Where’s the money? Questions mount over Australian company hoping to revive Britishvolt

Missed staff payments and an Australian police investigation – Scale Facilitation’s electric vehicle battery-making ambitions face serious hurdles

The Australian offices of Scale Facilitation, the company in charge of resurrecting the UK’s electric vehicle battery-making aspirations, were unusually quiet when the federal police used a search warrant to access its financial systems.

On 23 June, many employees at the Geelong premises, south-west of Melbourne, had the day off. The company had fallen behind in staff payments and offered several days off as a gesture of goodwill.

The near-vacant offices at Scale, the umbrella company for Recharge Industries, which recently took over the collapsed UK battery company Britishvolt, was not the first sign that the company was under financial stress.

It had started to rely on one-off payments, such as a tax refund in the UK owed to Britishvolt, to catch up on payroll. Australian employees are still allegedly owed significant backpay.

Scale said in a statement to the Guardian that it would fully cooperate with authorities over tax fraud allegations. It did not respond to questions about the state of its finances, or money owed to staff.

“The company denies any wrongdoing and is working with legal and other advisers to defend any matters arising from these discussions,” it said.

“As this is an ongoing matter, we cannot and will not be providing any additional comment to the media at this time.”

An ambitious pitch

The state of Scale’s financial books contrasts with the show of strength the company exuded just months earlier.

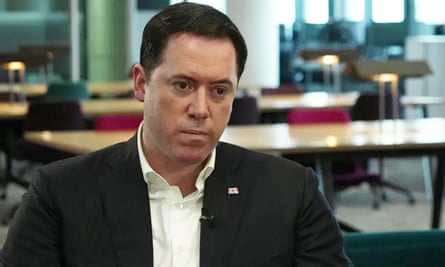

The Scale founder and chief executive, David Collard, a New York-based Australian and former PwC partner, put together a powerful bid team in January to take over the collapsed Britishvolt and revive UK’s battery-making ambitions.

This included plans to build a £3.8bn (A$7.3bn) “gigafactory” near Blyth in Northumberland that had been left in tatters.

The UK government had previously pledged to support the manufacturing plans with a £100m (A$191m) investment as part of a renewal of the country’s automotive industry. Northumberland County Council has the right to take control of the site if no gigafactory is built by the end of next year. The council still hopes the factory will materialise, bringing hundreds or even thousands of jobs to an area with relatively little advanced industry, but the questions over Scale’s finances have cast a cloud over those plans.

Its pitch was ambitious, given Scale’s Recharge was simultaneously developing plans to build a battery factory in Geelong, Collard’s home town. Collard and his team were yet to prove themselves in the renewables sector, but they were now responsible for two major battery factories on opposite sides of the globe.

They had, however, won noteworthy praise along the way. This included the public support of the former English cricketer Ian Botham, the deputy Australian prime minister, Richard Marles, and the opposition leader, Peter Dutton.

One person with knowledge of the bid credited Collard’s background as a partner in PwC’s New York office, and expertise in investment banking and mergers, for being able to quickly assemble a team of influential backers.

Scale’s Recharge also had a distinctly patriotic element. The proposed lithium-ion battery plants would not use Chinese or Russian materials, a decision that would leverage Australia’s deep mineral deposits, US battery technology and British manufacturing.

It fitted in neatly with Aukus, the trilateral security pact between the three nations.

While Scale’s efforts to alleviate the cash crunch continue, the recent resignations of high-profile employees, including its general counsel, Lucas Kenny, and managing director, Joey Ballantyne, have complicated matters.

“I’ll politely decline to comment,” said Kenny, who is based in New York and resigned shortly after the police searched the Geelong premises.

The live investigation into the company’s tax affairs now casts a shadow over Scale’s ability to raise funds and get the long-awaited UK battery factory built.

The Australian federal police said in a statement it executed multiple search warrants in the Geelong area on 23 June as part of an investigation into an “alleged taxation fraud”.

Along with the full-day search at Scale’s Geelong offices, police also allegedly searched the house of one of the company’s Australian directors, James Fatone, according to sources.

He is one of two directors of Scale’s Australian registered business, alongside Collard. Several senior employees at Scale, including Collard and Fatone, went to high school together at St Joseph’s College Geelong.

Fatone and Collard did not respond to requests for comment.

At the Geelong offices, the forensics team was largely interested in Scale’s digital records, such as information on its cloud service, although police have not detailed the precise nature of the alleged fraud.

The Australian Taxation Office, which is part of the joint operation, referred questions to the federal police as the lead agency in the search warrant activity.

The multiple warrants were executed by the police’s serious financial crime taskforce.

Revenue gap

Signs of financial stress at Scale were evident as early as February, the same month it beat out rival bids to take over Britishvolt, which was in the hands of administrators EY.

Australian staff who spoke to the Guardian said their usual superannuation payments were not made for the February pay run. While employers can make super contributions – pension payments – quarterly, the company had done so on a monthly basis until then.

Monthly pay packets for Australian staff were then allegedly missed in April and May, although back payments have been made to cover one of the two missing months’ pay. Employees will shortly be owed their June pay.

Expenses are mounting for Scale’s roughly 160 workers, spread out over three continents.

The company also needs to fund a multiyear lease for at least one upper floor of One World Trade Center and a new fit-out of the Geelong premises. The company is also expanding its office network in Australia.

Geelong property company Hamilton Group declined to comment on whether Scale was up to date on payments for the fit-out.

One person with knowledge of the operations said: “Collard has high costs and overheads and, at the moment, no revenue-generating business.”

Given the anticipated revenue-producing projects are yet to be built, Scale has relied on its initial funding to get the business off the ground, as well as various grants and tax benefits provided for research and development.

It had expected a payment recently of tens of millions of dollars from an Australian government program, but was told it did not meet the necessary requirements to qualify.

Scale also has a development finance deal with Tritax Management, a real estate fund manager majority owned by the investment giant Abrdn, to fund the initial stages of the planned Northumberland project.

The Guardian understands Scale is relying on the agreement to unlock about £45m.

Part of the complication is that Scale needs to find more money to complete its side of the deal. This includes paying just under £10m to secure the Northumberland land that was part of the Britishvolt agreement.

A person with knowledge of the arrangement said: “They need the money before they can buy the land and they need the land before they can get the money.”

The company has named several potential backers who could provide bridging funding for a relatively short period in order to buy the land. But that tends to be expensive – generally between 6% and 10% annually over the base interest rate.

Recharge’s failure as yet to come up with the money to secure the land has not surprised some people with knowledge of the process.

Collard is a “very charming, intelligent, motivated individual”, one said, but at no point has his company come up with a viable source of the millions needed to buy the UK site (which is controlled by receivers appointed by Britishvolt’s lenders).

“Cash is king,” the person said. “If you don’t have the cash, you can’t buy.”