The Ministry of Heavy Industries’ recent reduction of the FAME II subsides from 40 percent to 15 percent is severely impacting India’s electric two-wheeler growth. The number is likely to plummet back to June 2022 levels of the 40,000 to 45,000 units range. This is the opinion of industry analysts and experts.

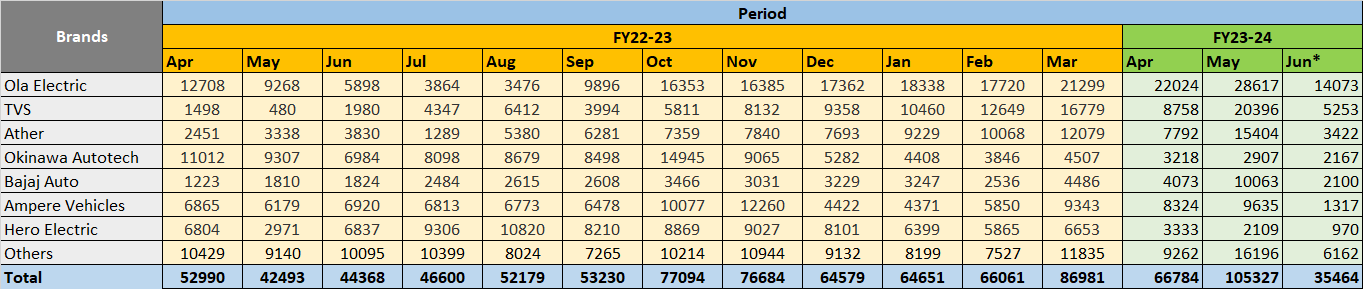

The numbers seen by Autocar Professional from the Vahaan data show that electric two-wheeler sales are down more than 60 percent at 35,464 units as of June 26, 2023, compared to an all-time May high of 1,05,000 units. (Being an exception as a pre-subsidy buying month).

Rohan Kanwar Gupta, Vice President and Sector Head – Corporate Ratings, ICRA, told Autocar Professional that the degrowth in sales is a direct fallout of capping on-demand incentives, as it led to an increase in retail prices of Rs 15,000-Rs 35,000 across E2W models.

Kanwar says that the E2W industry had ramped up volumes to 1,05,000 units in May 2023 as compared to 66,000 units in April 2023, the same reflected in the decline in retail sales in June, at 35,000 units registered till June 26, 2023.

“Retail sales are expected to only gradually recover. Going forward, with customers expected to take time to absorb the price hikes undertaken in the segment.” He said.

The Fame II subsidy curtailment has hit some of India’s leading two-wheeler companies including Hero Electric has clocked retail sales of only 970 units in June 2023, with its market share, which was above 16 percent, reduced to a meagre 3 percent. Hero Electric had registered sales of 6,486 units in the year-ago period of June 22.

Sohinder Gill, CEO of Hero Electric stated that “We are headed for a 60 percent achievement of the 23 lakh unit targets set by Niti Aayog due to the subsidy blockage further getting accentuated due to tapered subsidy.”

Gill said the government needs to consciously look at the strategic objectives linked to the idea of electric mobility and how we have performed against them.

“FAME was expected to catalyse a large-scale conversion of gasoline two-wheelers to electric in a short time. The E2W industry started picking up the tempo, however, the exponential growth was short-lived, with many E2W players getting their working capital choked due to blocking of over Rs 1,600 crore of their subsidy,” he added.

“It’s time government recalibrates its strategy and decides how important the targets are it set for itself on the role electric two-wheelers have to play in decarbonising India and accelerating the scale while pursuing economic growth,” Gill added.

*: upto June 26, 2023, Source: Vaahan.

*: upto June 26, 2023, Source: Vaahan.

Two million E2W target seems improbable at the moment

India’s electric two-wheeler players ended FY 23 with only 7.4 lakh units as against the target of 1 million and achieving the target of 2 million in FY24 set by Niti Aayog will be extremely difficult with the next two to three months of sales continuing to taper down till the festive period analysts have indicated.

Hemal Thakkar, Senior Practice Leader and Director at CRISIL Market Intelligence and Analytics indicated that this trend is likely to continue for another 2-3 months, after which some recovery can be expected. On industry touching the 2 million mark by the end of FY 24, Thakkar said, “It is going to get difficult for electric two-wheelers to reach the 2 million mark by end of FY24, but the long-term favourable total cost of ownership will help consumers go back to EVs around the festive period onwards.”

As per current data estimates, Ola Electric sales in July are estimated to be at 14,073 units, from 28,617 units in May, according to current data. The EV maker, which had an average run rate of 20,000 units for the last few months had clocked sales of 28,612 units for May 2023 and 22,024 units for April 2023.

The EV maker which has close to a 40 percent market share as of 26 June, 2023 is looking to gain from this consolidation to finish June close to 17,000-18,000 units and introduce new value for range products in July 2023 company sources indicated.

The Fame II subsidy curtailment has also hit TVS Motors hard with sales down by one-fourth from its high of 20,396 units for May 2023 to 5253 units as of June 26 while maintaining a 15 percent market share next to Ola Electric.

Ather Energy which clocked sales of 15,404 units for May 2023 and 8,758 units for April 2023, has had its sales crash by one-fifth to 3,422 units from May numbers and more than half as compared to its April numbers at 7,792 units to Vahaan Data.

Ampere Electric, a part of Greaves Electric Mobility also was pegged at the No 2 position with a total sale of 6,976 units in June 2022, with a dominant 16.89 percent market share. The maker of Primus, Magnus, and Zeal electric scooters has seen its market prospects shrink significantly to register 1,137 units by 26 June 2023.

Sanjay Behl, CEO, and Executive Director, of Greaves Electric Mobility mentioned that the sharp electric two-wheeler degrowth and the reduction in FAME II subsidy by the government pose a momentary challenge to sustain the rate of accelerated adoption of electric scooters for the industry.

“While the increased EV prices might temporarily slow the adoption, we believe that the industry’s overall growth trajectory remains intact. We are confident that as technology advances and economies of scale are achieved, EVs will become more affordable,” Behl indicated.

Dealers say OEMs will have to step in to arrest the slide

Automotive dealers who form the last mile of customer engagement have also confirmed that it is going to be a choppy ride for electric two-wheelers for the next couple of months.

Vinkesh Gulati, the former President of FADA (Federation of Automobile Dealers Associations of India) and one of the largest dealers for Bajaj Two wheelers in North India acknowledged that India’s electric two-wheeler industry is going through turmoil due to the ever-changing regulations, the latest being the massive reduction in Fame subsidies.

“We expect a decrease of 30 percent in the registration in June, which is expected to continue to be the same till the festive period,” Gulati said.

He further suggested that to further halt the slide in the sale of two-wheeler EVs “OEMs will have to have to take a hard decision in absorbing the major part of subsidy reduction to handle the de-growth.”

On reaching the 1 lakh retail unit target again, Gulati said that this can be possible not before the festive season comes in coupled with a normal monsoon and other factors.