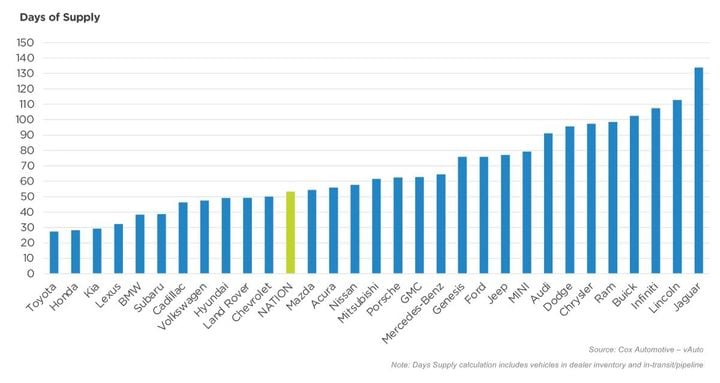

The highest inventories for non-luxury brands were dominated by Stellantis’ brands and a mix of foreign and domestic luxury makes.

Graphic: Cox Automotive

New-vehicle inventory and prices stabilized further in June while electric vehicle inventory climbed, closing the month with twice the days’ supply as new vehicles overall, according to Cox Automotive’s analysis of vAuto Available Inventory data.

The total U.S. supply of available unsold new vehicles stood at 1.95 million units at the end of June, off only slightly from a revised 1.96 million at the end of May, when inventory marked the highest level since April 2021. Inventory numbers include vehicles available on dealer lots and some in transit. As June closed, supply was up 75% from a year ago, or 835,000 units higher.

Days of supply stood at 53 at the end of June, up 39% from a year ago when days’ supply was 38. Days’ supply has been relatively stable for much of the year, hovering in the mid-50s. Historically, a 60-day supply across the industry was considered normal and ideal.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period ended June 26, when 1.1 million vehicles were sold, up 26% from the same period in the previous year.

“Sales of new vehicles closed the first half of 2023 surprisingly strong,” said Cox Automotive senior economist Charlie Chesbrough said in a recent news release. “Pent-up demand from individuals and businesses that could not find their product or a price they were willing to pay last year was unleashed.”

New-vehicle sales in June rose 20% from last June and posted the highest volume since May 2021. The seasonally adjusted annual rate of sales (SAAR) climbed to 15.7 million in June, up from May’s 15.1 million rate and 13 million in the year-ago June. Sales into fleet and increasing incentives supported the sales gain.

While inventory is up substantially compared to 2021 and 2022 levels, it remains low by historical standards. In pre-pandemic, pre-chip shortage June 2019, new-vehicle supply totaled 2.72 million units for an 86 days’ supply.

New-Vehicle Listing Price Growth Slows

The average listing price – or asking price – bounced around some throughout June, ultimately winding up somewhat higher than where it started. At the start of June, the average listing price was $47,487. As the month closed, the average listing price edged up to $47,571. The average new-vehicle listing price was only 3% higher than a year ago.

The average transaction price (ATP) – the price paid – for a new vehicle was only 1.6% higher than a year ago, the smallest year-over-year price increase since the start of the global pandemic, according to Kelley Blue Book.

The ATP in June was $48,808, a month-to-month increase of 0.3% ($150) from a revised May ATP of $48,658. Incentives increased for the ninth consecutive month in June to the highest level since October 2021, averaging $2,048, or 4.2%, of the average transaction price.

With some brands and segments experiencing excessive inventory and demand softening slightly, discounts and incentives have increased and will continue to do so, said Chesbrough.

EV Inventory Grows as Supply Varies by Brand, Segment and Price

The inventory of EVs grew further in June, closing the month at a 103 days’ supply. The industry had 90,953 EVs in supply during the 30 days that ended June 26, with 26,420 sold and an average listing price of $63,486. The numbers exclude Tesla, which sells direct to consumers. Only ultra-luxury vehicles and high-end luxury cars had more inventory.

Most EV models individually closed June with more than 100 days’ supply.

GM, which said many of its EVs in transit are already sold, had some of the lowest inventories of EVs. The Cadillac Lyriq closed June with a 50 day’s supply. The Bolt EV had only a couple thousand units available for a 23 days’ supply. The Bolt had just over 1,200 units available for a 23 days’ supply. GM is discontinuing production of the Bolt and Bolt EUV by year-end. However, GMC Hummer EV inventory had over 100 days’ supply.

The Ford F-150 Lightning closed June with an 88 days’ supply, below the supply count for all F-Series pickups, which is above 100 days. The Mustang Mach-E had 116 days’ supply.

The BMW i4 was at the low end with only a 40 days’ supply.

The average listing price for EVs was $63,486 in June. However, the average transaction price – the price paid – was down 20% compared with a year ago to $53,438, driven by Tesla price cuts and rising incentives. EVs had the next highest incentives in June, after luxury vehicles in general. EV incentives were 7.1% of ATP, compared with only 4.2% for the total industry.

Supply of Luxury Vehicles Rises; Inventory of Small, Midsize Cars Remains Low

The inventory of luxury vehicles (excluding ultra-luxury ones) stood at 310,304 at the end of June for a 62 days’ supply. Luxury vehicle supply has been mounting for the past few months. Non-luxury vehicle inventory totaled 1.64 million vehicles for a 52 days’ supply, about even with the end of May.

Import non-luxury and luxury brands had the lowest inventories.

With under 30 days’ supply, Toyota, Honda and Kia had the lowest supply in the industry, followed by Subaru, Volkswagen, Hyundai and Chevrolet, all with below-industry average supply.

Luxury brands at the low end were Lexus at under 30 days of supply, followed by BMW, Cadillac and Land Rover, all below industry average.

The highest inventories for non-luxury brands were dominated by Stellantis’ brands and a mix of foreign and domestic luxury makes. Luxury brands Jaguar, Lincoln, Infiniti and Buick had the highest inventory, all with more than 100 days’ supply.

Non-luxury brands with the highest inventory were Stellantis’ Ram, Chrysler and Dodge, with more than 90 days’ supply. Jeep inventory dropped to 77 days’ supply.

Small and midsize cars had the lowest supply. High-end luxury cars and EVs had the highest supply. Vehicle segments priced at $50,000 or more had the highest inventory.

Aside from low-volume, high-performance cars, vehicles with the lowest days’ supply were compact and midsize cars, with below 32 days’ supply, followed by compact SUVs, minivans, midsize trucks and subcompact cars.

Aside from niche ultra-luxury vehicles, segments with the highest supply were high-end luxury cars, followed by EVs. Full-size cars were next at 99 days’ supply and full-size pickups at 80 days’ supply, which is not outsized for trucks that come in multiple configurations.

The $50,000 to $60,000 segment had the heftiest inventory, with 72 days’ supply, followed by the $60,000 to $80,000 category, with 71 days’ supply, and the $80,000-plus segment at 62 days’ supply. The lower-price segments had the lowest inventory, with the under $20,000 group at 31 days’ supply.

Popular Toyota and Honda Models in the Lowest Supply

Of the 30 best-sellers for the 30 days ended June 26, 11 of the 12 models with the lowest inventory were Toyota and Honda vehicles.

Toyota Highlander, Honda CR-V, Toyota Camry, Toyota Corolla, Honda Civic and Toyota RAV4 had the least, all with less than 26 days’ supply. At 29 days’ supply, the Lexus RX had the lowest inventory among top-selling luxury vehicles.

Of the 30 best-sellers for the 30 days that ended June 26, full-size pickup trucks and SUVs from the Detroit Three had the biggest supply. The Ford F-150 and Ram 1500 had the most at more than 100 days’ supply.

Originally posted on Vehicle Remarketing