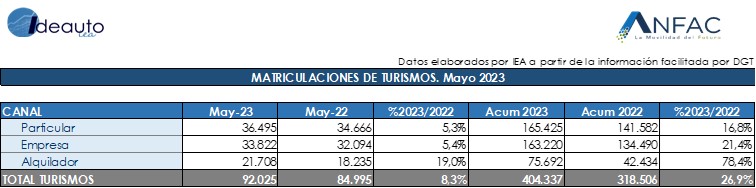

Sales of passenger cars and SUVs add up to May a total of 318,506 units, 26.9% better than the previous year but still 28% lower than the pre-pandemic records of 2019

Registrations of light commercial vehicles achieved a growth of 10% in May, with 12,048 sales

Sales of industrial vehicles, buses, coaches and minibuses grew by 27.4% in May with 2,486 units

Madrid, June 1, 2023. The market for passenger cars and SUVs registered an increase of 8.3% in May, with a total of 92,025 registered units. The improvement in production rates is making it possible to respond more quickly to orders from dealers, mainly from rent-a-car channels and companies, which are driving the figures. For their part, sales to individuals are viewed with concern as they are still a third below the rate prior to the pandemic.

With this figure registered in May, it is possible to chain five positive months, accumulating 404,337 units, 26.9% more than the same period of the previous year, but which is still 28% less than the sales that were made in 2019. before the pandemic.

The average CO2 emissions of passenger cars sold in May remain at 117.4 grams of CO2 per kilometer traveled, 3.7% lower than the average emissions of new passenger cars sold in the same month of 2022. During 2023, emissions stand at 118.7 grams of CO2 per kilometer travelled, 1.61% less than the same period of the previous year.

Although the registrations by channels registered increases in all of them with respect to the previous year, it is necessary to highlight the low rate of entry that comes from the private channel. These sales reached a total of 36,495 units in May, which represents a growth of 5.3% compared to 2022 but a sharp decrease of 33% compared to 2019. For its part, the rental channel grew 19%, with 21,708 sales , while the business market achieved 33,822 new registrations, growing 5.4% more and reaching similar records to 2019.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles reached 12,048 units in the fifth month, an increase of 10% compared to last year. Until the month of May, the market registered an improvement of 22.1%, reaching 56,842 units. Regarding channel sales, only companies managed to grow compared to the previous year, with an improvement of 27.4%, with 8,730 units. For their part, sales to the self-employed and renters fell by 25.3% and 10.9%, respectively.

INDUSTRIAL AND BUSES

In May, registrations of industrial vehicles, buses, coaches and minibuses achieved a notable increase of 27.4%, with a total of 2,486 units. In the first five months, 12,636 sales were reached, improving by 20.8% on the same period of the previous year. By type, industrial vehicles continue their growth streak, with 25.1% in May and 2,219 units. For their part, buses, coaches and minibuses, with 267 sales in the month, improved by 50%.

STATEMENTS

Félix García, director of communication and marketing at ANFAC, explained that “May accumulates a new positive month during this 2023. The market grows 8% compared to the same period of the previous year. With five months closed, we hope that the end of the year could be around 950,000 units, 25,000 more than the most optimistic forecast we had in January. However, we must be cautious. The uncertainty of citizens and companies about which car to buy is still latent and more, now, with the call for general elections that usually paralyzes economic activity. We observe that the private market has not yet started and is waiting for what happens not only in the elections but also if inflation manages to be contained and interest rate increases stabilize. The latter make financing a new vehicle more expensive, which does not benefit the renewal of a fleet that is already over 14 years old. It is necessary to recover the market volumes prior to the pandemic that guarantee both the competitiveness of our industry and the maintenance of the employment that the automotive sector generates”.

Raúl Morales, communication director of FACONAUTO, indicated that “it is very important that months of the year are discounted and that those months end with an increase in registrations in our country, as occurred in the month of May. However, we maintain the feeling that the recovery is being very slow. We are 25% below the sales that were made in 2019 and this recovery is becoming highly mediated by a lower purchasing power on the part of families that have less disposable income and less saving capacity. For this reason, the automobile maintains its caution regarding its evolution in the medium term and we foresee that this year it will end with some 950,000 registrations made, leaving for next year sales to exceed one million, which would bring us closer to a certain normality. ».

According to GANVAM’s communication director, Tania Puche, highlighted that “sales of new cars have been positive for five months, above all, due to the pull of rental companies; and in May, we are around 90,000 units per month, approaching the natural volume of our market. However, although we are in a context in which inflation is moderating, purchases by individuals are 30% below pre-pandemic levels. Therefore, the buyer continues to need, and now more than ever, both economic and technological certainty, as well as access to more affordable mobility. Hence the importance of reaching a horizon of stability as soon as possible in an election year in order to recover a market that in 2023 will once again fall below one million units for the fourth consecutive year”.