Tata Motors, which made a comprehensive presentation on its Investor Day on June 7, 2023, seems to be ticking all the right boxes when it comes to the present and future growth roadmap of its passenger vehicle (PV), electric vehicle (EV) and commercial vehicle businesses. This even as the competition grows across vehicle segments in the Indian automobile market.

The PV business, which includes EVs, is the one making most of the news. The company, which currently has a portfolio of seven models comprising two hatchbacks (Altroz, Tiago), one sedan (Tigor) and four SUVs (Nexon, Punch, Harrier and Safari), has capitalised on wave of demand for SUVs – the Nexon and Punch compact SUVs were the No. 1 and the fourth highest-selling SUVs in India in FY2023. With the tailwind of SUV demand firmly behind it, Tata Motors saw its quartet of SUVs contribute an estimated 355,810 units or 66% of total sales in FY2023.

Tata Motors, which sold a record 538,640 PVs in FY2023, up 45% over FY2022’s 370,372 units, has achieved lifetime highs across operational and financial metrics. While PV market share has risen to 13.9% from 12.1% in FY2022, 8.2% in FY2021 and 4.8% in FY2020, revenues have catapulted five times to Rs 47,868 crore in FY2023 and a resultant best-ever EBIDTA of Rs 3,085 crore.

Five-pronged focus for PVs

As per the company, the sustained growth for its PVs is the result of a five-pronged strategy – an aspirational product portfolio, EV network and ecosystem development, front-end reimagination, operational debottlenecking and product quality enhancement.

Striking design is among the hallmarks of Tata Motors’ ‘New Forever’ range, which also benefits from upgraded passive and active safety attributes and ADAS features along with an intelligent and integrated infotainment and driver information system (HMI), upgraded connected car ecosystem and tech upgrades on the existing engine portfolio for refinement.

In an effort to keep the portfolio fresh, there have been regular rollouts of variants and special editions to “sustain interest and address new microsegments of customers”. Tata Motors states that the ‘Dark’ range is driving premiumisation of the portfolio (Harrier, Nexon, Altroz and Nexon EV).

Tata Motors states the ‘Dark’ range is driving premiumisation of the portfolio.

Tata Motors states the ‘Dark’ range is driving premiumisation of the portfolio.

These moves have helped each model increase its market standing and share – the Nexon and Punch compact SUV siblings have helped Tata command a 35.2% share in the segment versus 12.3% in FY2020. The Harrier and Safari too have seen growth in segment share – to 28.8% in FY2023 from 26% in FY2020. The mid-level Tiago hatchback, which has recently gone electric, has a 21.8% share in FY2023 versus 15.4% in FY2020 in its segment. In the premium hatch market, the Altroz, which now has a CNG variant, has a 14.9% share, a big change over the 2.5% three years ago. The Tigor sedan, likewise, has done well to achieve 15.8% share from 4.5% in FY2020.

Tata Motors is also bullish on demand for CNG-powered cars and SUVs. With the premium Altroz having joined siblings Tiago and Tigor in the CNG portfolio, and the Punch CNG slated for launch, the carmaker expects to sell about 150,000 CNG PVs a year within the next couple of years in line with its vision to achieve 30% of total PV sales from CNG variants.

Driving home the EV advantage, readying new products

Tata Motors, which is among the few PV OEMs with multiple powertrains spanning petrol, diesel, CNG and electric is driving home the first-mover advantage it has in electric vehicles (EVs). Since launching the Nexon EV in January 2020, the company’s cumulative EV sales are crossed 75,000 units till end-May 2023.

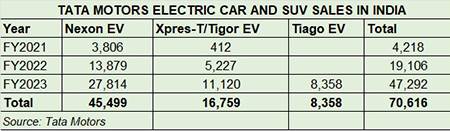

As per company data in the company’s investor presentation, between FY2020 and FY2023, its cumulative EV sales were 70,616 units, with the bulk – 47,292 units – being sold in FY2023.

Of this total, the Nexon EV with 45,499 units accounts for 64% of sales, followed by the Tigor/XPres-T sedan with 16,759 units and 24% share and the recently launched Tiago EV with 8,358 units and 12% share. While the Nexon EV, which has seen its first real competition in the Mahindra XUV400, continues to hold sway in the e-SUV market, the fleet-only X-Pres T (and sibling Tigor EV) has over 50,000 bookings. The Tiago EV, which has helped expand the market, had received over 20,000 bookings since its launch.

According to Tata Motors, 23% are first-time Tiago EV buyers, 24% comprise women buyers and 56% of buyers are less than 40 years.

Being the most affordable EV in Tata’s portfolio as well as India at Rs 869,000, the Tiago EV is helping expand the EV market. According to Tata Motors, the zero-emission hatchback is witnessing keen interest from potential buyers in smaller towns and also drawing new customer segments. Interestingly, as per Tata, 23% are first-time Tiago EV buyers, 24% comprise women buyers (twice the industry average) and 56% of buyers are less than 40 years.

Compared to the Nexon EV, for whom the bulk of bookings (49%) are from India’s Top 10 cities, 14% from the next 10 cities and 37% from rest of India, the scenario for the Tiago EV is very different. Fifty percent of Tiago EV bookings are from outside of the Top 10 cities, 35% in the Top 10 cities and 16% in the Top 11-20 cities.

On the EV retail front, the company has expanded its footprint considerably. With a presence in 165 cities and 250 EV dealerships, it has the widest EV network in India. Tata Motors also benefits from its Tata Universe, which is the synergies attained from Tata Group companies including Tata Power, Tata Chemicals, Tata AutoComp, Tata Motors Finance and Croma, to create an e-mobility ecosystem designed to accelerate EV adoption. Tata Power has set up over 5,000 public charging stations, enabled home charging in over 170 cities and community chargers in over 175 housing societies in the Top 5 metro cities in India.

Tata Motors’ overall retail sales showroom network now stands at 1,410, up from 806 in FY2020 while the service network’s footprint has expanded to 855 facilities from 653 three years ago.

Future EV roadmap and aggressive localisation

The company has outlined its future EV product roadmap which it had revealed at the Auto Expo in January 2023 in the form of the Curvv, Sierra and the Avinya. There is a fourth model albeit details are scarce on this one. While the Gen 02 modular platform (with 60% commonality with ICE platform) will deliver EVs with 500km range, the optimised, dedicated platform on which the over-550km-range Avinya will be developed.

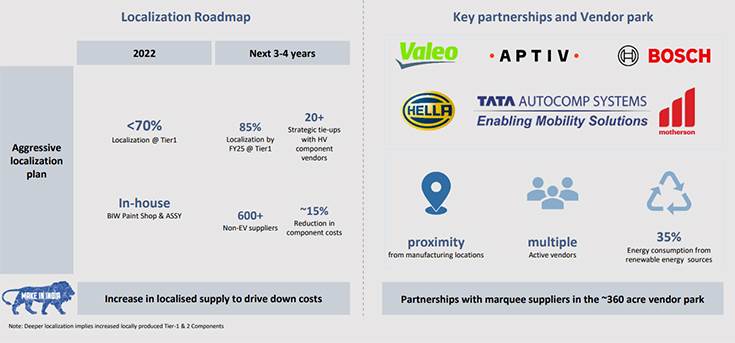

EV affordability is key to increased adoption and the path to it is higher localisation. As per its presentation, Tata plans to increase localisation at Tier 1 suppliers to 85% by 2023 from 70% in 2022 as detailed in its localisation roadmap (pictured below).

Keeping chip supplies going, expanding capacity

Compared to other OEMs like Maruti Suzuki and Mahindra, whose production continues to be impacted due to inclement supplies of semiconductors, Tata Motors does not seem to have such an issue. The company handle the semiconductor shortage through developing direct relationship with chip manufacturers, developing dual / alternate sources, formalising a long-term schedule and creating buffer stock for key semiconductors. What also helped is design innovation to reduce number of and use of next-gen semiconductors in its models.

Tata Motors states that its manufacturing capacity has been scaled up nearly 3x through interventions at the plant and with its component vendor. From around 20,000 units per month in CY2020 to 50,000 units a month in FY2023, the company has achieved agile debottlenecking of model-specific capacities, particularly for the much-in-demand Nexon, while ensuring supplier capacities also increased in sync with its in-house capacities (petrol engines)

Meanwhile, Tata Motors which has a cumulative PV manufacturing capacity of 600,000 units between the Pune, Sanand and Ranjangaon plants, will see its overall capacity expanded by another 420,000 units with the recently acquired Ford India plant, also in Sanand, Gujarat. When this plant goes on stream sometime in CY2024, it will help augment capacity to 1.02 million units per annum. Located adjacent to Tata’s existing Sanand plant, it is a smart, scalable factory with layout to expand. As per Tata, the capacity enhancement has been “achieved with prudent capital deployment – potential savings of around Rs 5,000 crore.”

Revision of capex by 25% to Rs 38,000 crore

On the back of its record FY2023 performance, Tata Motors plans to revise its capex upwards by 25% to Rs 38,000 crore in FY2024, with improved chip supplies and expected sustenance in demand for both the JLR and the standalone business. The company plans to invest in products, platforms, and debottlenecking of capacity.

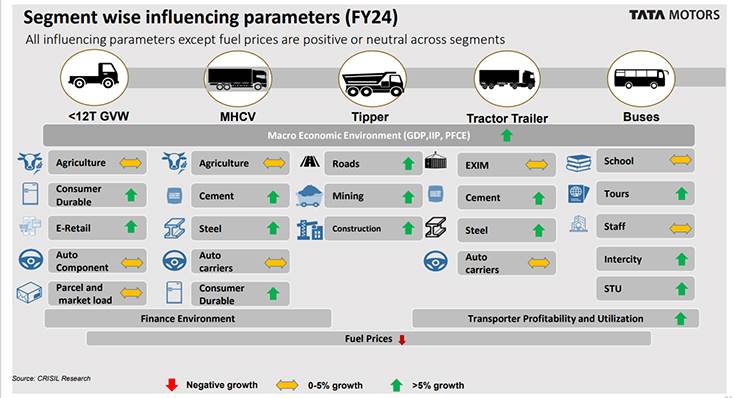

Commercial vehicles as a growth driver in FY2024

When it comes to commercial vehicles, Tata Motors seems to be cautiously optimistic about demand in FY2024. Growth for the CV industry comes in four-year cycles and FY2023 saw total M&HCV and LCV sales clock 962,468 units, an increase of 34% over FY2022’s 716,566 units. This is the industry’s best performance in four years but a tad less than the industry’s best-yet in FY2019 when it surpassed a million units: 10,07,319.

Tata’s combined domestic and export market CV sales in FY2023 were 356,972 units, up 36% (FY2022: 262,320).

The massive government as well as private sector spend in infrastructure development, mining and related activities is leading to fresh demand, particularly for HCVs, even as replacement demand is up and about with a vengeance as MCV operators scramble to update their fleets. The huge boom in e-commerce activity and the resultant demand for optimised hub-and-spoke-driven last-mile deliveries is also driving demand. That’s just what the company wants to capitalise on.

As per the company, underlying demand for CVs is quite strong on the back of robust infrastructure investment, fleet renewal requirements, e-commerce business, and healthy freight rates. What’s more, it is optimistic about demand even from the rural market. And it is making speedy moves on the electric and hydrogen vehicle front too in CVs.

All graphics/data charts: Tata Motors’ presentation