Indonesian brand aggregator Hypefast swung into the profit zone in 2022, on the back of efforts such as an increase in its headcount, Achmad Alkatiri, Hypefast’s founder and CEO, said on Wednesday without divulging the actual profit numbers.

The company had posted a loss of $1.38 million in the previous year, according to DealStreetAsia’s DATA VANTAGE platform.

Alkatiri said the company recorded revenues of roughly 1 trillion rupiah ($66.8 million) in 2022 with positive EBITDA and net income. In 2021, the platform had clocked revenues of $22.71 million, according to DATA VANTAGE.

After securing $19.5 million in a Series A round in November 2021, the company grew its headcount to 300 people in 2022 from 100 people a year earlier. “We’re quite blessed with strong teams—both retail and growth teams,” Alkatiri said, noting that he expects the growth to continue in 2023.

“At this point, on a year-to-date basis, we’re still growing revenues in double-digits [compared with a year earlier]. That’s what we want to keep. The most important thing is to grow brands sustainably,” he said in a press briefing.

Being a profitable company, the next round of fundraising is not on top of mind for Alkatiri. “I think we’re lucky enough to be a profitable business, so it’s not urgent for us,” he said. “We’re continuing to improve our unit economics, our financials, and other things… Being profitable, we can continue operations and businesses to achieve our targets this year and the next year. Fundraising has yet to become an objective at this time.”

Hypefast was founded by Alkatiri, a former Lazada and Shopee marketing executive, in 2020 to acquire and grow brands by bringing capital and expertise to scale them up. The company currently has 15 brands under its wings, including fashion brand Nona, cosmetics brand Luxcrime, and essential oil brand Bonnels. Hypefast acquired a skincare brand targeting Muslim customers in January.

“We’ll see whether we will acquire other brands this year,” Alkatiri said, noting that Hypefast is now focusing on brands that have made at least 3 billion rupiah a month and have been operating for at least a year.

Hypefast claimed that it will keep eyeing brands in Indonesia, mainly in categories such as “health and beauty” and “mom-and-kids” that have historically performed well in sales.

Hypefast also found that customers have slowly returned to favour shopping offline. Alkatiri told reporters that 88% of Hypefast’s revenue last year was generated online, compared with 50% so far this year.

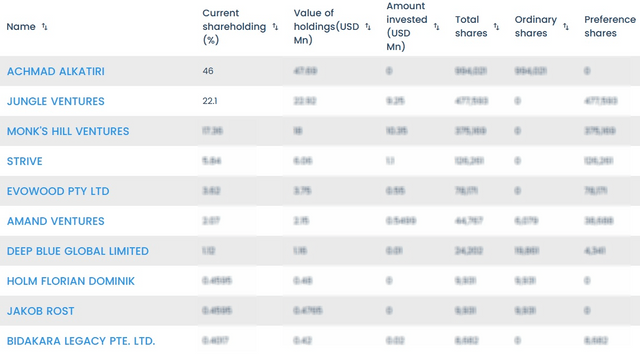

Hypefast has raised $22.02 million to date, backed by global investors such as Jungle Ventures, Monk’s Hill Ventures, and others, according to DATA VANTAGE.

Top shareholders of Hypefast

Indonesia is also home to other brand aggregators such as Open Labs, Una Brands, and Tjufoo.