Surging demand for its expanding portfolio of utility vehicles, comprising compact and midsized SUVs and an MPV, has meant that Maruti Suzuki India has managed to successfully buffer the slackened demand in the entry-level budget hatchback segment over the past few months. This is sharply reflected in the company’s wholesales performance in June 2023.

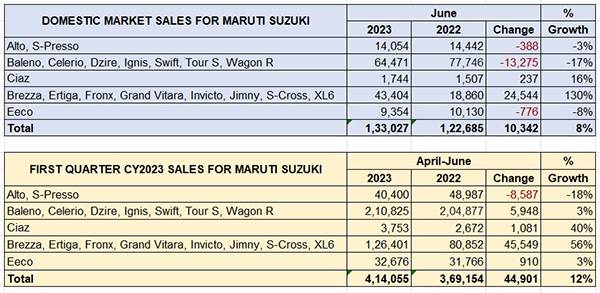

India’s passenger vehicle market leader clocked a total of 133,027 units in June 2023, up 8% (June 2022: 122,685 units). Month-on-month, this is a decline of 7.43% (May 2023: 143,708 units). While second-quarter (April-June 2023) sales of 414,055 units are a 12% increase over Q2 CY2022’s 369,154 units, they are down 13.66% on Q1 CY2023’s 427,578 units.

In June, the robust 130% year-on-year increase for seven UVs, including the soon-to-be-launched premium Invicto MPV which is being despatched to showrooms, has more than made up for the decline in sales of the Alto and S-Presso. Surprisingly, there has been a 17% YoY decline in the company’s ‘compact car’ sub-segment comprising the high-selling Baleno, Swift and Wagon R hatchbacks, which keep company with siblings Celerio and Ignis, as also the Dzire/Tour S sedan. This seven-pack sold 64,471 units last month compared to 77,746 units in June 2022 (see data table below).

Upping the ante in the UV segment

Maruti Suzuki has in the recent past outlined its strategic plan to increase its UV market share and the company’s performance, in the first two quarters of CY2023, reflect just that. A closer look at the company’s UV sales in the past six months reveals that Q2’s 126,401 units are up 19.29% on Q1’s 105,957 units.

From 24% in January 2023 to 33% in June 2023, the share of Maruti’s UV portfolio in the overall passenger vehicle sales is growing speedily.

From 24% in January 2023 to 33% in June 2023, the share of Maruti’s UV portfolio in the overall passenger vehicle sales is growing speedily.

The data table above also indicates how the share of UVs is growing amidst the overall passenger vehicle pie. From 24% in January 2023 (35,353 UVs of 147,348 PVs) to 33% in June 2023 (43,404 UVs of 133,027 PVs), the share of Maruti’s UV portfolio is growing at a rapid pace. This trend is also in line with the overall industry dynamics where at present, UVs account for 54% of the overall PV market, up from the 51% they had in FY2023.

In June 2023, UVs accounted for 43,404 units and a handsome 130% year-on-year (June 2022: 18,860) increase for Maruti Suzuki India. They comprise new products like the Fronx, Jimny, Grand Vitara, the soon-to-be-launched premium Invicto MPV, Brezza, S-Cross, XL6 and the Ertiga. Clearly, their numbers have more than made up for the decline in sales of the Alto and S-Presso, the seven-strong pack of compact cars and also the Eeco van.

Maruti Suzuki India, which has been the UV market leader for the past two fiscals, has taken an early and strong lead in FY2024. In the first two months of the ongoing fiscal, the company has increased its UV share to 23% from 20.53% a year ago. With over 43,000 UVs sold for the second month in a row, Maruti Suzuki would most likely have further increased its share.

ALSO READ: Hyundai Motor India sells 50,001 units in June, up 2%

Toyota Kirloskar Motor’s strong showing continues in June