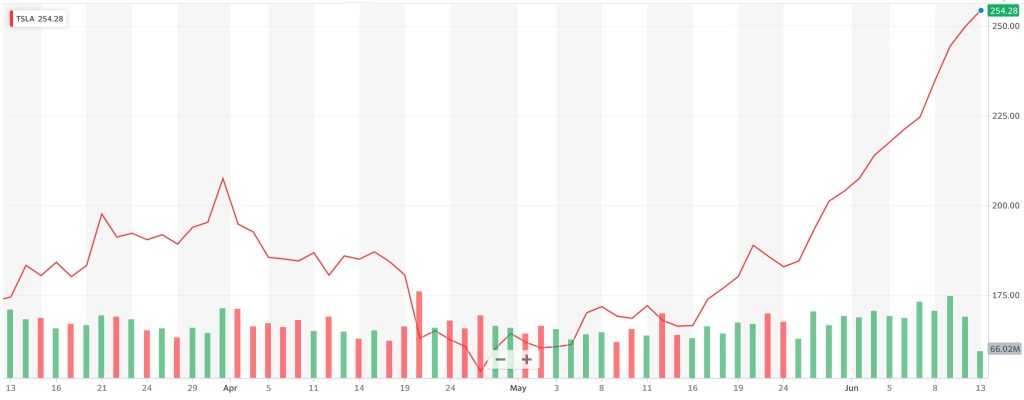

Tesla’s stock (TSLA) is up more than 50% over the last month in one of the company’s best runs in value ever.

Here’s an idea of why Tesla’s stock is gaining momentum.

Macroeconomics has a big impact on large stocks, like Tesla, and improvements on that front have helped the automaker, but the NASDAQ is up 10% while Tesla’s up 51% over the last 30 days.

A string of good news seems to have helped Tesla push higher at a faster rate than the rest of the market.

Tesla’s NACS gets adopted

Most recently, the adoption of NACS, which is Tesla’s connector, as the new North American charging standard has resulted in several Wall Street analysts considering Tesla’s Supercharger business.

With electric vehicles from GM and Ford adopting the connector to take advantage of Tesla’s Supercharger network, analysts believe that Tesla could start making billions of dollars in revenue per year from its charging business by the end of the decade.

Beyond the potential revenue from the Supercharger network, the adoption of NACS also validates Tesla’s approach to charging. Also, it should help the overall EV market in North America if NACS is adopted as the unified charging standard.

Tesla calms down with price changes

The other thing that is likely helping Tesla’s stock is that confidence in demand for Tesla’s vehicles seems to be improving – primarily due to the fact that Tesla has slowed down its constant price changes over the last month.

Tesla still discounts some inventory vehicles, but it mainly affects Model 3 vehicles – leading us to believe that the automaker might be liquidating inventory ahead of the Model 3 refresh.

With the end of the quarter approaching and Tesla not aggressively changing prices again, it is giving the market more confidence in the demand for Tesla’s vehicles.

The fact that Tesla somehow gained access to the full tax credit on its base Model 3 also didn’t hurt.

What else do you think is contributing to Tesla’s stock run? Let us know in the comment section below.

FTC: We use income earning auto affiliate links. More.