The retail sales numbers for the Indian electric two-wheeler industry for June 2023 are out – 45,734 units. This statistic is as per the government’s Vahan website as of 7am today (July 1) and should increase marginally as additional new EV registrations from across the country are factored in.

Following the industry’s best-ever performance in May 2023 (105,338 units), which was a result of the buyer rush in the last week of May to avail of the 40% FAME subsidy before it was slashed to 15% from June 1, June’s 45,734 units are a 56.58% month-on-month decline.

However, a comparison with the record May 2023 retails may not be optimal because of the shift in market dynamics.June 2023 retail sales have fallen to June 2022 levels (44,380 units). Electric two-wheeler retails in India crossed the 50,000-unit mark for the first time in August 2022 (52,225 units) and rose to above 75,000-unit levels in the festive months of October 2022 (77,250 units) and October 2022 (76,774 units). That high was surpassed in the fiscal year-ending March 2023 (86,283 units).

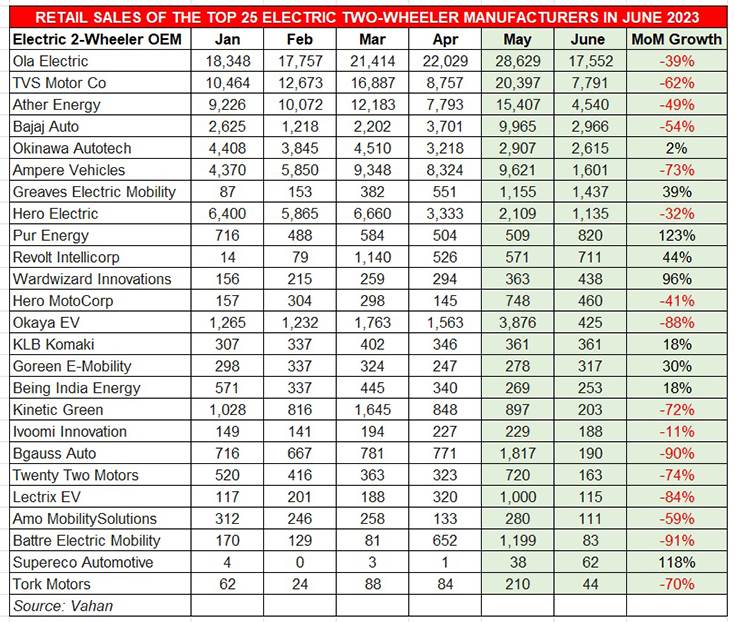

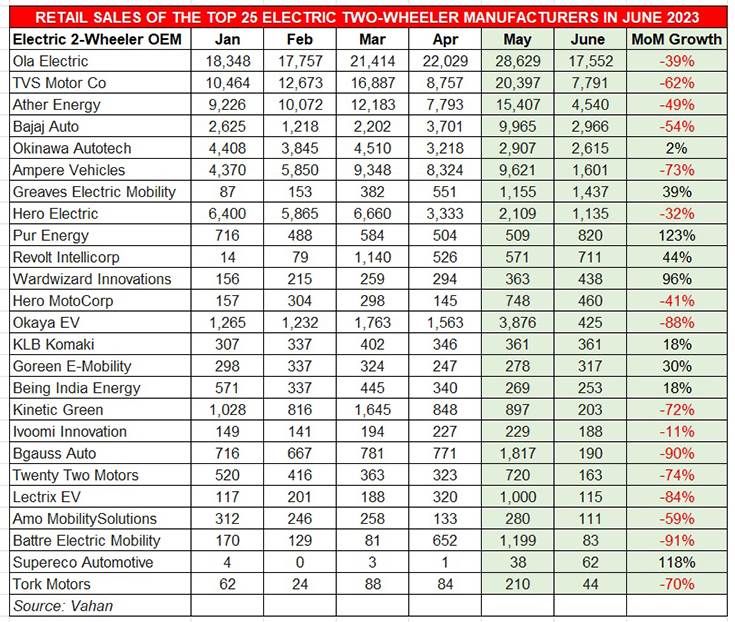

How the OEMs fared in June

June 2023 was clearly a month fraught with worry for India eTwo-Wheeler Inc. Till June 9, only 5,224 units had been retailed, increasing marginally to 10,202 units on the evening of June 13. By June 22, another 15,000 EVs went home to buyers, with the three-week total growing to 25,939 units. This means in the last eight days of June, 19,795 units were sold.

Compared to the industry’s best-ever sales in May 2023, when retails crossed the 100,000-unit mark for the first time, June 2023 numbers are a substantial climbdown but they are also a reality check for the industry, both in terms of what consumers are willing to spend as well as a future when subsidy per se may not be available. Last month’s sales would also likely be the template for the coming July-September 2023 quarter before the festive season kicks in and demand picks up once again.

With month-on-month demand down by over 50%, it’s not surprising that the OEM sales table reflects a sea of red. Of the 135 e-two-wheeler OEMs in the fray, the top 8 continue to dominate the proceedings and accounted for 39,637 units or 86.66% of total sales in June. And they too have felt the heat of the impacted sales as a result of the slashed FAME subsidy.

Ola Electric, which remains the market leader by a fair margin – 38% share – sold a total of 17,552 units, down 39% MoM (May 2023: 28,629 units). This performance is level with its February 2023 sales of 17,757 units.

TVS Motor Co holds onto its second rank with sales of 7,791 iQube e-scooters last month, down 62% on May 2023’s 20,397 units. It is followed by Ather Energy with 4,540 units, down 49% (May 2023: 15,407) and Bajaj Auto with 2,966 units (down 54%, May 2023: 9,965).

Maturing of the Indian e-two-wheeler market

While the June 2023 sales are somewhat harsh reality check for OEMs, who were extremely bullish about demand continuing to extend across 65,000 units a month, they also in a way point to a maturing of the e-two-wheeler market.

The fact that 45,734 buyers have opted to purchase an eco-friendly, zero-emission two-wheeler, despite the reduced-by-25% FAME subsidy and in turn a higher product price, indicates that the consumer is willing to spend more to benefit from the wallet-friendly EV compared to a petrol-engined scooter or motorcycle.

Despite e-two-wheeler sales down substantially, overall EV industry sales for all vehicle segments in June have clocked 101,832 units – marking the ninth consecutive month in a row that EV retails have surpassed 100,000 units.

As OEMs continue rolling out new and improved products with better features and higher riding range on a single charge, consumers benefit from a wider choice. While the June numbers are no doubt a real-world reality check for OEMs, the fact is that the EV story is here to stay as a value proposition in terms of mobility. The monthly sales charge might be slow at present but should improve after a few months. Stay plugged in for further industry updates.