With the economy ticking along in good gear and consumer sentiment keeping pace, dispatches of two- and three- wheelers and of cars and SUVs from vehicle manufacturers to their showrooms across India maintained double-digit growth in May 2023.

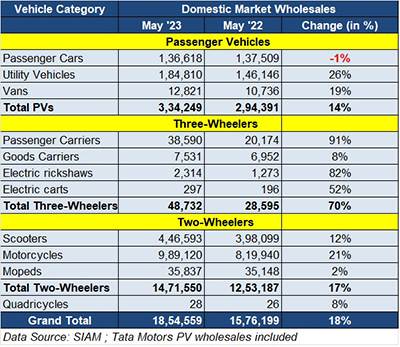

As per the wholesales numbers released by apex industry body SIAM, combined sales of these three segments (data for commercial vehicles was not released) were 18,54,559 units, up 18% year on year (May 2022: 15,76,199 units). The month-on-month growth for the three vehicle categories was 11.33% (April 2023: 16,65,805 units) and is reflective of the improved production levels at most automakers and their resultant suppliers to their dealer network.

However, when compared month-on-month versus April 2023, passenger vehicle numbers are flat. In contrast, two- and three-wheeler demand maintain double-digit growth. Will the current momentum in PV sales continue in the months to come or moderate?

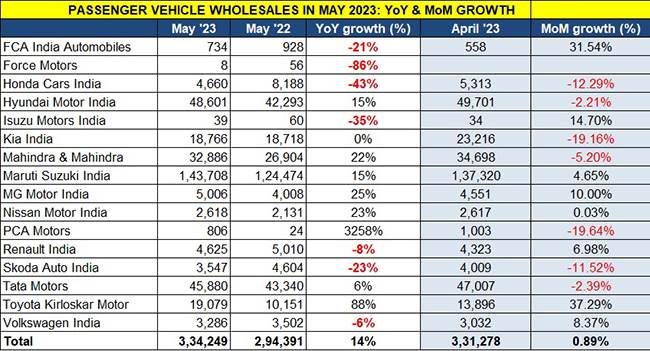

Passenger Vehicles: 334,249 units – up 14% YoY, 0.89% MoM

Of all the sub-segments, passenger vehicles comprising cars, SUVs and vans continues to be the newsmaker. At 334,249 units, YoY growth in May 2023 was 14% (May 2022: 294,391) and represents the fifth month in a row this year that PV despatches from factories to showrooms have crossed the 330,000-unit mark, following January (346,080 units), February (334,790 units), March (336,074 units) and April (331,378 units). Last month’s numbers were also the best-ever PV wholesales clocked in the month of May in India.

While cars at 136,618 units (down 1%) accounted for 40.87% of overall PV share, utility vehicles with 184,810 units (up 26%) expanded their share to 55.29%. Vans with 12,821 units (up 14%) comprised the remaining 3.83 percent.

With sustained demand for utility vehicles – SUVs and MPVs – which now account for every second PV sold in the country, most of the companies with strong UV portfolios have recorded double-digit gains year on year. Maruti Suzuki India with 1,43,708 units and 15% YoY growth has a 43% share of total PV despatches, followed by Hyundai Motor India with 48,601 units, up also 15% and with a 14.54% share. Close behind Hyundai is Tata Motors with 45,880 units, up 6% and a 13.72% share. Mahindra & Mahindra’s 32,886 units last month were a 22% improvement over year-ago numbers, and gives it a 9.83% share of the PV market. Toyota Kirloskar Motor went past Kia India to take fifth rank with 19,079 units, a strong 88% increase and 5.70% share, bettering the 4.72% PV share it had in May 2022. MG Motor India also did well to clock 5,006 units, up 25% YoY.

However, compared to April 2023’s wholesales of 331,278 units, month-on-month growth is minimal – 0.89 percent. Of the 16 OEMs in the fray, seven see month-on-month wholesales declines (see data below).

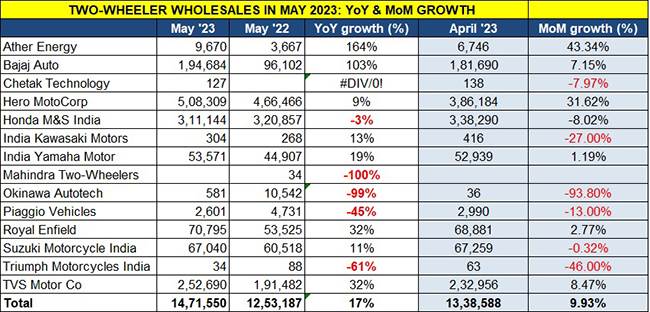

Two-wheelers: 14,71,550 units – up 17% YoY, 9.93% MoM

The two-wheeler segment was in the black with total dispatches of 14,71,550 units, up 8% (May 2022: 12,53,187) and importantly 10% better than April 2023’s 13,38,588 units. Both scooter and motorcycle sales saw double-digit increases – 12% and 21% respectively – and the humble moped too saw demand rise by 2% to 35,837 units.

What is helping the segment is the green shoots of recovery in rural market demand and the ongoing marriage season in the country.

The electric two-wheeler share of total sales rose to 2.57% in May 2023 as a result of sales doubling to 37,859 units compared to 1.50% a year ago (May 2022: 18,895 units). This is essentially a result of rapid consumer buying in the last week of last month, following the slashing of the FAME subsidy which has driven up prices from June 1. Expect electric scooter and bike sales to plunge in June.

Bajaj Auto is back in action with a robust 103% YoY increase to 194,684 units and MoM growth of 7.15%. Market leader Hero MotoCorp, which believes demand is returning from the rural market, and amid the marriage season in India, despatched over half-a-million units to record 9% YoY growth and 31% MoM growth.

Rival Honda Motorcycle & Scooter India saw a decline on both counts – the 311,144 units of May 2023 were 3% down on May 2022’s 320,857 units and 8% down on April 2023’s 338,290 units.

TVS Motor Co, with 252,690 units, saw a 32% YoY increase and 8% growth over April 2023’s 232,956 units, which gives it a 17% share of the overall two-wheeler market.

Three-wheelers: 48,732 units – up 70% YoY, 13.63% MoM

The three-wheeler market continues to see strong momentum and May 2023’s 48,732 units, up 70% YoY (May 2022: 28,595 units), are a reflection of that. What’s adding to their heft is the growing demand for electric vehicles – combined sales of e-rickshaws and e-carts at 2,611 units were up 77.73% over May 2022’s 1,469 units. This is also reflected in the growing EV share of the total three-wheeler market – 5.35% of total sales compared to 5% in May 2022.

Bajaj Auto has delivered a strong performance with 33,555 units, which is a 107% YoY increase and 7% month-on-month growth. Piaggio Vehicles with 6,530 units, up 19% YoY, takes second rank among the seven players listed by SIAM. Mahindra & Mahindra, which is the leader in three-wheeled EVs, despatched 5,851 units, up 61% YoY. The two other OEMs with four-figure sales were TVS Motor Co with 1,312 units and Atul Auto with 1,101 units.