Tata’s gigafactory gives Britain’s battery industry potential at last

The Jaguar Land Rover owner’s new plant should encourage more similar investments in the UK by others

France has four. Germany has nine. The US has 34. China has a staggering 283. Around the world, countries are racing to announce plans for huge gigafactories to supply the batteries to power the electric car era.

By contrast, the presence of only one large UK gigafactory project with big financial backers – supplying Nissan in Sunderland – was growing increasingly alarming. That changed last week as Jaguar Land Rover’s owner, Tata Group, chose the UK for a new £4bn battery factory. It had considered a rival site in Spain for the plant.

The decision counts as a victory for the UK, which committed subsidies worth up to £500m, and will bring new jobs, probably to a site near Bridgwater in Somerset. Yet government and the industry have their eye on a bigger prize: they hope the investment will spur more spending in a broader battery supply chain, and more gigafactories.

Ian Constance, chief executive of the Advanced Propulsion Centre, the body that runs the government’s automotive subsidies, said he believed Tata’s decision would prompt other companies to choose the UK for investments in gigafactories and materials suppliers.

“We have other gigafactory investments in the pipeline which we’re talking to,” he said. “This will only strengthen the case.”

Constance declined to give details on how advanced those talks were, but said there was “more than one” and that they were “international” rather than UK-based. Only one other company has publicly declared an intention to build a gigafactory: Australia’s Recharge Industries, a startup yet to secure major funding that bought the remnants of Britishvolt, a collapsed firm with a factory project in Northumberland.

Tata’s investment “is the next step in creating the demand for the next layers of things in the supply chain”, Constance said. “While we’ve done a lot of background work, it’s really difficult to land those investments without a demand signal.”

The Tata plant will aim to produce 40 gigawatt hours (GWh) of battery capacity a year, enough to power hundreds of thousands of cars.

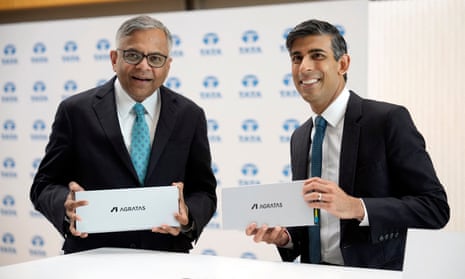

Rishi Sunak signalled the importance of the investment last Wednesday by taking a helicopter to Jaguar Land Rover’s design centre in Gaydon, Warwickshire, to meet Tata’s boss, Natarajan Chandrasekaran.

However, the subsidy floodgates are not completely open: the government has reportedly snubbed the financial pleas of AMTE Power, a struggling firm aiming to build an battery factory in Dundee.

The UK government and many in the British car industry have long feared that, without enough gigafactories, the UK could lose out on many of the nearly 100,000 jobs linked to making cars and internal combustion engines.

Some of those jobs have been protected by pledges to switch to electric technology, such as at Ford’s plant in Halewood, Merseyside, and Stellantis’s Vauxhall factory in Ellesmere Port. Yet others – notably petrol and diesel engine factories such as Ford’s at Dagenham and Toyota’s at Deeside – will be increasingly reliant on exports as the UK approaches a ban on new internal-combustion vehicle sales in 2035.

“The size of the Tata gigafactory is very substantial,” said David Greenwood, professor of advanced propulsion systems at Warwick Manufacturing Group, part of the University of Warwick. “It really pushes the UK battery industry above critical mass for supply chain companies to start to locate in the UK.”

Greenwood said that the Tata investment could start a “virtuous circle” in which it attracted suppliers, which in turn made it more likely that further battery cell manufacturers would choose the UK.

The UK’s one existing gigafactory shows it can work. Chinese-owned company AESC supplies batteries for Nissan Leaf cars made at a neighbouring factory in Sunderland, and has plans to expand from 1.8GWh of capacity a year to up to 38GWh. AESC said in its latest UK accounts that it was trying to “localise” key materials as much as possible.

The company added that a “key component”, module casings, were “localised from a Japanese supplier to a UK supplier” in 2021. “Discussions are also under way with UK and European suppliers for further longer-term localisation opportunities,” the accounts said. The company declined to comment on the identity of the supplier.

The Tata plant will mean that battery supply to UK car factories will largely be covered – unless the UK can expand production significantly above 1m vehicles a year. Mini and Rolls-Royce will use BMW batteries from Germany; Stellantis will get batteries from France; Bentley’s will come from Volkswagen in Germany as well. That leaves only Toyota’s plant at Burnaston, Derbyshire, without an obvious battery supplier.

However, some in the industry believe the UK will need to attract several more gigafactories to become anything more than a bit-part player in the global industry. In 2030, the UK is set to have 66GWh of capacity, compared with 1,176GWh in the US and 325GWh in Germany, according to battery analyst Benchmark Minerals.

Simon Moores, Benchmark’s chief executive, says the UK needs another three gigafactories, at least, to begin to replace the UK’s output of internal combustion engines as well as cars, and to meet increasing demand for stationary batteries used to power homes or industry.

“Tata is great news but the work has just begun,” he said.