The year was 1994. It was a new, liberalised and fast-growing India. Global automotive brands were making a beeline for the country, one by one.

Rahul Dhoot, a 22-year-old aspiring electronics engineer born into an Aurangabad based automotive dealership run family, decided to join his father’s business. While he loved the automotive sector, car sales didn’t excite him enough.

After passing out from Jawaharlal Nehru Engineering College, Aurangabad in 1994, Rahul did spend a month at his father’s automotive dealership business, but within a month he quickly realised it was not his cup of tea, so he decided to venture out on his own.

Much like thousands of fresh engineering graduates passing out, unsure of what the right path is for future growth, Dhoot tried his hands at used two-wheeler financing. A few missteps and an inevitable rise in bad debt forced him to fold the business within a couple of years.

The engineer in him, then went back to basics, getting an early break with auto parts maker Varroc in 2002. This was followed by a business deal with homegrown scooter maker Bajaj Auto, which was making a rapid transition to premium motorcycles under young Rajiv Bajaj. Bajaj preferred engineering led companies that gave Dhoot Transmission business wings.

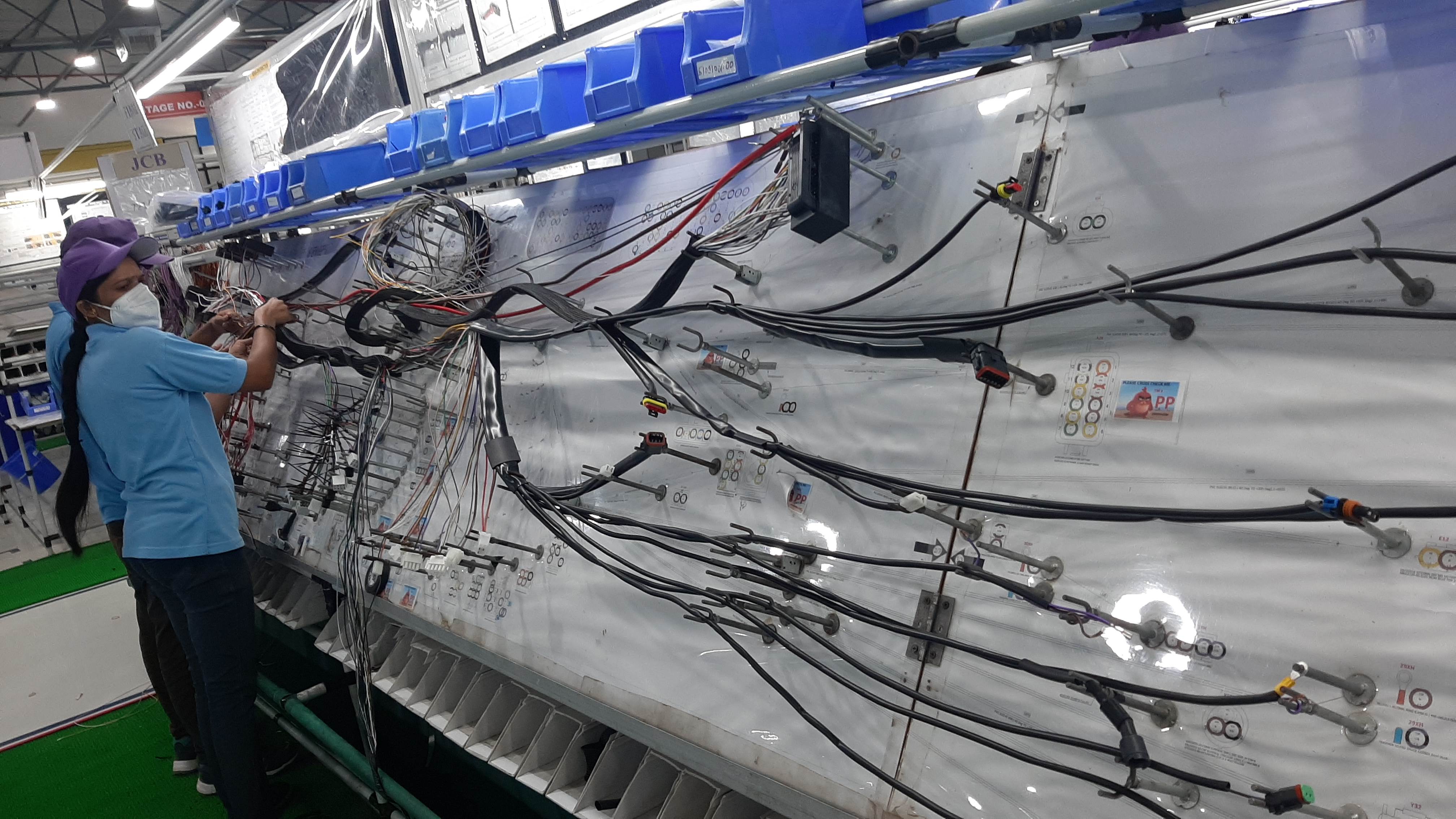

Under the Dhoot Transmission umbrella, non-transmission parts were also made and supplied to clients. “We started supplying wiring harnesses to Bajaj Auto in 2003 for motorcycles and three-wheelers, which was a very large business for us,” says Dhoot. This business helped the company grow from Rs 1 crore in annual turnover to Rs 100 crore in three years, and eventually add more customers in the off-road highway segment.

“The wiring harness business was further diversified into cables, electronic parts, and sensors, and now we are looking at a full-fledged electric powertrain supplier for two- and three-wheelers,” says 51-year-old Dhoot.

Birth of a First Gen Entrepreneur

Much like majority of auto component makers who grew with the large vehicle makers, Dhoot’s foundation years were significantly supported by Bajaj Auto’s expanding footprint and mushroom appliance manufacturing hub in Aurangabad, Dhoot’s home base.

The growth and transformation at the company also benefited with Aurangabad’s industrial progress, which in the past couple of decades has turned into Maharashtra’s second-largest auto cluster from an industrial backwater in the previous decades.

The region today boasts four industrial clusters at Waluj, Chikalthana, Chitegaon (Bidkin) and Shendra, with manufacturing plants for some of the best-known global automotive brands like Bajaj Auto, Endurance Technologies, Varroc Engineering, Skoda, Goodyear Tyres, and Balkrishna Tyres, among others.

Almost until the end of 2010, the predominant business for the company came from the western belt of India.

However, young Dhoot had high aspirations, and he had even grown in confidence as the total industry volume in the country grew multi fold. India was rising and so was Dhoot Transmission, which was also looking beyond the domestic mainland.

He started charting plans to first diversify the customer base in India and then go global to the United Kingdom.

The risk-taker in Dhoot decided to set up factories for wiring harnesses in South and North India without an assured order. A strong believer in manifestation, Dhoot was able to quickly generate business across different corners of the country. The company got orders from Suzuki Honda, Royal Enfield, and TVS Motor in the south and north regions that set the ball rolling. “A strong fundamental technological base along with an attractive cost structure helped us acquire new businesses,” Dhoot recalled.

Similarly, to cater to its customers in the UK, Dhoot set up a warehouse in the country, even though the cost of the warehouse was more than the business the company generated in England. Yet Dhoot had the vision and confidence to grow his business, which he did.

With a bias towards electronics due to his engineering background, Dhoot had in the back of his mind to get into manufacturing electronics someday. The moment the business reached a certain size and scale, he promptly took the decision and expanded the business scope into component electronics in 2013.

Yet again, he put up the electronics part facility without any order, underscoring his conviction in the strategic decisions he takes. Dhoot says the discussion on the BS VI emission norms had started, and the company developed parts and technologies on its own without any technical partnership or joint venture.

Foundation for a tech company

To what started with wire harnesses and endured for two decades, Dhoot added multiple product lines like automotive switches, electronic sensors and controllers, connectors and terminals, automotive cables, and power cords for OEMs. However, the wiring harness business still remains at the core of its existence.

In the last decade, Dhoot has also spread his business globally, with manufacturing footprints in the UK, Slovakia, and Thailand. Additionally, it also has engineering support centres located in South Korea and Japan.

Dhoot Transmission counts some of the marquee OEMs such as Bajaj Auto, Royal Enfield, TVS Motor, Yamaha, Suzuki, Honda, and others among its clients.

Having crossed the first landmark of Rs 100 crore (107.211 crore, to be precise) in FY06, the revenues crossed Rs 1,000 crore in FY19, (Rs 1,155 crore to be precise) — this has more than doubled in the last three years to Rs 2,062 crore at the end of FY23. This fiscal year, it is likely to close around Rs 2,600 crore and already has an orderbook of close to Rs 3,200 crore in hand.

Vision and growth strategy

The company wants to be the world’s largest wiring harness supplier for three-wheeler makers and one of the top three two-wheeler wiring harness suppliers in the world. The approach is to specialise on product lines and diversify customer bases and geographies, instead of having a wide bouquet of products and spreading itself too thin.

Dhoot has deliberately stayed away from the passenger car wiring harness business, a space dominated by Motherson Sumi and Minda. Instead, the company turned into a child part supplier to them, given the strong backward integration.

Dhoot believes in having a sharper focus on product categories instead of expanding and diversifying into too many areas and adding to the risk. “Thought process essentially is to define the core business area and build the complementary adjacencies around it,” he added.

Dhoot believes in having a sharper focus on product categories instead of expanding and diversifying into too many areas and adding to the risk. “Thought process essentially is to define the core business area and build the complementary adjacencies around it,” he added.

Apart from growing the core business of wiring harness, what has helped Dhoot outperform the market is its timely transition to the electric vehicle space. The company produces wiring harnesses, junction boxes, cables, cord sets, charging connectors, off board chargers, sensors, and lithium battery assemblies, among others.

It is already a sole supplier to electric three-wheeler makers Bajaj Auto, Piaggio, and Atul Auto, among several others, and it is fast expanding its footprint in the two-wheeler domain as well. Dhoot says he wants to be the leading powertrain supplier for two or three electric vehicle makers.

The EV business is likely to account for 25 percent of its overall business, or Rs 650 crore, at the end of FY24.

The way ahead

In the next three years, the company will invest close to Rs 500 crore. Of this Rs 250 crore will go towards acquisition and the balance will go towards Greenfield expansion.

The head of the company says he expects the outperformance to continue, and he is currently on an aggressive expansion spree both organically and inorganically. He has potential markets like Mexico and Southeast Asia on his radar to set up new facilities, and alternatively, the company is looking at acquisitions in switches, sensors, and controllers, including EV parts.

“Every three years, we look at acquiring new business, stabilising the acquired company’s business, and again looking for opportunity. Now we are again on the lookout for a potential and many opportunities to grow,” he added.

Looking for inorganic opportunities is also part of the thought process of companies scouting for prospects in Europe and the UK. The acquisition funding will be done through a combination of debt and equity.

Dhoot Transmission, which is now widely regarded as the country’s largest manufacturer of two-wheeler wiring harnesses, has set an internal revenue target of Rs 5,000 crore over the next five years, based on the strength of domestic demand as well as the introduction of new export markets such as the lucrative ones in the United States and Europe.

“There is no reason we can’t get there,” Dhoot said.

When asked if there was a plan to take the company public, Dhoot explained that discussions among his leadership team take place every few years, though nothing is planned at the moment.

Even as electric vehicles are going to play a bigger role, the company is currently in talks with a partner for a joint venture to get into oxygen sensors for internal combustion engines.

M&A on the radar

The company generates about Rs 500 crore, or about 20 percent of its business, from overseas markets. The company already has a plant in Thailand, and Vietnam is next on the horizon for 2024 to cater to the large two-wheeler market.

The company also wants to open its US office in 2024 and cater to the large Mexican market. Dhoot plans to have a manufacturing facility in Mexico, and in the US, it will open a new technical centre.

In order to ensure that the company succeeds in some of the key global markets, Dhoot, as a strategy, has retained the erstwhile promoters as the managing directors of the company, who will continue to run the show.

Alliances and acquisitions

“We make it (the acquired company) stable, and after we have reached our plateau, we will plan our next steps,” Dhoot added.

Dhoot Transmission acquired TFC Cables in Slovakia in 2017. In the same year, it entered strategic alliances and technical collaborations through a technical JV with Carling Technology, USA, in 2017. It acquired UK-based Parkinson Harness in 2018 and San Electromek in 2019, which turned out to be a landmark step, as the company opened seven new plants in just one year: Shendra, Aurangabad, Pune, Indore, Thailand, Bangalore, and Chennai.

Dhoot is already looking at two more companies, and indicated that one of them would be a JV in the oxygen sensor space.

Strengthening global presence

The global opportunity size, particularly in the fast-emerging new age of mobility is certainly big. According to industry estimates, the global automotive wiring harness market was valued at US$ 48,614.7 million in 2022 and is expected to grow at a CAGR of 3.3 percent from 2023 to 2030 on the back of increasing demand for electric vehicles, the growing popularity of connected cars, and the rising adoption of advanced safety features in vehicles. Some of the global giants, such as Robert Bosch GmbH, Furukawa Electric, Delphi Technologies, and Aptiv PLC, are already ruling the roost in the segment.

The company’s latest move in January this year seemed to be a sign of things to come when it announced plans to set up a new factory in the UK, where it already has a six percent market share. Globally, the company’s next priority is to strengthen its bases in Thailand, Vietnam, and Indonesia. Additionally, it has also set its sights on opening offices in the US and starting operations in Mexico. “We are serving a large customer base stretched across eight countries across three continents. We are one of the most ‘in-demand’ companies globally for wiring solutions. The upcoming plant in Kirton, UK, will strengthen our global presence exponentially,” says Dhoot.

Dhoot opines that the idea is to enter new geographies with relevant products and then go on to become among the top three players there. “As the industry is scaling up, apart from existing businesses, EV is going to be a big focus area for us.” Rahul continues before adding that the e-mobility business is expected to generate around 25 percent of the company’s business in the current fiscal year.

Crucially, Dhoot Transmission intends to penetrate across all the segments in the e-mobility space, unlike in the ICE, where it has largely refrained from getting into passenger vehicles, as it is already strongly dominated by some of the large German and Indian companies.

“I guess the next stage for Dhoot Transmission Group would be to become a global tech company,” he further continues.

Diversification into cars and EVs

So far, Dhoot has stuck to its core of two-wheelers, three wheelers, farm equipment, and construction equipment, but he believes that there are a lot of opportunities opening up in the passenger vehicle business thanks to the transition into EV space.

This is part of the plan to become a full-fledged EV powertrain supplier. The company is developing low-voltage and high voltage wiring harnesses for the electric car market. He would be exploring opportunities to cater to both local and global markets with its EV parts for the passenger vehicle business.

“India has a great potential to leapfrog in the electric vehicle space. Given the large demographic population who will transition to EVs from a demand standpoint and from a technology standpoint, the diverse terrain and temperatures will help in building the EV solutions tailored for different parts of the world at a much lower cost,” he added.

Game of leverage

A CARE Edge rating report from February provides a peek into the company’s financials including its large capex and brownfield acquisitions. It suggests that the fixed asset addition of around Rs 366 crore over the last five fiscal years through FY22 was largely debt-financed. Further, with an increase in the scale of operations, the company has heavily relied on debt to fund incremental working capital requirements. The report, however, further added that the scheduled repayments of term loans and accretion to reserves improved overall gearing to 1.49x as of March 31, 2022, from 2.03x as of March 31, 2021.

In this regard, focus is drawn to growth in income, profit before interest, lease rentals, depreciation, and taxation. (PBILDT), which stands as one of the key indicators of profitability in any manufacturing or service activity. Dhoot Transmission’s PBILDT interest coverage improved to 4.00x in FY22 (2.99x in FY21), and TDGCA was better at 4.25x in FY22 (5.96x in FY21).

On the positive side, Dhoot Transmission has continuously been able to develop a backward integration facility for the production of various input products such as terminals, connectors, cables, and mouldings, which it previously outsourced to the outside market. The in-house manufacturing of raw materials also helps in cost saving and improve profit margins in the long run. Approximately 30 percent of its raw material requirements are met through captive production, the rating agency said in an earlier report.

Gen-next to step in

With the next generation taking over the guards, Dhoot’s eldest daughter, Vedika, is now expected to join the organisation in 2024. With plans to base herself in Cambridge, she will be looking to take care of the company’s marketing in the UK, Europe, and the US. Vanshika, the second daughter, on the other hand, is pursuing a psychology degree and will handle the human resource’s function. His teenage son Rudraansh seems more interested in technology and is pursuing his own interest in the subject.

While there have been multiple opportunities to move out of Aurangabad, Dhoot has stuck around to the city where he was born and raised. He feels the quality of life and the bonhomie within the organisation and its workforce have compelled him to stick around his hometown.

Asked about retirement plans, Dhoot said, “I will never retire, but yes, I would love to reduce my work hours and spend more time at home with family and pets.”