Southeast Asia-headquartered venture capital (VC) firms’ fundraising slump persisted throughout the first half of this year, finds the latest report by DealStreetAsia – DATA VANTAGE.

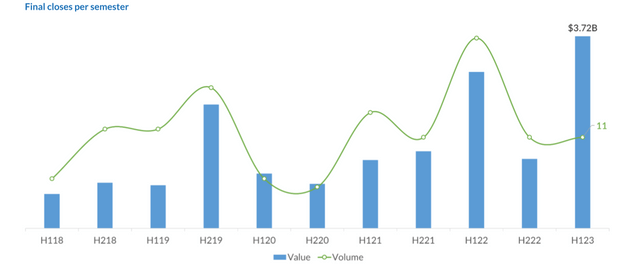

Homegrown VCs closed 11 funds during the period, raising $3.72 billion in total proceeds, according to the report titled SE Asia’s VC Funds: H1 2023 Review. While the number of fund closes was consistent with the previous six months, H1’s fundraising haul was less than half the amount raised during the same period in 2022. This marks the second consecutive six-month period where regional VC fundraising fell below pre-pandemic levels.

The fundraising environment was particularly difficult for first-time fund managers as only one debut fund reached a final close in the first half. Institutional investors that commit capital to VC funds – known in industry parlance as limited partners (LPs) – have shown a preference for doubling down on established relationships than betting on new ones in the current market environment.

In comparison, nine first-time funds had closed in the first half of last year.

Singapore slumps, Indonesia bounces back

On the back of VC firm B Capital’s massive $2.6 billion fundraising haul, Singapore-based fund managers accounted for 82% of the total regional tally in the first half. It is important to note that B Capital allocates only a small fraction of its corpus to Southeast Asia. Only seven of the 118 portfolio companies listed on its website are based in the region.

Coming in second, Indonesia secured 16% of the total proceeds worth $610 million. According to the report, the remaining 2% was divided between VCs in the Philippines ($21 million) and Thailand ($30 million).

While Singapore has traditionally been the most active market in the region, recent data indicate a slowdown in fundraising by VCs in the city-state. In the first half of this year, only five funds by local VCs reached a final close, compared to eight in the second half of 2022.

In contrast, Indonesia experienced an upward trend in the number of fund closes.

Macro rules

Fund managers interviewed for the report said that an improvement in LPs’ risk appetite is contingent on stabilising macro-fundamentals.

“I believe macro-economic and geopolitical factors will continue to play a big part, which we in the market find very much out of our control,” said Chik Wai Chiew, CEO and executive director at Heritas Capital.

If the macro-fundamentals turn neutral, the LP landscape should start recovering in the next 12 to 24 months, he said, adding that there remains substantial dry powder for fund managers to deploy.

The current macroeconomic headwinds aside, Collyer Capital managing partner Eric Marchand believes Southeast Asia’s growth story remains attractive as the region is poised to become the world’s largest economy by 2030.

“Nevertheless, it is conceivably expedient and simplistic to stop at this region’s attractive fundamentals… The region’s complexity and lack of homogeneity warrants a bespoke approach,” Marchand said.

Buy the dip

Jennifer Ho, a partner at Integra Partners, said a market downturn is typically the best time to deploy capital.

“What is really important now is for managers to produce consistent and sizable exits. Given that most funds only got started around 5-10 years ago, that will take some time, but it is what will drive long-term stable capital to the best managers in the region,” she said.

Magnus Grimeland, the founder and CEO of Singapore-based venture builder Antler, agrees. He believes the most opportune time to build new companies is just after a market peak.

“Some of the best vintages of VC returns came after the 1999-2000 dotcom boom and bust, as well as the 2008 Global Financial Crisis. We expect a similar pattern now, with companies founded during this period potentially delivering the highest returns for VC investors,” he said.

Grimeland is particularly upbeat on artificial intelligence for its potential to drive generational platform shift. He said that energy transition, health tech, and deep tech are other areas that hold great potential in a post-pandemic world.

SE Asia’s VC Funds: H1 2023 Review is available exclusively to DealStreetAsia – DATA VANTAGE subscribers. Subscribe/upgrade your subscription now to access our entire set of reports.