The vehicle market in Vietnam, the gateway to Southeast Asia, is slated to grow at a CAGR of 25% and demand for EVs, particularly two- and three-wheelers, continues to soar. Reason enough for Indian suppliers to tap into the opportunity, says the Director General of the Automotive Component Manufacturers Association of India, in an email interview.

Where does Vietnam stand in terms of global importance and what gains do you expect from ACMA India’s participation at last month’s Automechanika Ho Chi Minh City expo?

Vietnam has gained global prominence due to its strategic location, robust economic growth, and favourable business environment. It has become a preferred destination for foreign direct investment (FDI), particularly in the manufacturing, electronics and services sectors.

As a key manufacturing hub and exporter, Vietnam has integrated into global value chains, attracting multinational companies seeking cost-effective production and access to the rapidly growing Southeast Asian market. Its exports, including electronics, textiles, footwear, and agricultural products, have gained recognition worldwide.

Having said that, with growing consumer spending in Vietnam, the vehicle market is expanding at rapid pace – it is expected to grow at a CAGR of 25% in the next few years. Considering the auto components base in Vietnam is not very robust, it offers a great opportunity for Indian auto components industry to explore business opportunities for both supplying to the OEMs and the aftermarket.

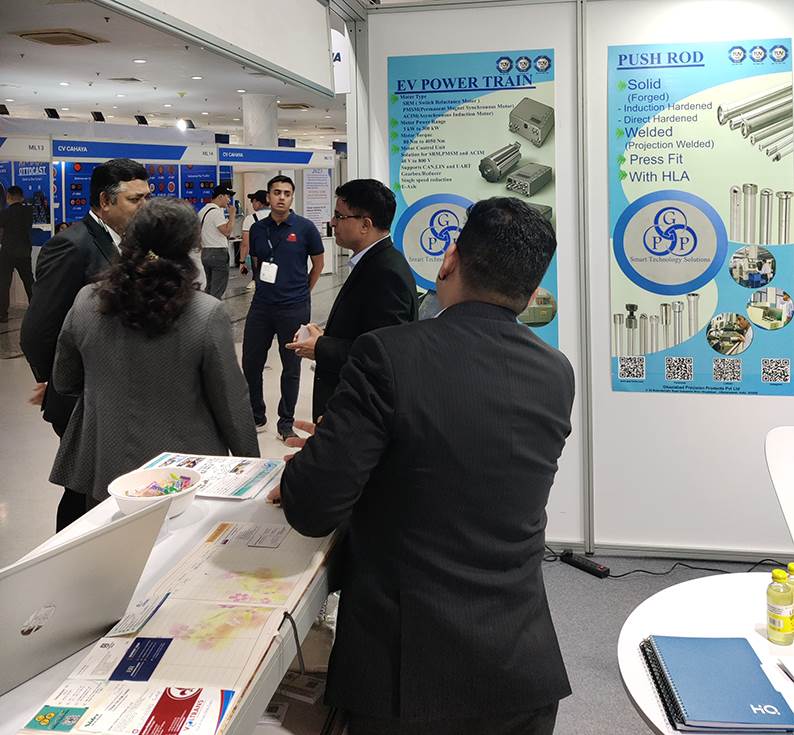

The India pavilion at Automechanika Ho Chi Minh City 2023, held last month, featured 14 exhibitors.

The India pavilion at Automechanika Ho Chi Minh City 2023, held last month, featured 14 exhibitors.

What was the USP of Indian suppliers at Automechanika Ho Chi Minh City?

The India pavilion by ACMA at the Automechanika Ho Chi Minh City held on June 23-25, 2023 served as a platform for Indian exhibitors to explore new business opportunities in Vietnam while showcasing their latest product portfolios for both ICE vehicles and EVs.

The show being an aftermarket one, the India pavilion featured 14 exhibitors, each bringing their unique offerings to strengthen the aftermarket value chain in the country. Among these exhibitors were Paracoat Products, Paras Lubricants, Garima Global, Auto Ignition, JCBL India, DGC Industries, Bony Polymers, Ghaziabad Precision Products (GPP), GoMechanic, Swarup Polymers, Dell’Orto India, Waxpol Industries, Punjab Bevel Gears, and GreenFuel Energy Solutions.

Given that Vietnam is the gateway to the fast-growing Southeast Asia and ASEAN markets, which are looking to speedily shift to EVs, what is the potential for made-in-India e-two-wheeler and three-wheeler components?

Vietnam presents a promising market for Indian manufacturers as the demand for EVs, particularly the two- and three-wheeler category, continues to soar in the region. The country’s favourable geographical location and its increasing emphasis on sustainable transportation creates an ideal environment for expanding the market for electric mobility.

India is well positioned to cater to Vietnam’s rising demand for reliable, cost-effective, and sustainable electric mobility solutions as India has made significant strides in developing and manufacturing components for e-two-wheelers and three-wheelers in the recent years.

What were the findings of the ACMA delegation to Vietnam in August 2022?

The ACMA delegation visited Vietnam in August 2022 to strengthen economic ties and explore auto sector investment opportunities. Collaborating with the Indian Embassy in Hanoi and Vietnam’s Invest Global Investment Advisory and Information Centre, the ‘India Vietnam Business Meet on Auto Sector’ B2B event was organised to foster cooperation between Vietnamese auto industry representatives and ACMA.

ACMA led a delegation of 28 leading Indian auto parts manufacturers to meet with Vietnamese enterprises and explore investment and market opportunities. They also visited manufacturing plants, solar panel factories, and R&D companies, gaining insights into Vietnam’s auto industry. The visit culminated in an MoU between ACMA and the Association of Foreign Investors in Vietnam. Notably, Indian companies like Uno Minda, Spark Minda and Star Engineering have already invested in Vietnam.

Which are the key components Vietnam imports from India?

Whilst the trade between India and Vietnam in the automotive component segment is small, it is growing at the rapid pace – exports from India to Vietnam have grown from US$ 250 million (Rs 2,061 crore) in FY2020 to US$ 406 million (Rs 3,348 crore) in FY2023.

India today exports engine components, electrical components, and transmission components to Vietnam. Additionally, Vietnam imports accessories from India to enhance vehicle functionality and aesthetics, catering to the diverse preferences of Vietnamese consumers. Considering the auto industry in Vietnam is growing at a very fast pace, India needs to stay engaged with Vietnam to capitalise on the increasing demand for auto components there.

ALSO READ: Skoda set to enter Vietnam, CKD assembly of made-in-India Kushaq and Slavia from 2024

Autoliv to set up airbag cushion plant in Vietnam