,818 units, 22% better than the 10,482 units it had clocked in May 2022.

Maruti Suzuki India’s SUVs – the Brezza, Ertiga, Fronx, Grand Vitara, S-Cross and the XL6 – clocked 46,243 units, which constitutes strong 65% YoY growth. What’s more, the 26% month-on-month increase (April 2023: 36,754 units) of this six-pack reflects the growing demand for Maruti’s SUVs and the popular Ertiga MPV.

While SUVs led the charge and contributed 22% to overall PV sales last month, Maruti’s key UV models – the Brezza, Grand Vitara and Fronx – remain in high demand. While the Brezza currently commands an 18-19-week wait time for its over 55,000 pending orders, the bigger Grand Vitara is yet to be delivered to more than 33,000 customers. And the recently launched Fronx crossover has over 46,200 bookings, and an estimated wait time of 16 weeks, depending upon variant and city.

Maruti Suzuki, which has an estimated order backlog of around 375,000 PVs, continues to be impacted by a shortage of semiconductors. Production of key models like the Ertiga, XL6, Grand Vitara, Brezza and Fronx was hindered last month.

Hyundai Motor India

48,601 units – up 15% YoY, down 2.21% MoM

Hyundai Motor India reported domestic market wholesales of 48,601 units, which is a 14.91% increase over May 2022’s 42,293 units. Month-on-month, May 2023 sales are down 2.21% on April 2023’s 49,701 units.

Commenting on the May 2023 sales, Tarun Garg, COO, Hyundai Motor India said, “The healthy double-digit sales growth for May 2023 was fuelled by our SUVs, Hyundai Creta and Venue. The recently launched new Verna again clocked strong numbers, while the our soon-to-be-launched Exter SUV continues to ramp up excitement amongst customers in the SUV space.”

In April 2023, soon after the company had upgraded its entire car and SUV line-up to the BS6 Phase II emissions norms, it added safety equipment in the Creta and Venue and also the i20 hatchback.

Tata Motors

45,984 units – up 6% YoY, down 2.38% MoM

Tata Motors’ PV sales maintained their sales trajectory albeit growth moderated last month to single digit. In May 2023, the company despatched a total of 45,984 units, which is a 6% YoY increase (May 2022: 43,392 units). Month on month, this is a decline of 2.38% (April 2023: 47,107 units).

The company, which retails seven models – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari – is currently ranked No. 3 after Maruti Suzuki India and Hyundai Motor India and has capitalised on the surging demand for its SUVs, particularly the Nexon and the Punch, currently the best-selling and the No. 4 SUVs respectively in India.

Tata Motors is betting big on its CNG-powered cars and the premium Altroz hatchback has become the third Tata car, after the Tiago and Tigor, to get the CNG treatment. Among the Altroz’s highlights is the dual-cylinder setup that enables two 30-litre tanks positioned under the boot floor to free up storage space.

Where Tata Motors continues to have a strong advantage is in the fast-growing electric vehicle market where it has four products – Nexon EV, Tigor EV and Xpres-T (for fleet buyers) and the sub-Rs 10 lakh Tiago EV. In May, the company despatched an estimated 5,805 EVs, which takes the April-May 2023 total to 12,321 units.

Nevertheless, in India’s expanding electric car and SUV market, Tata Motors, which had commanded an 80% EV market share, is beginning to see competition. As per Vahan retail sales data for April-May 2023, Tata Motors has sold 10,274 EVs which gives it a market share of 77%, followed by Mahindra & Mahindra (889 units and 6.64% share), and MG Motor India (779 units / 5.82% share).

Mahindra & Mahindra has moved into second place, which is clearly an impact of the growing demand for the all-electric XUV400, the first real challenger to the Nexon EV. And MG Motor India’s recently launched MG Comet EV, which has received a positive market response in its first month of sale, goes head to head with the Tiago EV.

Mahindra & Mahindra

32,886 units – up 22% YoY, down 5.21% MoM

Mahindra & Mahindra (M&M) reported wholesales of 32,883 SUVs in May 2023, which is a 23% year-on-year increase (May 2022: 26,632 units) but 5.21% down on April 2023’s 34,694 SUVs. The company also sold three sedans/vans last month, down 99% on May 2022’s 272 units. Cumulative sales for the first two months of FY2024 are 67,584 units, up 37% YoY (April-May 2022: 49,430 units).

Like Maruti Suzuki India, M&M also continues to be impacted by semiconductor supply constraints on specific parts like airbag ECU. According to Veejay Nakra, President, Automotive Division, M&M, “The sales volume for both SUVs and Pik-Ups was restricted by a short-term disruption in engine-related parts at the supplier end. The semiconductor supply constraints on specific parts like airbag ECU continued during the month too.”

In the EV segment, the XUV400 clocked retail sales of 363 units in May 2023, adding to the 526 units it sold in April 2023. Its cumulative sales of 889 XUV400s gives it a 6.64% share of the EV market, giving M&M second place behind market leader Tata Motors (10,274 units / 77% share) and ahead of MG Motor India (779 units / 5.82% share).

Meanwhile, the order backlog at M&M has increased to 292,000 cars. On November 1, 2022, the company had pending orders of 260,000 units. The rise of 32,000 units over seven months hints that demand for the company’s range of SUVs continues to outstrip its production capacity. The Scorpio N with 117,000 bookings is the one with the biggest backlog and accounts for 40% of overall bookings. Flagship XUV700, with 78,000 bookings, has 27% and is followed by the Thar (58,000 bookings), the XUV300 / XUV400 (29,000 bookings) and the Bolero (8,200 bookings).

M&M has already expanded its SUV manufacturing capacity from 29,000 units per month to 39,000 units by December 2022 and plans to further increase it to up to 49,000 units in the current financial year or 600,000 units per annum.

Toyota Kirloskar Motor

19,379 units – up 90% YoY, 39% MoM

Toyota Kirloskar Motor despatched 19,379 units in May 2023, growing strongly by 90% (May 2022: 10,151 units), while the month-on-month growth is 39% (April 2023: 13,896 units). This robust performance comes on the back of improved supplies following the start of the third shift at the Bidadi plant and has helped TKM go ahead of Kia India in the OEM rankings to occupy fifth position.

Commenting on TKM’s sales in May 2023, Atul Sood, Vice-President of Sales and Strategic Marketing said, “We believe that the strong upward trajectory highlights the company’s customer alignment and ever-growing product popularity with the latest launches like Urban Cruiser Hyryder, Innova Hycross and the Hilux that continue to support the strong sales momentum in their respective segments.”

He added, “We recently enhanced our production by implementing the third-shift of operations at our Bidadi plant from May 2023 which has greatly contributed to addressing the market’s needs.”

Kia India

18,766 units – flat sales (0% YoY), down 19% MoM

Kia India’s domestic market wholesales of 18,766 units constitute flat sales (May 2022: 18,718 units). Compared to April 2023’s 23,216 units, sales were down 19% month on month.

The Sonet compact SUV with 8,251 units was the best-seller and has outsold Kia’s longstanding best-seller, the midsize Seltos SUV for the fourth month in a row. What could have given a fillip to Sonet sales is the recent launch of a new variant. On May 11, Kia India launched the Sonet Aurochs Edition at Rs 11.85 lakh (ex-showroom), which sits between the HTX and HTX+ trims in the Sonet’s variant line-up.

The Carens MPV, which is fast turning out to be a new growth driver for the Korean carmaker, is the second highest seller with 6,367 units. The Seltos, with 4,065 units, takes third rank in the May 2023 sales chart.

Meanwhile, the EV6, Kia’s maiden electric vehicle in India, gained traction with 83 units sold, signalling a growing uptake for premium vehicles.

Commenting on the sales performance, Hardeep Singh Brar, National Head, Sales & Marketing, Kia India said, “Although we faced some production limitations due to our plant annual maintenance shutdown for a week in May which impacted our numbers, we are confident of strong performance in coming months. We are witnessing a growing demand for our latest technology innovation – iMT range. This month, iMT has contributed to 38% of our total sales. While Sonet emerged on the top with 8,251 units, Carens and Seltos continued to drive our growth to 19% YTD.”

MG Motor India

5,006 units – up 25% YoY, 10% MoM

MG Motor India reported retail sales of 5,006 units in May 2023, which marks 25% YoY growth (May 2022: 4,008 units) and a 10% month-on-month increase (April 2023: 4,551 units). The company states it remains “optimistic about growth and meeting the rising customer demand through various ongoing and planned production and operational initiatives.”

MG Motor India has reported growth in sales of its ZS EV and a positive response to the recently launched MG Comet EV. Also, on May 29, the company introduced ‘The Advance Blackstorm’ edition of the MG Gloster.

The company, which sold a record 48,866 units in FY2023 and currently produces the Astor, Gloster, Hector 5-seater, Hector Plus and ZS EV SUVs, and the Comet EV from its plant in Halol, Gujarat, is eyeing rapid growth this fiscal and has targeted sales of 80,000 to 100,000 units, which would mean doubling of sales.

One of the drivers of growth is billed to be the compact two-door Comet EV, launched on April 26 at Rs 798,000. MG Motor India is bullish on consumer demand for the Comet EV and is targeting a 20% share of India’s passenger EV market.