Options traders are blasting China-based electric vehicle (EV) name Nio Inc (NYSE:NIO), after the company reported first-quarter earnings on Friday. At last glance, more than 246,000 calls and 107,000 puts had crossed the tape, which is triple the intraday average amount. Most popular and seeing new positions opening is the June 8.50 call.

These traders are getting a deal, too, as options look affordable at the moment. This is according to NIO’s Schaeffer’s Volatility Index (SVI) reading of 69% that sits in the low 14th percentile of readings from the past 12 months, and implies options traders are pricing in lower-than-expected volatility expectations at the moment.

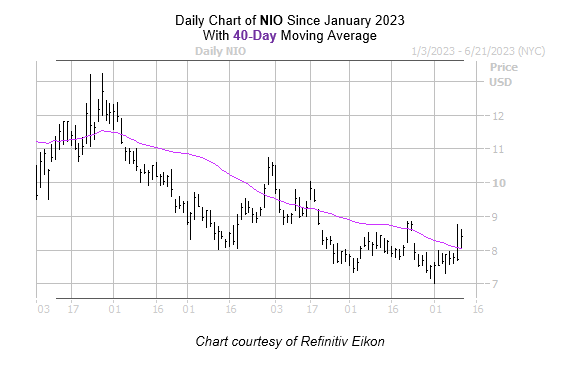

In its report, Nio marked narrower-than-expected losses, and said it expects deliveries to improve in June. The company followed this news up by slashing its prices on all models by 30,000 yuan. The shares were last seen 8.5% higher to trade at $8.39, though they remain down 19.6% in 2023. Today’s pop is helping the equity overcome consistent pressure from its 40-day moving average.

Analysts are cutting their price targets following the EV price cut, J.P. Morgan Securities, Citigroup, and Mizuho all adjusting lower. There’s room for additional price-target slashes as well, considering the 12-month consensus target price is still a 44.3% premium to Nio stock’s current perch.

Elsewhere, short interest is up 9.9% in the last two reporting periods, and the 108.05 million shares sold short account for 7% of NIO’s total available float.

Circling back to options, calls were already the popular choice coming into today. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security’s 50-day call/put volume ratio of 3.49 ranks higher than 99% of readings from the past year.