Bangladesh-based ShopUp more than doubled its revenues for the year ended June 30, 2022, but the company was unable to keep a lid on losses on account of its mounting expenses.

The company’s net loss ballooned 84.8% to $42.7 million in the financial year, from $23.1 million in the previous 12 months, show financial statements it filed with Singapore’s Accounting and Corporate Regulatory Authority (ACRA).

The startup, which digitalises neighbourhood stores in Bangladesh, also reported a 117% increase in revenue during the year to $83.2 million from $38.3 million in the previous year.

Rising cost of sales and administrative expenses, both of which more than doubled, contributed to the widening losses. While the cost of sales surged to $85.9 million during the year, from $41.6 million in the previous year, administrative expenses rose to $28.7 million from $12.1 million in the period, show ACRA data.

DealStreet Asia has reached out to the company for comments.

The B2B commerce platform for small businesses, which raised $65 million in a follow-on round led by Peter Thiel’s Valar Ventures in June last year, has three major offerings: Mokam, a sourcing platform for small neighbourhood stores with a wide range of products; REDX that offers logistics and delivery services to the stores; and Onkur, which provides supplies on credit to small businesses.

The startup makes money primarily from logistics and delivery of goods, which accounted for 90% of the revenue in the year ended June 30, 2022. Facilitation fees accounted for 9% of the revenue, while the remaining revenue dollars flowed in from commission and digital platform fees.

The company’s trade receivables climbed 4.7x to $20.2 million in 2022 from $4.3 million in the previous year.

The mounting inventory levels of the company also look concerning. Inventories more than tripled to $4.97 million in 2022 from $1.52 million a year earlier.

Cash and cash equivalents jumped 25.6x to $87.1 million as on June 30, 2022 from $3.4 million a year ago.

Prior to the Series B4 funding in June 2022, the startup had raised $74.4 million in September 2021 — a funding round led by Valar Ventures that was hailed as the largest in the South Asian nation.

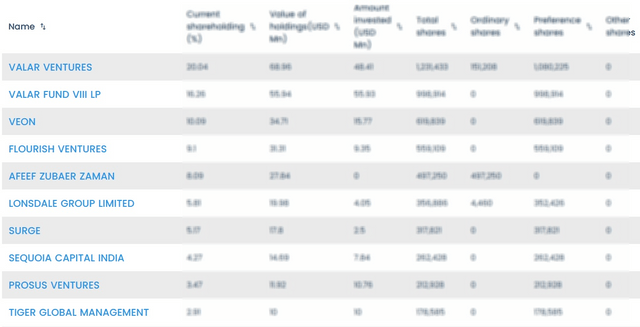

Valar Ventures is the top shareholder in the firm, show data from DealStreetAsia’s DATA VANTAGE platform. The company is also backed by Flourish Ventures, Sequoia Capital India (now Peak XV Partners), and Tiger Global Management, among others.

Mudir Dokans, as the neighbourhood mom-and-pop shops are locally called, dominate Bangladesh’s retail space accounting for 98% of the retail market. This makes the South Asian nation one of the most fragmented retail markets in Asia.