India’s market for CNG-powered cars and SUVs has expanded with the launch of the Hyundai Exter mini-SUV on July 10. Of the 22 CNG passenger vehicles sold in India, it is only the second compact SUV to get the CNG treatment after the Maruti Brezza. The launch comes at a time when retail sales in this segment have reduced by 5 percent for the first half of calendar year 2023.

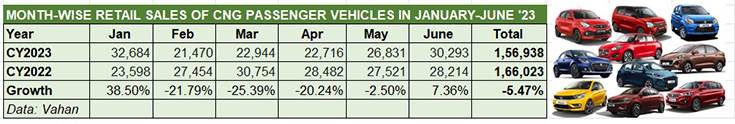

Cumulative retail sales of CNG passenger vehicles in the January-June 2023 period are 156,938 units, down 5.47% YoY (April-June 2022: 166,023 units).

Cumulative retail sales of CNG passenger vehicles in the January-June 2023 period are 156,938 units, down 5.47% YoY (April-June 2022: 166,023 units).

As per details available on the Vahan website (LMV and petrol-CNG), cumulative retail sales of CNG passenger vehicles in the January-June 2023 period are 156,938 units, down 5.47% year on year (April-June 2022: 166,023 units). This scenario is rather different to India Passenger Vehicle Inc registering record sales of 318,752 units in FY2023, up 41% (FY2022: 226,547 units). The decline in retail sales in the first half of CY2023 could be likely due to supply constraints for CNG parts, which is impacting vehicle deliveries to showrooms.

How the top CNG OEMs have fared

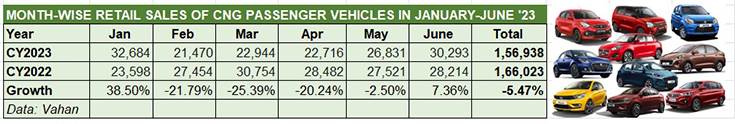

There are only four CNG carmakers in India. Maruti Suzuki India, with all of 12 models (Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Swift, Wagon R, XL6), understandably, has a vice-like grip on the market. Hyundai Motor India’s CNG range has expanded to three models now (Aura, Grand i10 Nios, Exter). Tata Motors has three models (Altroz, Tigor, Tiago) and Toyota Kirloskar Motor two (Glanza, Hyryder).

A quick look at the OEM-wise retails in the January-June 2023 period reveals that market leader Maruti Suzuki has sold 115,484 CNG variants of its cars, SUVs and MPV, accounting for 16.60% of its total PV retails of 695,425 units. The H1 CY2023 CNG retails, however, are 3.87% down on year-ago first-half retails of 120,141 units.

A quick look at the OEM-wise retails in the January-June 2023 period reveals that market leader Maruti Suzuki has sold 115,484 CNG variants of its cars, SUVs and MPV, accounting for 16.60% of its total PV retails of 695,425 units. The H1 CY2023 CNG retails, however, are 3.87% down on year-ago first-half retails of 120,141 units.

Hyundai Motor India has clocked sales of 22,625 CNG units, which gives it an 8.65% share of its PV sales albeit it is also down on YoY performance by 11.61 percent. Tata Motors’ performance is in the same vein – the 15,965 units in H1 CY2023 are down by 17% YoY (January-June 2022: 19,257 units). Toyota Kirloskar Motor is the sole OEM to be in positive territory but that’s because it has only recently entered the CNG market with the Glanza and Hyryder.

The marginal 5% decline in sales in H1 CY2023, which translates into a deficit of 9,085 units, could likely be a temporary phenomenon because of the lower cost of ownership mantra that the greener fuel offers in the face of high petrol and diesel prices. The sustained growth of the CNG PV sector is also why vehicle manufacturers are gradually expanding their product portfolios to include CNG variants. The past few years have seen the share of the CNG car market in the overall PV market increase – from 6.30% in FY2021, the CNG share increased to 8.60% in FY2022 and was 8.19% in FY2023. In the first half of CY2023, at 156,938 units, the CNG share of total PVs retailed is 8.53% of total 18,39,514 PVs retailed.

Wallet- and eco-friendly fuel

From a consumer point of view, other than the environment-friendliness of CNG, a CNG-powered vehicle provides considerable savings compared to its petrol or diesel-engined siblings. What’s also driving the consumer shift to CNG models is the high price of petrol (Rs 106.49 a litre in Mumbai) and diesel (Rs 94.27 a litre in Mumbai on July 10, 2023).

The slashing of CNG prices in early April was a welcome respite to motorists using CNG-powered vehicles and at present, at Rs 79 per kg in Mumbai, CNG is Rs 27.49 cheaper than petrol and Rs 15.27 cheaper than diesel.

CNG power vs shift towards EVs

While CNG vehicle running costs are significantly lower compared to petrol or diesel as a CNG vehicle inherently delivers better fuel economy, a few challenges to speedier adoption of CNG vehicles remain.

Refuelling takes longer due to a fewer number of CNG stations and highway driving requires additional planning in terms of trying to take a route with a CNG station. That’s set to gradually change though. Plans are to substantially increase the existing parc of 4,500 CNG stations to 8,000 over the next two years. Also, servicing costs of CNG-powered cars are higher compared to petrol siblings with the CNG filter requiring scheduled replacement in factory-fitted CNG kits.

CNG vehicle manufacturers also face some level of competition from electric vehicles, which are seeing demand accelerate with the expanding EV charging infrastructure. While the initial cost of an EV is higher than a CNG or petrol/diesel model, the much lower cost of EV ownership in the long run remains a very attractive buying proposition. With the Central and state governments offering a host of subsidies, the fast-expanding EV charging infrastructure and also banks and financing institutions plugging into the EV growth story, it is likely the CNG sector’s loss could be the EV segment’s gain.

Will CNG car, SUV and MPV retail sales bounce back in the second half of CY2023? As per Vahan, in the first 11 days of July 2023, 11,500 CNG-powered PVs have been sold. Keeping watching this space for regular updates.