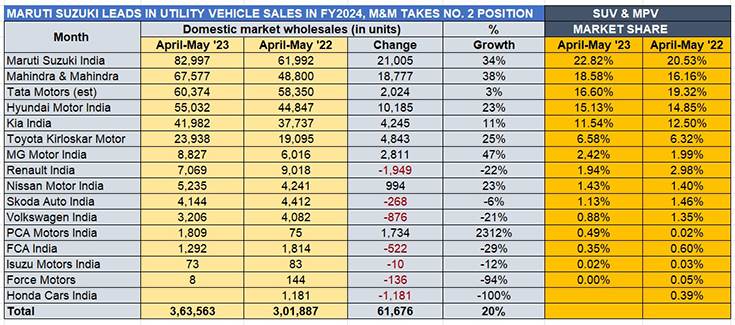

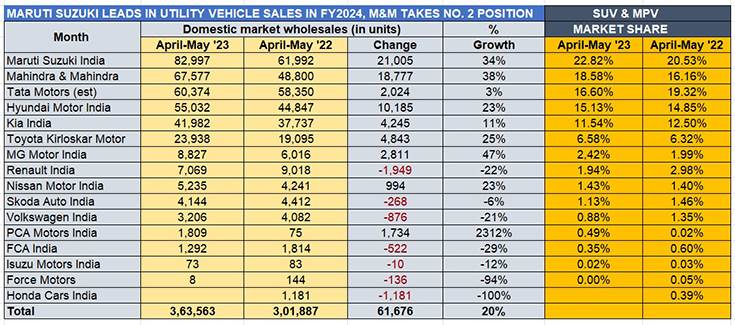

Two months into the fiscal year, the utility vehicle (UV) segment, which includes SUVs and MPVs, continues to be the bulwark of the overall passenger vehicle segment in India. With cumulative wholesales of 363,563 units in April-May 2023, UVs accounted for 54.61% of total PV sales of 665,625 units, improving upon the 51.50% they had in FY2023 when they surpassed the 2-million mark for the first time in India.

Passenger vehicle market leader Maruti Suzuki, which is banking on its utility vehicle portfolio to achieve speedy gains, particularly in the midsize SUV segment, has taken an early lead in the ongoing fiscal year. Two months into FY2024, the company has a lead of 15,420 units over the No. 2 player, whose status has changed in the past two months.

Maruti Suzuki India: 82,997 units, up 34% YoY

UV market share: 22.82%

Maruti Suzuki India, which has been the UV market leader for the past two fiscals, has taken a early and strong lead by dispatching 82,997 units in April-May 2023. This constitutes robust 34% year-on-year growth (April-May 2022: 61,992 units) and has helped the company increase its UV share to 23% from 20.53% a year ago.

The company’s charge is led by its recently launched SUVs. While the Brezza compact SUV is the best-seller in April-May 2023 with 25,234 units, the Baleno-based Fronx, which entered the market only in end-April at Rs 746,000, has 18,647 units to its name, followed by the Grand Vitara with 16,619, the Ertiga MPV with 16,060 units and the XL6 with 6,437 units.

Of the five models, three (Fronx, Grand Vitara and XL6) are Nexa models and account for 41,703 units or 50.24% of the two-month UV sales, reflecting growing demand for Maruti’s premium SUVs. And with the Jimny five-door being launched on June 7, at Rs 12.74 lakh, expect Maruti Suzuki’s UV numbers to stay in acceleration mode.

Mahindra & Mahindra: 67,577 units, up 38% YoY

UV market share: 18.58%

Mahindra & Mahindra, which missed out on the No. 2 UV rank in FY2023 by a whisker – only 288 units – to Tata Motors, has taken that position with sales of 67,577 units, which marks a robust 38% YoY increase (April-May 2022: 48,800 units), selling 18,777 units more than it did in the same two-month period last year.

Leading the charge for the company is the Scorpio and Scorpio N with 18,935 units, accounting for 28% of M&M’s UV sales. It is followed by the indefatigable Bolero with 17,224 units and 25% share. The third and fourth best-selling Mahindra is the XUV300 compact SUV with 10,187 units and flagship XUV700 with 10,002 units respectively. Meanwhile, the Thar has sold 9,598 units, the all-electric XUV400 1,598 units and the Marazzo MPV 33 units.

Expect M&M to up the ante in the coming months as it ramps up production to meet surging demand for most of its models. On May 26, the company had revealed that it has open bookings of 292,000 units with customer enquiries holding steady with low cancellations. Of this, the Scorpio N with 117,000 bookings is the one with the biggest backlog and accounts for 40% of overall bookings. Flagship XUV700, with 78,000 bookings, has 27% and is followed by the Thar (58,000 bookings), the XUV300 / XUV400 (29,000 bookings) and the Bolero (8,200 bookings).

M&M has already expanded its SUV manufacturing capacity from 29,000 units per month to 39,000 units by December 2022 and plans to further increase it to up to 49,000 units in the current financial year or 600,000 units per annum.

Tata Motors: 60,374 units, up 3% YoY

UV market share: 16.60%

Tata Motors, which has sold a total of 60,374 SUVs in April-May 2023, up 3.46% YoY (April-My 2022: 58,350 units), seems to be coming under pressure from a hard-charging, new model-laden Maruti Suzuki and also Mahindra & Mahindra. Both these rival OEMs, which continue to face chip supply issues, have ramped up their production and supplies.

The Tata Nexon continues to be India’s best-selling SUV with 29,425 units in April-May 2023, a YoY increase of 4.77%. It is followed by sibling compact SUV, the Punch with 22,058 units, up 8.27% YoY. Sales of the Harrier (5,086 units) and Safari (3,805 units) are down 8.83% and 11.77% YoY respectively.

Hyundai Motor India: 55,032 units, up 23% YoY

UV market share: 15.13%

Hyundai Motor India maintains its fourth rank it held in FY2023 in April-May 2023 with sales of 55,032 units, up 23% year on year (April-May 2022: 44,847 units). Likewise, the midsized Creta holds onto its position as India’s second-best-selling SUV with 28,635 units in the first two months of FY2024, bettering its year-ago sales by 21 percent.

The Venue, with 20,555 units, has seen sales improve by 23% YoY. Together, these two models account for 89% of Hyundai’s UV sales. This over-reliance on the Creta-Venue combine will now reduce with the launch of the Exter midsize SUV.

The other contributors to sales were the Alcazar (4,480 units), Tucson (929 units) and the two EVs – Ioniq 5 (349 units) and the Kona (84 units).

Kia India: 41,982 units, up 11% YoY

UV market share: 11.54%

Kia India, which registered total sales of 41,982 UVs in April-May 2023, up 11% YoY, seems to be impacted by the growing and fresh competition. Both the Sonet compact SUV and the Carens MPV have outsold the longstanding best-seller for Kia in India – the Seltos – in the first two months of FY2024.

The Sonet sold 17,995 units, a 35% YoY increase over the year-ago 13,303 units. What could have given a fillip to Sonet sales is the recent launch of a new variant. On May 11, Kia India launched the Sonet Aurochs Edition at Rs 11.85 lakh (ex-showroom), which sits between the HTX and HTX+ trims in the Sonet’s variant line-up.

The Carens, which has turned out to be a high seller for Kia in a short span of time, sold 12,474 units, up 20% YoY (April-May 2022: 10,366 units). The Seltos now takes third place at 11,278 units – its sales are down 16% YoY (April-May 2022: 13,459 units), possibly a result of the heightened and new competition in the midsize SUV market. Meanwhile, the all-electric EV6, Kia’s maiden electric vehicle in India, gained traction with 235 units sold, signalling a growing uptake for premium vehicles.