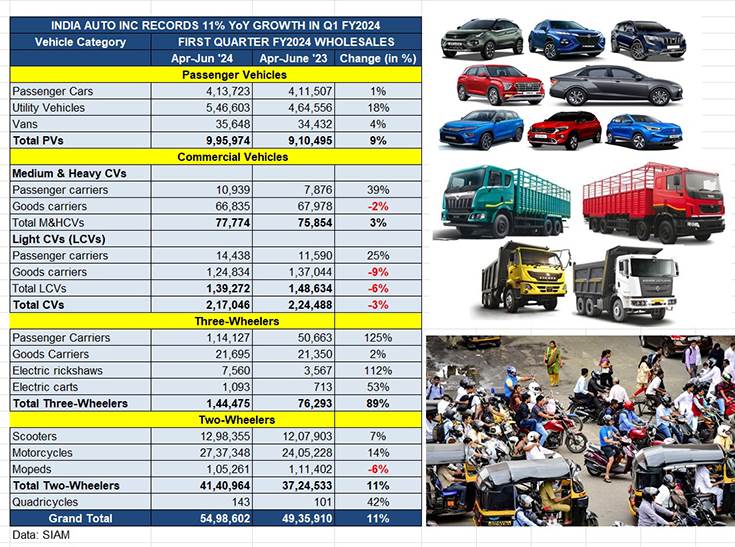

The first quarter of fiscal year 2024 is over and the wholesales report card is out. As per the numbers released by apex industry body SIAM, India Auto Inc dispatched a total of 54,98,602 vehicles, which is an 11% year-on-year increase (April-June 2022: 48,33,910 units). This means Q1 FY2024’s performance can be viewed to be around that of Q1 FY2018 (5,882,912 units) and considerably lower than Q1 FY2019 (6,942,742 units).

Of the four vehicle segments – passenger vehicles, commercial vehicles, three- and two-wheelers – CVs are the sole category to be in the red, with sales declining by 3% year on year. Let’s take a look at the industry performance in the first quarter, segment-wise

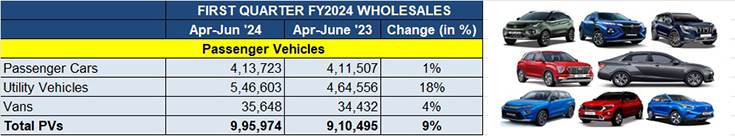

Passenger vehicles – 995,974 units, up 9% YoY

The utility vehicle (UV) sub-segment continues to power the overall passenger vehicle (PV) segment, which comprises cars, UVs and vans. If the PV segment has notched its best-ever first-quarter wholesales of 995,974 units, up 9% YoY – just 4,006 units shy of the million mark – in April-June 2023, then it has UVs to thank. FY2024’s first three months saw wholesales of 546,603 UVs, up 18% YoY, accounting for 55% of overall PV sales, 4% more than the 51% they had in Q1 FY2023.

In contrast, sales of hatchbacks and sedans saw a marginal uptick of just 1% to 413,723 units – passenger cars at present have a 41.53% share of the PV market, down from the 45% they had a year ago. The difference in market share – 4% – is just what UVs have gained and passenger cars lost.

What has helped accelerate sales is a combination of factors like ramped-up production for popular models which have long order backlogs, improving supplies of semiconductors, new models in the market and positive customer and economy sentiment.

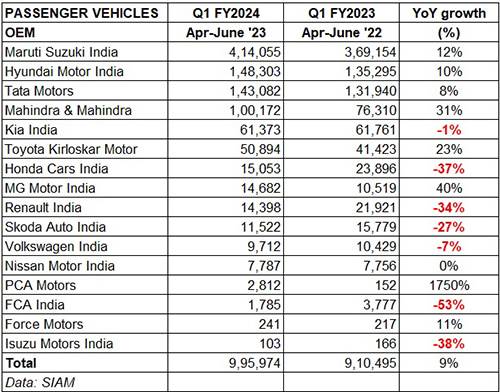

Market leader Maruti Suzuki with 414,055 units posted 12% growth, largely driven by demand for its recently launched SUVs. In fact, its car sales at 254,978 units are down by 0.60% YoY (April-June 2022: 256,536 units). In contrast, UVs with 1,26,401 units and 56% growth (Q1 FY2023: 80,852) have clearly saved the day for the company – cars comprised 61.50% in Q1 FY2024 vs 69.49% in Q1 FY2023; UVs comprised 30.52% in April-June 2023 vs 22% in April-June 2022; and vans have an 8% share in Q1 FY2024 vs 8.60% a year ago.

Hyundai Motor India with 1,48,303 units saw 9.61% growth in Q1, its sales comprising of 64,661 cars (up 0.76%) and 83,642 UVs (up 17.56%). Like Maruti, Hyundai too is feeling the heat of the consumer shift from hatchbacks and sedans to SUVs and MPVs. Tata Motors, the challenger to the No. 2 position, has seen a subdued Q1, particularly when compared to previous quarters: 1,43,082 units, up 8.44%. Mahindra & Mahindra, whose entire portfolio barring the e-Verito, is made up of UVs has delivered a strong performance – 1,00,172 units and 31% growth. Kia India, the fifth-ranked OEM, sold 61,373 units – flat sales marking a marginal 0.62% increase YoY.

According to Vinod Aggarwal, President, SIAM, “Even though the demand for PVs in the entry-level segment has declined, there is a significant migration of the demand to UVs in the sub-four-metre segment. Therefore, we see no concern for the PV segment. Holistically, PVs are growing and the segment is doing well.”

He added, “The demand in rural areas has also picked up based on better prospects – a good monsoon which is expected to drive better farm income. We remain confident about the PV segment.”

As regards the July 11 upward revision of cess on UVs, he said: “We are awaiting the notification of the GST Council and, therefore, are yet to determine its implication on SUV prices.”

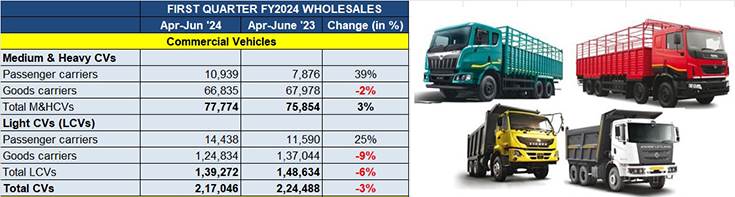

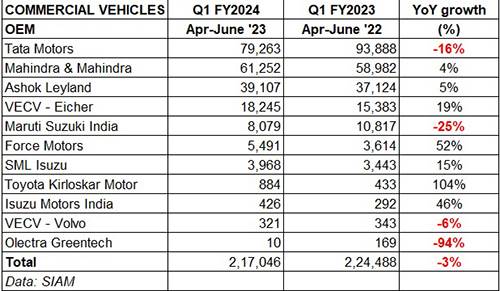

Commercial vehicles – 217,046 units, down 3% YoY

Just when it seemed the CV sector was cruising along at a good pace, given that it closed FY2023 with 34% growth and close to a million units, combined M&HCV and LCV sales in Q1 FY2024, at 217,046 units, are down 3% (Q1 FY2022: 224,488). While passenger carriers (buses), both M&HCV and LCV, have seen strong demand (see the CV sub-segment sales-split table above), the slackened demand for goods-transporting CVs in both sub-segments has proved to be drag on the overall segment. Combined LCV & M&HCV goods carrier sales at 191,669 units are down 6.5% on year-ago sales of 205,022 units.

However, the Q1 downturn in the segment did not elicit any concern from the SIAM president who said: “That does not pose any major concerns as we are expecting the Indian economy to grow very well in the medium to long term.”

Tata Motors maintains its market leadership with 79,263 units sold but its Q1 FY2024 numbers are down 15.57% (Q1 FY2023: 93,888 units). Mahindra & Mahindra, thanks to demand for the Bolero pickup among other models, dispatched 61,252 units, a YoY increase of 3.84% (April-June 2022: 58,982 units). Ashok Leyland, with 39,107 units, reported an increase of 5% (April-June 2022: 37,124 units). VE Commercial Vehicles delivered a strong performance – 18,245 units, which is 18.60% better than the year-ago 15,383 units.

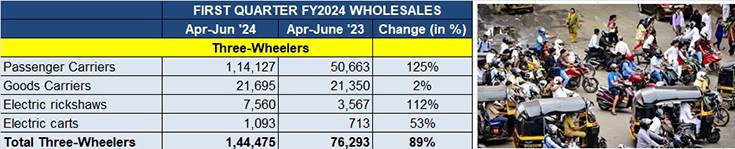

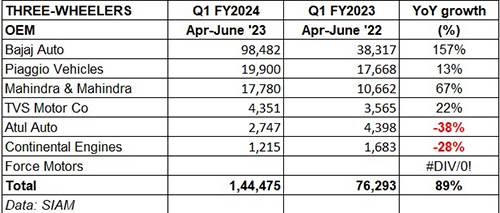

Three-wheelers – 144,475 units, up 89%

When it comes to YoY growth, the three-wheeler segment with 89% – 144,475 units – is head and shoulders above the other three vehicle segments, albeit the numbers are far fewer. With India on the move, demand for passenger-transporting three-wheelers is on the upswing: 114,127 units in Q1 FY2024 is a robust 125% YoY increase. Meanwhile, in a trend similar to the CV sector, demand for goods carriers grew by only 2% to 21,695 units.

What has given a fillip to this segment is the accelerating demand for electric mobility, both for passenger and goods operations. Clearly, the USP of lowest cost per kilometre is a big draw, be it a single owner or a fleet operator. In Q1 FY2024, EV OEMs dispatched a total of 8,653 units, which constitutes solid 102% YoY growth (Q1 FY2023: 4,280).

Bajaj Auto is the boss of the three-wheeler market. With wholesales of 98,482 units, the company has clocked 157% YoY growth (Q1 FY2023: 38,317). There is a yawning gap between Bajaj Auto and Piaggio Vehicles (19,900 units), the No. 2 OEM here – all of 78,582 units! Mahindra & Mahindra, with 17,780 units, is ranked third and is followed by TVS Motor Co (4,351), Atul Auto (2,747) and Continental Engines (1,215). The last two OEMs have seen their sales decline year on year.

In his comment on this segment, the SIAM president said: “The segment has recorded its third-highest sales in Q1 FY2024 and has been growing because of high demand for short-distance commuting.”

Two-wheelers – 41,40,964 units, up 11% YoY

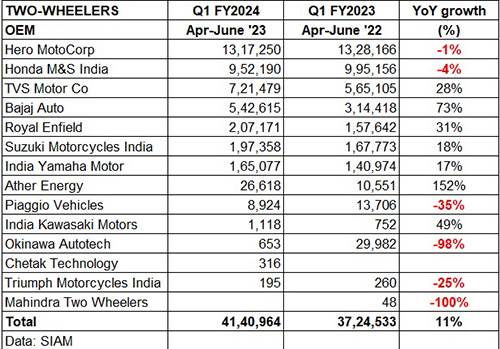

At 4.14 million units, the Indian two-wheeler industry has registered 11% growth (Q1 FY2023: 3.72 million units) with motorcycles (2.73 million units) recording 14% growth and accounting for 66% of total sales. At 7%, the scooter market (1.29 million units) logged half the growth that bikes did and accounted for 31% of the market. Moped sales were down 6% at 105,261 units and filled up the balance 3 percent.

Market leader Hero MotoCorp dispatched 13,17,250 motorcycles and scooters, down 0.82% on year-ago sales of 13,28,166 units and with a 32% market share. Honda Motorcycle & Scooter India was also in negative territory with 9,52,190 units, down 4.31% (Q1 FY2023: 9,95,156).

The four OEMs to follow the top two are the ones to have recorded strong growth. TVS Motor Co, with 7,21,479 units, has posted 27% growth (Q1 FY2023: 565,105); Bajaj Auto sold 5,42,615 units to record 73% growth (Q1 FY2023: 314,418); Royal Enfield surpassed the 200,000 mark with 2,07,171 units and 31% growth; Suzuki Motorcycle India dispatched 1,97,358 units to post an 18% YoY increase in wholesales, and India Yamaha Motor had 1,65,077 units and 17% growth to its credit.

Vinod Aggarwal’s observation for this sector was that “even though the numbers being substantially lower than pre-Covid levels, the indications are positive, based on the anticipated growth in the rural economy. The price increases due to various regulatory norms have impacted the two-wheeler industry in the past. The realignment in the FAME subsidy did lead to sudden consumer buying in May 2023, and affected e-two-wheeler demand in June.”

FY2024 growth outlook: Optimistic

Despite the key CV sector registering a sales decline, which has been impacted somewhat by a number of fleet operators having advanced their new truck purchases in March 2023, ahead of the mandated shift to BS VI Phase 2 norms which also necessitated a price increase, SIAM remains optimistic about India Auto Inc’s growth prospects in FY2024.

Commenting on the Q1 2023-24 wholesales numbers, Vinod Aggarwal, President, SIAM said: “In the quarter, the auto industry seamlessly transited to the very stringent BS 6 Phase 2 emission norms from April 1, 2023. Overall passenger vehicles, two-wheelers, three-wheelers and commercial vehicles have performed well in Q1 of 2023-24, although some sub-segments have shown slight momentary decline, compared to Q1 of last year. With expectations of a reasonable monsoon, which has now covered most parts of the country, coupled with lowering inflation, we expect the economy to continue to grow, which in turn should help the auto sector. High interest rates remain a concern.”

“Commodity prices have stabilised, chip supplies are no longer an industry-wide issue, and despite the recent concerns about floods, we are likely to see uniform spread of monsoon driving the agricultural sector, and indirectly benefiting the automotive industry as a whole,” Agarwal concluded on an optimistic note.