PT Global Digital Niaga Tbk—the Indonesia-listed entity that owns e-commerce player Blibli, online travel agency Tiket.com, and supermarket chain Ranch Market—trimmed its losses by almost 30% in the first half of 2023 on higher revenues and an improved cost structure, the company said in a statement late on Friday.

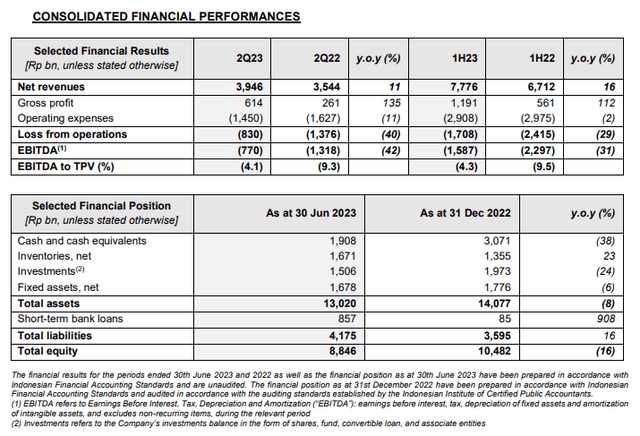

Blibli recorded 3.95 trillion rupiah ($261 million) in net revenues in the Apr-June period, an 11% year-on-year (YoY) increase. For the first six months of 2023, Blibli recorded 7.78 trillion rupiah in net revenues, a 16% increase compared with the same period a year earlier.

“Our first half 2023 financial results were a positive trend, which resulted in an improved profitability performance,” Blibli CEO and co-founder Kusumo Martanto said in the statement.

According to a separate filing to the Indonesian Stock Exchange (IDX), Blibli reported 1.76 trillion rupiah ($116 million) in losses for the six-month period that ended on June 30, 2023. That was 29.65% lower than the 2.5 trillion rupiah loss posted a year earlier.

While Blibli did not share its losses for the Apr-June period, the company said its losses from operations was 830 billion rupiah in the second quarter of 2023, down 40% down from 1.38 trillion rupiah in Q2 2022.

“However, we cannot be complacent and will not stop here; we’re going at full throttle to ensure that the company will continue to implement its strategic plans in the right direction, including to drive focus on what our customers want, focus on the selections (categories) we plan to offer to them and focus on the details that set us apart from the competition,” said Martanto.

Blibli stands apart from peers Shopee, Tokopedia, Lazada, and Bukalapak as its operations go beyond e-commerce including online travel, which benefited from a pent-up demand after the pandemic; a growing offline presence selling mainly electronic goods; and its presence in high-end groceries.

The company recently added 14 consumer electronic stores in the first six months of 2023. It has also started the construction of a 100,000-square-meter tech-powered warehouse in West Java to support storage automation, supply chain distribution, and delivery to end-consumers. This warehouse is expected to start operating in 2024.

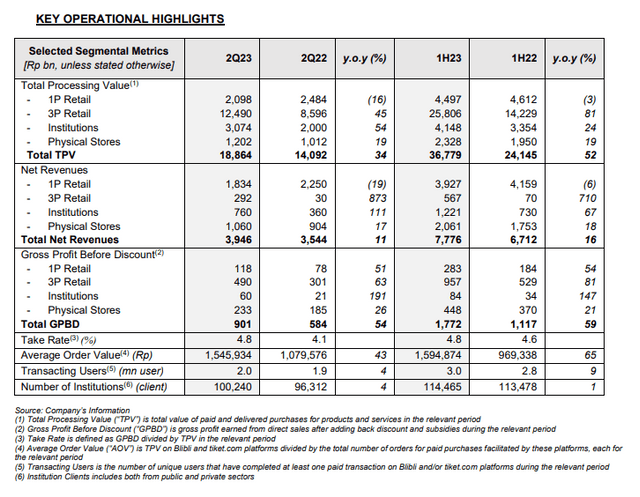

Blibli credited its growing revenue to an increased performance in the 3P retail segment. Blibli generates fees from products and services sold by third-party sellers through Blibli and Tiket.com platforms. Other than its 3P business, Blibli has three other income-generating businesses, namely 1P retail, institutions, and physical stores.

“Throughout the second quarter of the year, we have been focusing on the alignment of our category mix across our 1P Retail and 3P Retail segments in order to accelerate the optimisation of our gross profit generation,” Blibli CFO Ronald Winardi said.

“In combination with our relentless focus on cost discipline, we are pleased to see that our strategy has started to show positive results in our financial results,” Winardi added.

Blibli recorded total processing value (TPV)—the total value of paid and delivered purchases for products and services in the relevant period—of 18.86 trillion rupiah in the second quarter of 2023, up 34% YoY. Its TPV grew 52% YoY to 36.78 trillion rupiah in the Apr-June 2023 period compared with the same period in 2022.

The group reported an improved cost structure—consolidated operating expenses as a percentage of TPV—at 7.7% in Q2 2023, down from 11.5% in Q2 2022. For the six-month period, cost structure stood at 7.9% in H1 2023, down from 12.3% in H1 2022.

Net cash used in Blibli’s operating activities was 2.32 trillion rupiah in Jan-June, which includes 20.06 trillion cash payments to suppliers, which was partly offset by 20.55 trillion rupiah cash receipts from customers. The company also recorded 525 billion rupiah in net cash provided by investing activities and 636 billion rupiah from financing activities.

Divesting non-core assets

In H1 2023, Blibli divested a 7.23% stake in PT Polinasi Iddea Investama (Halodoc) to PT Global Investama Andalan (GIA) at a total transaction value of 538 billion rupiah as part of the efforts to focus on core assets that are in line with Blibli’s business activities.

The company’s cash and cash equivalents stood at 1.91 trillion rupiah at end-June, compared with 3.07 trillion rupiah at end-December 2022.

“The company believes the strategic business plans set out at the beginning of the year were right on target and in line with the company’s efforts to achieve its goals for 2023… The overall margin kept improving, reflecting better focus on product selections and pricing strategy that the company offered to its customers, while cost efficiency measures were being implemented appropriately without sacrificing business growth potentials… the company is convinced that it is on the right path to achieve profitability,” Blibli said in the statement.

Blibli listed on the IDX in November last year.