The buzz is back in India’s two-wheeler industry and that’s thanks to the recent high-decibel launches of two midsize motorcycles from two Indian OEMs partnering two American and British icons of two-wheeled motoring. And they are challenging the as-yet-unchallenged leader of the midsize bike market, Royal Enfield which, along with Bajaj Auto and TVS Motor Co, has increased its market share in the first quarter of the ongoing fiscal year.

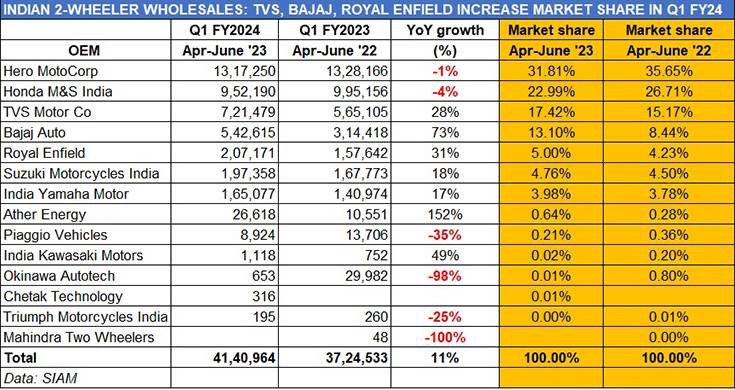

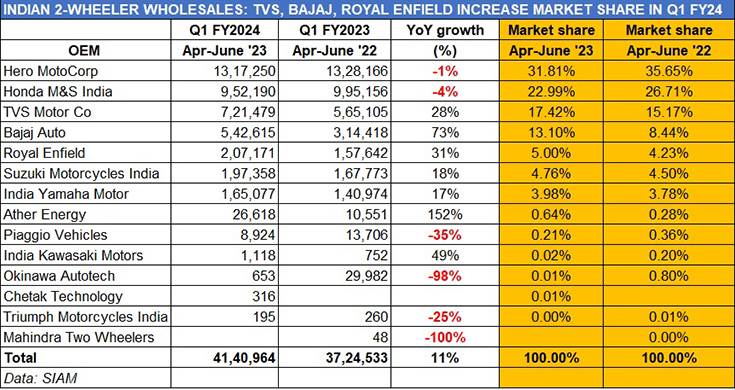

As per the wholesale numbers released by industry body SIAM for the first quarter of FY2024 (April-June 2023), a total of 41,40,964 scooters and motorcycles were dispatched by OEMs, which is an 11% year-on-year increase (Q1 FY2023: 37,24,533 units) .

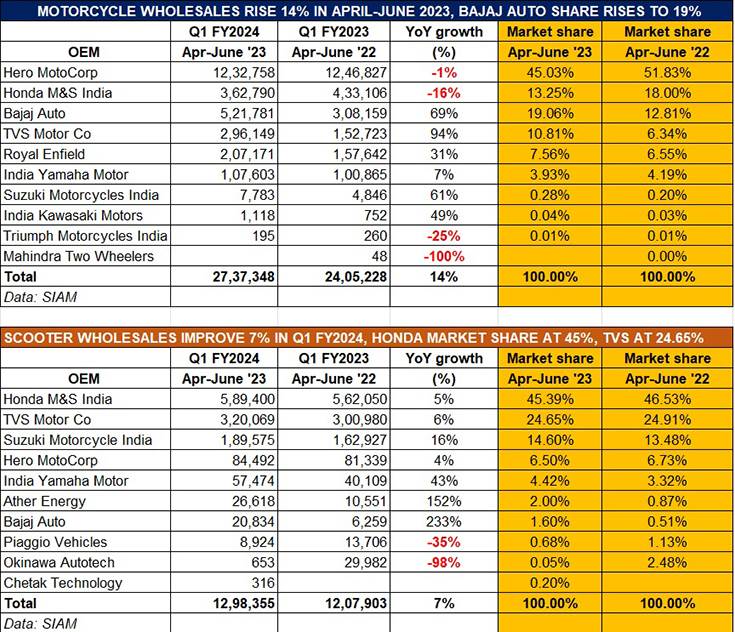

Importantly for industry, the growth is democratised across the two key sub-segments. While scooter sales at 12,98,355 units are up 7% (Q1 FY2023: 12,07,903), motorcycle numbers are up 14% to 27,37,348 units (Q1 FY2023: 24,05,228).

What has helped drive numbers in Q1 FY2024 is a combination of factors including the growth in the country’s GDP, green shoots of recovery in the rural market and new product launches. Of the 13 OEMs in the fray, five manufacturers, including the top two OEMs, have seen their sales decline albeit marginally.

A look at the wholesale numbers of all the OEMs, who are SIAM members, reveals that three companies – Bajaj Auto, TVS Motor Co and Royal Enfield – are the ones to have increased their market share, indicating their growing level of competitiveness and in turn profitability. Bajaj Auto, which sold 542,615 units (228,197 units more than in April-June 2022), sees it overall two-wheeler share grow by nearly five percentage basis points to 13.10% from 8.44% a year ago. In similar vein, TVS Motor Co, with sales of 721,479 units (156,374 units more than in Q1 FY2023), sees its market share increase to 17.42% from 15.17% in April-June 2022. Royal Enfield’s strong performance, with sales of 207,171 units, up 31% YoY, gives it an exact 5% share in the overall Indian two-wheeler market; being a bike-only OEM, its share rises to 7.56% from 6.55% a year ago in the pure motorcycles segment.

Let’s take a closer look at how the top five two-wheeler manufacturers have performed in April-June 2023 and the resultant impact on their market share. While the data for overall wholesales is depicted above, the company-wise split for motorcycles and scooters appears at the bottom of this analysis.

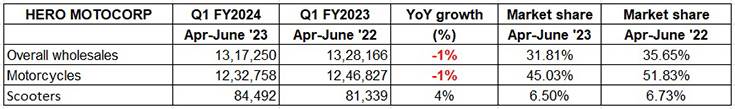

Hero MotoCorp: 13,17,250 units, down 1% YoY

Market share: 31.81%, down from 35.65% in April-June 2022

Overall two-wheeler market leader and also bike market leader Hero MotoCorp with sales of over 1.31 million units saw a 1% dip in YoY sales and its market share has reduced to 31.81% from 35.65% in Q1 FY2023. Tepid demand for commuter motorcycles, for which the company is the largest OEM, has meant that bike sales at 12,32,758 units were also down 1% YoY. In the scooter market, Hero is ranked fourth – it sold 84,492 units, up 4% YoY for a share of 6.50%, slightly down from the 6.73% it had a year ago.

With demand from rural India yet to pick up, demand has been impacted for Hero MotoCorp which is the biggest manufacturer of fuel-efficient commuter bikes. Combined sales of its three key fuel-sipping bikes models (HF Deluxe, Passion, Splendor) were 10,64,846 units, just 1.44% more than the 10,49,687 units this trio sold a year ago.

Then, in the 110-125cc bike market (Glamour-Splendor), sales of 152,280 units are down 12% (April-June 2022: 173,711). And in the 150-200c segment (XPulse 200, Xtreme), sales were down 33% to 15,588 units.

On July 3, Hero launched the Harley-Davidson X440 at Rs 229,000, which marks the American OEM’s foray into the 400-450cc segment and aims to challenge Royal Enfield’s dominance in the fast-growing 850,000-unit-strong midsize bike market. The X440 goes head to head again the RE Classic, Hunter, Himalayan, Bajaj-Triumph Speed 400 and Scrambler 400 and the Honda Highness.

Hero MotoCorp’s scooter sales at 84,492 units, including 3,480 all-electric Vidas, were up 4% in Q1 FY2023.

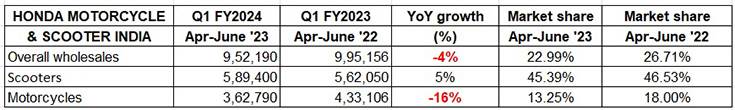

Honda Motorcycle & Scooter India: 952,190 units, down 4% YoY

Market share: 23.11%, down from 26.71% in April-June 2022

With cumulative three-month sales of 952,190 two-wheelers, Honda Motorcycle & Scooter Q1 numbers were a 4% decline YoY (April-June 2022: 995,156 units). The sustained demand for its Activa brand of scooters has helped buffer the 16% YoY decline in sales of its motorcycles (see sub-segment-wise split above).

HMSI sold 589,400 scooters, which is a 5% increase but sees its scooter share dip slightly to 45.39% from 46.53% a year ago. HMSI was among the first OEMs in India to become OBD-II emission compliant ahead of the April 1, 2023 deadline – in January with the 110cc Activa, the largest-selling scooter in India, and the 125cc Activa in March. The user- and urban-friendly Activa is sold in seven variants – four 110cc and three 125cc – and is Honda’s trump card in the competitive Indian two-wheeler market. And HMSI has on July 13 expanded its 125cc portfolio with a sibling to the 109cc Dio – the Dio 125 priced at Rs 83,400.

Like Hero MotoCorp, HMSI too is feeling the heat of slackened demand for commuter bikes. While the Shine 100 has seen a 10% sales uptick to 53,135 units, combined sales of the 109cc CB Shine and the 125cc Shine at 2,71,745 units are down 22% (Q1 FY2022: 351,125). In the 150cc-200cc category, Honda bike sales are up 8% to 26,692 units.

Reflecting the growing demand for midsize bikes, the CBR300 and the H’Ness 350 together have sold 11,218 units, up 28% but with the bulk of bike sales being impacted adversely, they have dragged overall growth down for HMSI.

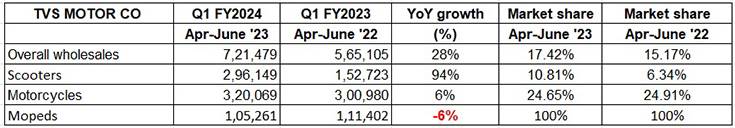

TVS Motor Co: 721,479 units, up 28% YoY

Market share: 17.42%, up from 15.17% in April-June 2022

TVS Motor Co, which has been on a good run in the domestic market, has reported wholesales of 721,479 units in April-June 2023, up 28% YoY (April-June 2022: 565,105) with motorcycles contributing 3,20,069 units or 44%, scooters 41% with 2,96,149 units and mopeds, for which TVS is the sole OEM in India, 1,05,261units and 14.58 percent.

TVS has recorded robust growth in its motorcycle sales – 94% – thanks to strong and continuing demand for the Raider 125 which is coming into a league of its own with 1,00,240 units sold in Q1 FY2024. And the premium Apache brand has seen demand zoom 111% with sales of 1,08,230units (April-May 2022: 34,386). The trio of entry-level bikes – the 110cc Radeon, Sport and 100cc Star City – clocked sales of 86,748 units, up 2% YoY. TVS also sold 931 units of the RR 310, down 11% YoY.

What has helped TVS’ high-double-digit growth of 28% is the robust performance on the bike front – its bike share is now 11% from the 6% a year ago. This has helped buffer the 6% sales increase in scooters and the resultant marginal market share decline.

TVS sold a total of 320,069 scooters (April-June 2022: 300,980 units). The trio of the Jupiter, NTorq and Scooty Zest sold 276335 units, up 1% (April-June 2022: 272790). Demand for the Scooty Pep+ has plummeted 73% to 5,132 units from 19,466 units in April-June 2022. What has saved the blushes for TVS in terms of scooter sales is the spurt in buying of the al-electric iQube scooter – up 342% to 38,602 units from 8,724 units a year ago. Put that down to the frenzied customer buying in the last 8 days of May 2023 before e-two-wheeler prices were hiked following the slashing of the FAME subsidy. June sales were sizeably down and it remains to be seen if the

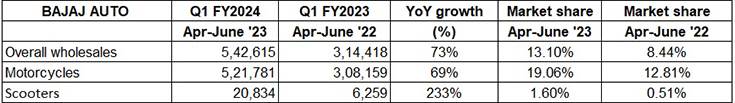

Bajaj Auto: 542,615 units, up 73% YoY

Market share: 13.10%, up from 8.44% in April-June 2022

Bajaj Auto, which had closed FY2023 with an overall two-wheeler market share of 11.35%, has registered strong sales and growth in the first quarter of FY2024. The predominantly motorcycle player, which has only recently ventured into e-scooters, sees its market share rise by four percentage basis points to 13.10%, mainly as a result of its 73% growth in motorcycle sales. A look at the SIAM data reveals that Bajaj Auto has recorded strong growth in each of the 6 segments it is engaged in, with particularly smart growth in the premium bike categories.

The Pune-based OEM sold a total of 542,615 units, comprising 521,781 bikes (up 69% YoY) and 20,834 electric Chetaks (up 233 YoY on a low base). The robust motorcycle sales have increased Bajaj’s share in the segment to 19% from 12% a year ago.

Clearly, Bajaj is well set to accelerate growth in FY2024. Like Hero MotoCorp, Bajaj Auto too has challenged Royal Enfield’s midsize bike market dominance – the launch of the Triumph Speed 400, priced at Rs 223,000, which will roll out of the Chakan factory, along with the Scrambler 400X (planned for an October 2023 rollout).

In the entry level 100-110cc segment, the Platina 100 and CT100X have sold 1,38,569 units, up 48% YoY. The 110-125cc segment, which has the CT125X, Platina 110, Pulsar 125 and KTM 125 Duke and RC125, delivered sales of 2,39,640 units up 59% YoY (April-June 2022: 150,732). Then, in the 125-150cc category, the Pulsar 150 clocked sales of 52,543units, up 89% (Q1 FY2023: 25,785).

In the 150-200cc segment, the Pulsar N160, NS200 and RS200, along with the KTM 200 Duke and RC200 brought in sales of 64,214 units, rising 107% YoY. A segment above, in the 200-250cc category (Pulsar 22F, N250, F250, Dominar 250, KTM 250 Duke and Husqvarna Vitpilen and Svartpilen 250s), the growth story is even better – 21,428 units versus 4,659 units, which constitutes 359% YoY growth. And in the 350-500cc segment (Dominar 400, KTM RC390 and 390 Adventure) Bajaj sold 5,387 units, up 116% YoY.

Bajaj Auto also sold 20,834 Chetaks, a 233% YoY increase (April-June 2022: 6,259), which is a result of its highest-ever e-scooter monthly sales in May (9,208) with buyers rushing to buy two-wheeled EVs before June 1.

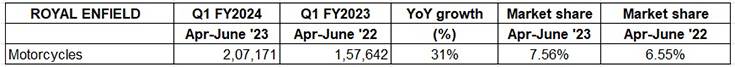

Royal Enfield: 207,171 units, up 31% YoY

Market share: 7.56%, up from 6.55% in April-June 2022

The Chennai-based motorcycle manufacturer reported total wholesales of 207,171 units, up 31% on its year-ago sales of 157,642 units. This has helped the company increase its bike market share to 7.56% from 6.55% a year ago.

The bulk of its sales, as is usual, came in the 250-350cc category where the Bullet 350, Hunter 350, Classic 350 and Meteor 350 reside – 1,89,647 units, which marks 34% YoY growth. The 411 Himalayan adventure bike clocked sales of 10,840 units, up 19.58% YoY. In the 500-800cc segment (Continental GT650, Interceptor 650, Super Meteor 650) Royal Enfield saw sales rise to 6,684units, up 35% over April-June 2022’s 4,941 units.

Challenges to growth remain

Given the 11% YoY increase in cumulative sales in the first three months of FY2024, OEMs must be keeping their fingers firmly crossed that the momentum remains in the months ahead. Scooter and motorcycle buyers seem to have taken the marginal price increases for the OBD II emission tech upgrade, effective from April 1, 2023, in their stride. However, while improved consumer sentiment and rollout of new models from OEMs augur well for the industry, a few challenges remain as some OEMs continue to wrestle with supply constraints, softer demand for mass-market motorcycles, which constitute the bulk of sales and have also seen their prices rise.

Over the past three-odd weeks, incessant rainfall has badly impacted North India, particularly the states of Himachal Pradesh, Uttarakhand, Haryana, Rajasthan and Punjab. Such extreme weather conditions also weigh heavy on India’s agricultural sector, damaging thousands of hectares of land and in turn produce. The collateral damage to the two-wheeler industry will be slower two-wheeler offtake in rural India, just when things looked to be improving.

The other market dynamic is the slowing sales of electric two-wheelers, following the slashing of the FAME II subsidy from 40% to 15% from June 1, 2023. India’s electric two-wheeler OEMs, who recorded their best-ever monthly retail sales of over 105,000 units in May 2023, saw numbers plunge 56% month on month to an 11-month low of 45,734 units in June. However, it also points to a gradual maturing of the market as consumers bought 45,734 EVs at higher prices. Midway into July, 26,535 electric scooters and bikes have been retailed (as of 8am, July 16), which indicates that EV sales on two wheels should go beyond 50,000 units this month.