Tightening crypto regulations by the US Securities and Exchange Commission (SEC) in the past few months has led to widespread pessimism in the industry. So much so that many hedge funds are reconsidering their crypto strategy.

Cryptocurrency platform Coinbase was sued by the SEC on June 6, a day after the regulator launched a lawsuit against Binance, the world’s largest crypto bourse. The lawsuits centre around the question of whether crypto tokens should be treated as a security or a commodity.

Around 23% of hedge funds expect the tightening regulatory landscape to have a major impact or lead them to reconsider the viability of their crypto-assets, according to The 2023 Global Crypto Hedge Fund Report by the accounting and consulting firm PricewaterhouseCoopers (PwC).

PwC conducted two separate surveys for the report. The first interviewed a total of 131 crypto-native hedge funds, while the second surveyed a total of 59 hedge funds with some or no exposure to crypto assets.

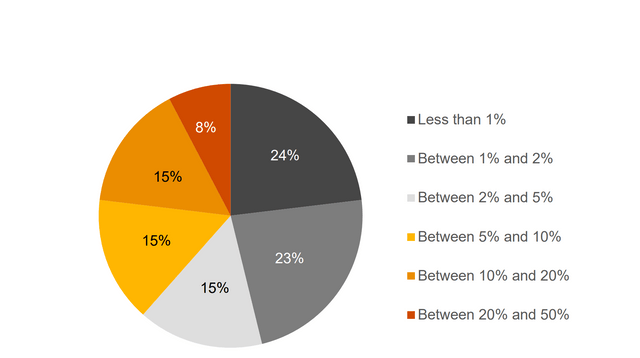

Share of AUM invested in crypto assets by hedge funds

As a result of the ongoing regulatory clampdown, more than one-third of the hedge fund managers surveyed expect higher legal and compliance costs, while 31% say it is leading to increased difficulty in accessing banking services, per the report.

The regulatory crackdown comes after a series of business collapses and bankruptcies in 2022, including the downfall of crypto lender Celsius Network, hedge fund Three Arrows Capital, crypto broker Voyager Digital, crypto exchange FTX, and more. Around 69% of respondents said that the collapses affected their appetite in deploying more capital in 2022, per the report.

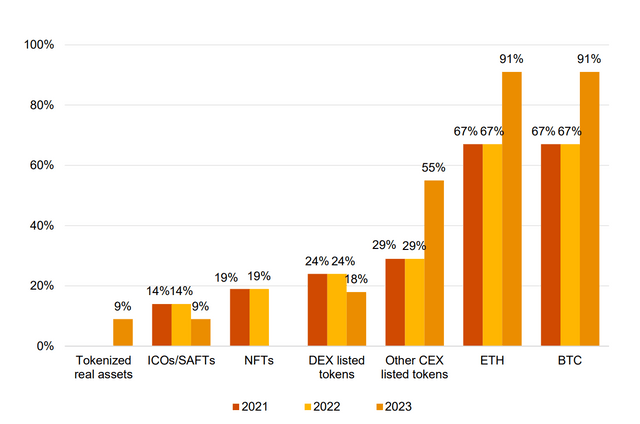

The majority of the surveyed hedge fund managers invest in Bitcoin (91%) and Ethereum (91%), the two largest crypto assets by market cap, while around half of the respondents invest in other tokens listed on centralised exchanges, per the report.

Hedge fund managers invested in various crypto assets

None of the interviewees invested in non-fungible tokens (NFTs), which marked a significant drop from 20% last year. This comes after sluggish NFT market sales in Q2, which saw trading volume fall by 38% quarter-on-quarter to $2.9 billion, according to data from blockchain tracker DappRadar.

Rising interest in tokenizing funds

The tokenization of an asset or a fund using blockchain technology has been gaining momentum. Around 25% of the respondents from across the alternative investments industry, including hedge funds that are not investing in crypto assets, said that they are now exploring tokenization, according to the report.

The report added that the tokenisation of a fund could accelerate efficiency and reduce friction, which will shorten the time required for settlement.

Average AUM injected into crypto rises

Although the number of traditional hedge funds investing in crypto-assets in 2023 has dwindled compared to last year, the average assets under management (AUM) injected in the asset class has grown 4-7%, the report added.

Going forward in 2023, over half of the hedge funds that invest in crypto-assets will inject the same amount of capital; while the rest of the respondents plan to inject more by the end of this year.

However, a slew of challenges remain for hedge fund managers when it comes to investing in crypto assets, including access to traditional banking services, lack of regulatory and tax regime clarity, and insufficient or unreliable third-party data, among others.