The funding winter in Southeast Asia showed no signs of a thaw in the second quarter of this year. Despite a slight uptick relative to the previous quarter, both deal value and volume dipped year on year during the April-June period, finds the latest report from DealStreetAsia – DATA VANTAGE.

Privately-held companies in the region clocked 208 equity funding deals in Q2 to raise $2.13 billion, down 58.6% year-on-year, according to the report titled SE Asia Deal Review: Q2 2023.

The second quarter numbers failed to lift the overall performance in the first half of the year. Traversing a tight liquidity environment, homegrown startups in the region secured 403 equity funding deals with $4.2 billion in total proceeds in H1. This marks a 30% sequential and a 56% year-on-year drop, respectively.

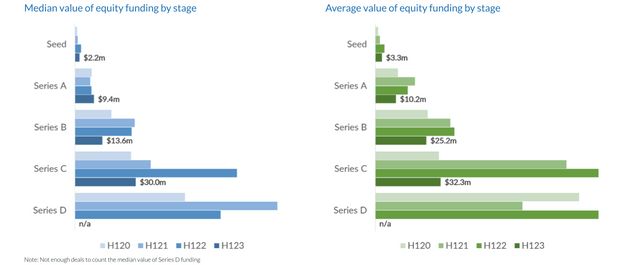

A major cause for concern was the reduction in the volume of seed funding, which plays a crucial role in helping startups off the ground. The first half of the year revealed an alarming 43% decrease in such deals.

Additionally, the median value of seed rounds experienced its first decline, indicating that early-stage funding is no longer insulated from the effects of the ongoing global liquidity crunch.

“I believe there is still more [corrections] to come, though we are seeing gradual levelling of where valuations should be after a period of steep adjustments,” said Kuo-Yi Lim, co-founder and managing partner at Monk’s Hill Ventures, when asked whether corrections have bottomed out.

Beacon VC managing director Thanapong na Ranong said corrections will persist in the “next few quarters” and added that most private companies will eventually be subjected to public market multiples.

“Investors are very careful at evaluating any specific investments and [are] lengthening the decision-making time to reach the conclusion or prepare an investment case for their investment committee. This delay in the decision-making process may be at the expense of the survivability of many startups during the fundraising period,” Na Ranong said.

A nascent venture debt market

While recognising limited visibility into debt financing deals in the region, our review of the H1 deals identified 18 transactions, lower than 24 and 27 deals recorded in the preceding two semesters.

In terms of the total proceeds generated from debt instruments, the first half of this year recorded a haul of $222 million. This figure represents a significant reduction of 82.2% when juxtaposed with the previous semester and a decline of 69.2% compared to the corresponding period last year.

While not conclusive, this pattern hints at a possible diminished demand by homegrown startups for debt within the region, potentially influenced by the persistent inflationary pressures across Southeast Asia.

“In a mature VC market, venture debt typically represents 15-20% of overall VC funding in the region. However, in Southeast Asia’s growing ecosystem, it is expected to be around 5-10% of the total VC funding,” said Ankit Agarwal, a venture debt director at Lighthouse Canton.

Agarwal expects a venture debt deployment opportunity of $1 billion to $2 billion for the next 2-3 years in the region, with the possibility of reaching $4 billion to $5 billion in the long term.

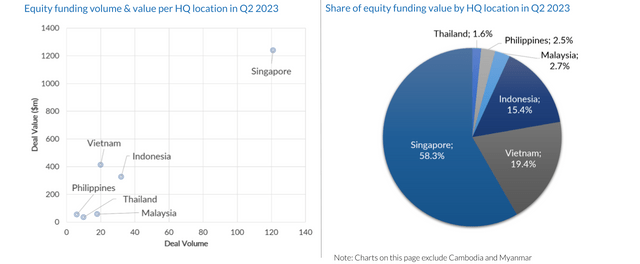

Vietnam tops Indonesia

While Singapore’s regional leadership remains uncontested, Indonesia has faced a consistent decline in deal volume over the past four quarters. In Q2 2023, Indonesia recorded its lowest quarterly deal volume since Q4 2020.

After being overtaken by Thailand in deal value during the first quarter, Indonesia was outranked by Vietnam in Q2.

While Vietnam experienced a notable resurgence in deal volume after six quarters of decline, Thailand witnessed a significant drop in funding activity, with funding plummeting to a mere $39 million in Q2 2023, compared to $529 million in Q4 2022 and $413 million in the same period last year.

Telkomsel Mitra Inovasi, the venture arm of Indonesia’s largest telco company, Telkomsel, said more price corrections are necessary to incentivise more deals.

“When it comes to the filtering system, we revert back to fundamentals … I can see that not all startups have undergone the necessary corrections, so their prices remain high. For example, consumer internet platforms are still expensive,” said TMI chief executive officer Mia Melinda.

Gary P. Khoeng, a partner at Vertex Ventures Southeast Asia & India who also oversees the Indonesian market, said that deal volumes are expected to come down following macro headwinds and investor conservatism, which have been prevalent since 2022.

“In general, we are cautiously optimistic for the end of 2023 and 2024 because it appears that overall macro has somewhat ‘improved’ when compared to last year, although there could still be black swan events that may happen,” he said.

Major verticals under fire

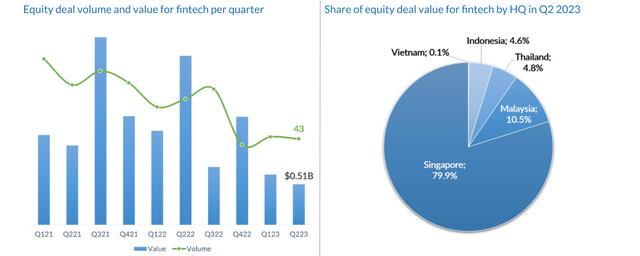

The fintech sector, per usual, emerged as the most active vertical in the second quarter. However, fintech deals activities have exhibited a general downward trend since reaching their apex in 2021.

Southeast Asia witnessed close to a 30% year-on-year drop in fintech deal volume in the first half of this year and a 65% drop in value.

While the global liquidity crunch undeniably impacts overall activities, the pain is particularly pronounced within the realm of decentralized finance (DeFi), a fusion of blockchain-based fintech services, which has seen deep corrections since the so-called crypto winter began in late 2021.

The investment landscape for wealthtech startups serves as a prime illustration of this trend, where the total deal value for the first semester dropped 91% year-on-year despite a recovery in deal volume.

“For fintech, a downturn provides an ideal time to build underwriting and credit models and revamp collections practices. These form the bedrock of a successful fintech company,” said Sandeep Patil, head of Asia at QED Investors, a fintech-focused US venture fund that entered Southeast Asia last year.

Patil said the subdued market enables businesses to benefit from lower customer acquisition costs and reduced competition, and recruit top-tier talent at more reasonable compensation levels compared to the peak market cycle.

With Southeast Asia no longer under pandemic-induced lockdown, investors are limiting their exposure to e-commerce. The vertical, which traditionally ranks as the second most active, recorded a 60% yearly drop in both deal volume and value.

Indonesia, which has traditionally dominated e-commerce fundraising, has seen its quarterly deal value falling behind Singapore in the last five quarters. To be fair, this is partly due to the fact that major local e-commerce giants such as Bukalapak, BliBli and Tokopedia have graduated to the public market.

Rethinking SE Asia’s growth story

As founders and investors pay closer attention to market fundamentals, many have revisited Southeast Asia’s growth story. There is growing concern regarding whether the expected demographic bonus, middle-class expansion, and rising purchasing power have progressed as anticipated.

The poor financial performance of publicly-listed consumer-focused tech giants in Southeast Asia, such as Bukalapak, GoTo, Grab and Sea Ltd, has often been cited as an indication that the trajectory of the region’s consumer market has not achieved its drummed-up potential.

A big believer in Southeast Asia, Sameer Mehta of consumer brand-focused VC fund DSG Consumer Partners, said many of the consumer tech-focused giants have scaled on the back of real consumer demand. Whether they were overvalued by the private and then public markets is beside the point, he added.

“The growth story in our region is barely beginning. We are in the early innings with the possible goldilocks of large, young populations with amongst the world’s highest working age cohorts about to come of age,” Mehta said.

He argues that across markets in Southeast Asia, GDP growth has been growing consistently in the 4-8% range across multiple years, while the relatively stable and orderly transitions of elected governments and significant infrastructure buildout will have multiplier effects.

“We are thrilled to be investing in the regions we are. Nonetheless, there are no guarantees, and there have been false dawns in the past, so the region will have to continue to stay committed to equitable development,” he remarked.

The SE Asia Deal Review: Q2 2023 report covers fundraising by startups in the second quarter and the previous quarters. It covers:

- Funding trends across quarters, sectors and countries

- Deal volume and value across funding stages

- Median and average deal value across stages

- Investor perspectives, and more.

The report is available exclusively to DealStreetAsia – DATA VANTAGE subscribers. Subscribe/upgrade your subscription now to access our entire set of reports.