South Korean shares fell on Wednesday as battery makers slumped, although losses were capped by gains in chipmakers after a rise of Sino-U.S. tensions in the industry. The benchmark KOSPI ended down 17.20 points, or 0.67%, at 2,564.19, marking its lowest closing level since May 26.

The market was broadly in a cautious mood as investors awaited Federal Reserve Chair Jerome Powell‘s remarks after strong economic data in the United States provided support for more rate hikes.

Powell will attend the European Central Bank’s annual forum later the day, together with the heads of the ECB and the Bank of Japan.

U.S. consumer confidence increased in June to the highest level in nearly 1-1/2 years amid renewed labour market optimism, while business spending appeared to hold up in May.

“Investors were in a wait-and-see mode ahead of Powell’s speech and an earnings release by U.S. chipmaker Micron Technology,” said Kim Seok-hwan, an analyst at Mirae Asset Securities.

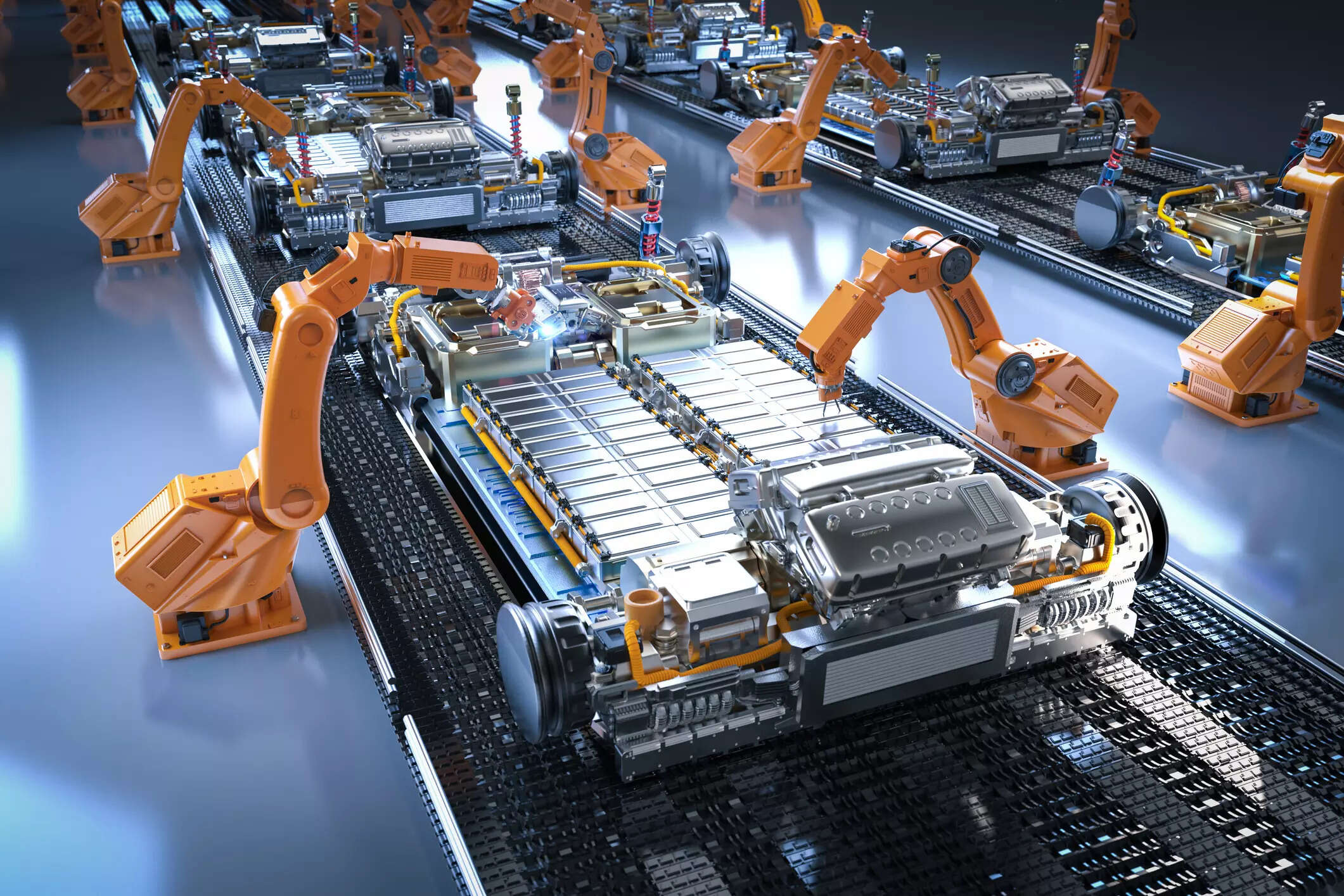

Battery makes slumped, with LG Energy Solution falling 2.50% and its parent LG Chem plunging 5.83%. Peers Samsung SDI and SK Innovation lost 3.10% and 3.95%, respectively.

Meanwhile, chipmaker Samsung Electronics rose 0.14% and peer SK Hynix gained 1.15% after a media report that the U.S. was considering new restrictions on exports of artificial intelligence chips to China.

Of the total 936 issues traded, 367 shares rose. Foreigners were net sellers of shares worth 399.1 billion won (USD305.2 million).

The won ended onshore trade at 1,307.3 per dollar, 0.54% lower than its previous close.

In money and debt markets, September futures on three-year treasury bonds fell 0.02 point to 104.04.

The most liquid three-year Korean treasury bond yield rose by 1.8 basis points to 3.555%, while the benchmark 10-year yield was flat at 3.603%. (USD1 = 1,307.8100 won)